Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden

What is the Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden

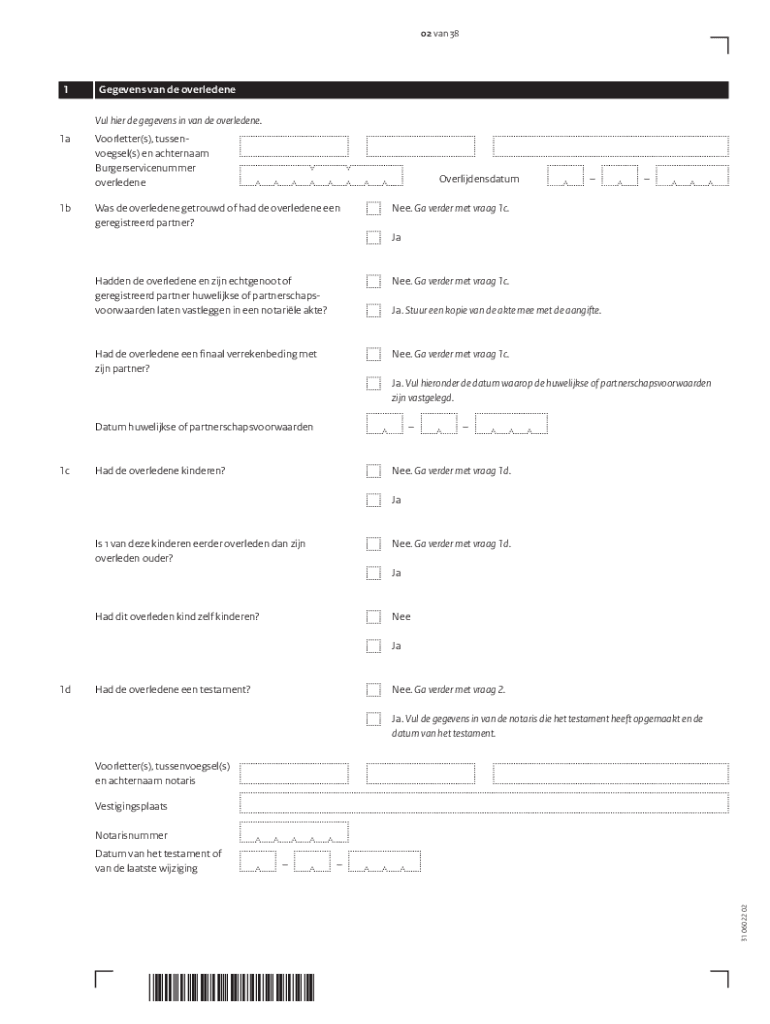

The form titled "Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden" serves as a declaration for inheritance tax following a death. This document is crucial for ensuring that the estate of the deceased is assessed for tax liabilities in accordance with state laws. It provides a structured way for the executor or administrator of the estate to report the assets and liabilities of the deceased, which will determine the tax owed to the state. Understanding this form is essential for anyone handling the affairs of a deceased individual, as it outlines the necessary steps to comply with legal requirements.

Steps to Complete the Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden

Completing the "Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden" involves several important steps:

- Gather all necessary documents, including the death certificate, asset valuations, and any debts owed by the deceased.

- Fill out the form accurately, ensuring that all information regarding the deceased’s estate is included.

- Calculate the total value of the estate, which includes all assets and liabilities, to determine the taxable amount.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the specified deadline to avoid penalties.

Required Documents

To successfully complete the "Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden," several documents are required:

- Death certificate of the deceased.

- List of assets, including real estate, bank accounts, and investments.

- Documentation of debts and liabilities, such as loans or mortgages.

- Any previous tax returns related to the deceased.

- Identification of the executor or administrator of the estate.

Filing Deadlines / Important Dates

Filing deadlines for the "Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden" can vary by state, but generally, it must be submitted within a specific time frame after the death. It is important to be aware of these deadlines to avoid late fees or penalties. Typically, the form should be filed within nine months of the date of death. Some states may allow extensions under certain circumstances, but it is advisable to check with local regulations for specific dates.

Legal Use of the Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden

The legal use of the "Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden" is to ensure compliance with state inheritance tax laws. This form is legally required for the proper reporting of the deceased's estate to the tax authorities. Failing to file this form can result in legal consequences, including fines and potential legal action against the estate. It is essential for the executor or administrator to understand their legal obligations when handling this form.

Who Issues the Form

The "Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden" is typically issued by the state tax authority where the deceased resided at the time of death. Each state may have its own version of the form and specific instructions for completion. It is important for individuals to obtain the correct form from the appropriate state agency to ensure compliance with local laws and regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the met dit formulier doet u aangifte erfbelasting voor een overlijden

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form 'Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden'?

The form 'Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden' is designed to help individuals report inheritance tax following a death. It simplifies the process of declaring assets and liabilities to ensure compliance with tax regulations. Using this form can help avoid potential penalties and ensure a smooth transition of the estate.

-

How does airSlate SignNow facilitate the completion of the inheritance tax form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out the form 'Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden'. With features like e-signature and document sharing, it streamlines the process, making it faster and more efficient. This ensures that all necessary information is accurately captured and submitted.

-

Is there a cost associated with using airSlate SignNow for this form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. Pricing plans vary based on features and usage, allowing you to choose the best option for your needs. Investing in this service can save you time and reduce the stress associated with filing 'Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden'.

-

What are the key benefits of using airSlate SignNow for tax declaration?

Using airSlate SignNow for tax declaration offers several benefits, including ease of use, time savings, and enhanced security. The platform ensures that your documents are securely stored and easily accessible. Additionally, it allows for quick collaboration with other parties involved in the inheritance process.

-

Can I integrate airSlate SignNow with other software for managing my documents?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your document management capabilities. This allows you to seamlessly connect with tools you already use, making it easier to manage the process of 'Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden'. Integration can streamline workflows and improve efficiency.

-

How secure is the information I submit through airSlate SignNow?

airSlate SignNow prioritizes the security of your information, employing advanced encryption and security protocols. This ensures that all data submitted, including 'Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden', is protected from unauthorized access. You can trust that your sensitive information is handled with the utmost care.

-

What support options are available if I have questions about the form?

airSlate SignNow offers various support options, including a comprehensive help center, live chat, and email support. If you have questions about 'Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden', you can easily signNow out for assistance. The support team is dedicated to helping you navigate any challenges you may encounter.

Get more for Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden

Find out other Met Dit Formulier Doet U Aangifte Erfbelasting Voor Een Overlijden

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word