If Wanting to Designate Beneficiaries for a Non IRA Account, Please Submit a Transfer on Death Agreement Beneficiary TOD Agreeme Form

What is the Transfer On Death Agreement (TOD Agreement)?

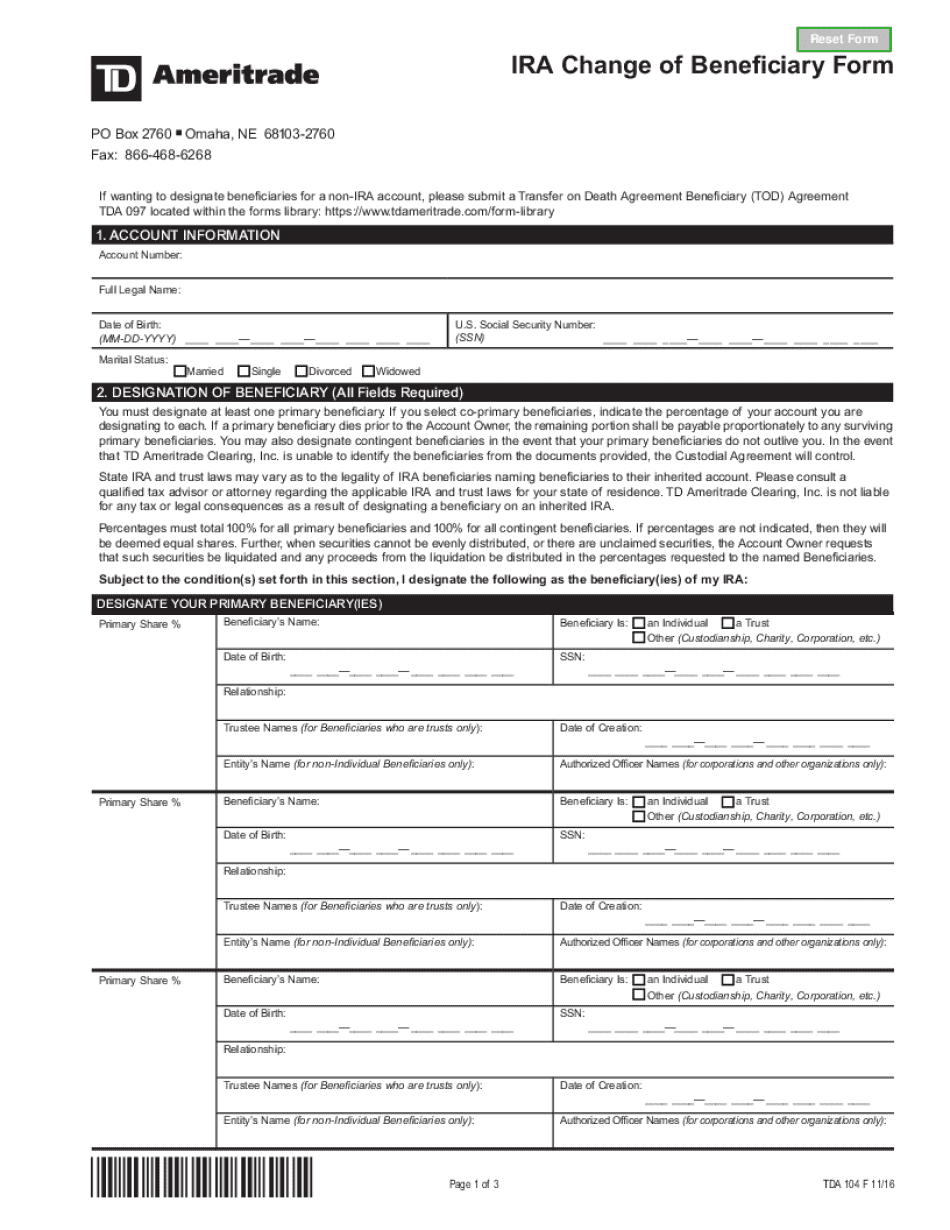

The Transfer On Death Agreement (TOD Agreement) is a legal document that allows individuals to designate beneficiaries for their non-IRA accounts. This agreement ensures that upon the account holder's passing, the assets in the account are transferred directly to the named beneficiaries without going through probate. This process simplifies the transfer of assets and provides clarity on the distribution of funds. It is important for account holders to understand that a TOD Agreement only applies to non-IRA accounts, such as brokerage accounts or bank accounts.

How to Use the Transfer On Death Agreement

To utilize a Transfer On Death Agreement, account holders must first obtain the form from their financial institution or download it from a reputable source. Once the form is acquired, the account holder needs to fill it out by providing necessary details, including the names and contact information of the chosen beneficiaries. After completing the form, it should be signed and submitted to the financial institution managing the account. This submission will officially designate the beneficiaries and ensure that the account assets are transferred according to the account holder's wishes.

Steps to Complete the Transfer On Death Agreement

Completing a Transfer On Death Agreement involves several straightforward steps:

- Obtain the TOD Agreement form from your financial institution.

- Fill in the required information, including your details and those of your beneficiaries.

- Review the form for accuracy to ensure all information is correct.

- Sign the form in the presence of a witness, if required by your state.

- Submit the completed form to your financial institution for processing.

Following these steps helps ensure that your wishes regarding the distribution of your assets are honored.

Key Elements of the Transfer On Death Agreement

Several key elements are essential to include in a Transfer On Death Agreement:

- Account Holder Information: Full name, address, and account details.

- Beneficiary Designation: Names, addresses, and relationship to the account holder of the beneficiaries.

- Signature: The account holder's signature, which validates the agreement.

- Date: The date the agreement is signed, which is crucial for legal purposes.

Including these elements ensures that the agreement is legally binding and effective in transferring assets as intended.

Legal Use of the Transfer On Death Agreement

The Transfer On Death Agreement is legally recognized in many states across the United States. It serves as a valid method for individuals to manage the distribution of their non-IRA assets upon death. However, it is important to verify that the agreement complies with state laws, as requirements may vary. Consulting with a legal professional can provide guidance on the proper execution and implications of the TOD Agreement.

State-Specific Rules for the Transfer On Death Agreement

Each state may have specific rules governing the use of Transfer On Death Agreements. Some states require notarization or witness signatures, while others may have different stipulations regarding beneficiary designations. It is essential for account holders to familiarize themselves with their state's regulations to ensure compliance. This knowledge will help prevent any potential legal issues that could arise during the asset transfer process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the if wanting to designate beneficiaries for a non ira account please submit a transfer on death agreement beneficiary tod

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Transfer On Death Agreement Beneficiary TOD Agreement?

A Transfer On Death Agreement Beneficiary TOD Agreement allows you to designate beneficiaries for a non-IRA account, ensuring that your assets are transferred directly to them upon your passing. If wanting to designate beneficiaries for a non-IRA account, please submit a Transfer On Death Agreement Beneficiary TOD Agreement to streamline this process.

-

How do I create a Transfer On Death Agreement Beneficiary TOD Agreement using airSlate SignNow?

Creating a Transfer On Death Agreement Beneficiary TOD Agreement with airSlate SignNow is simple. You can use our intuitive platform to draft, customize, and eSign your agreement, ensuring that it meets all legal requirements. If wanting to designate beneficiaries for a non-IRA account, please submit a Transfer On Death Agreement Beneficiary TOD Agreement through our service.

-

What are the benefits of using airSlate SignNow for my TOD Agreement?

Using airSlate SignNow for your Transfer On Death Agreement Beneficiary TOD Agreement offers numerous benefits, including ease of use, cost-effectiveness, and secure document management. Our platform allows you to efficiently manage your agreements and ensure that your beneficiaries are designated correctly. If wanting to designate beneficiaries for a non-IRA account, please submit a Transfer On Death Agreement Beneficiary TOD Agreement with us.

-

Is there a cost associated with creating a TOD Agreement on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be affordable and competitive. Our pricing plans cater to various needs, ensuring that you can create your Transfer On Death Agreement Beneficiary TOD Agreement without breaking the bank. If wanting to designate beneficiaries for a non-IRA account, please submit a Transfer On Death Agreement Beneficiary TOD Agreement at a reasonable price.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various applications, enhancing your workflow and document management capabilities. This means you can easily incorporate your Transfer On Death Agreement Beneficiary TOD Agreement into your existing systems. If wanting to designate beneficiaries for a non-IRA account, please submit a Transfer On Death Agreement Beneficiary TOD Agreement seamlessly through our integrations.

-

What types of documents can I eSign with airSlate SignNow?

With airSlate SignNow, you can eSign a wide range of documents, including contracts, agreements, and forms like the Transfer On Death Agreement Beneficiary TOD Agreement. Our platform is versatile and user-friendly, making it easy to manage all your eSigning needs. If wanting to designate beneficiaries for a non-IRA account, please submit a Transfer On Death Agreement Beneficiary TOD Agreement among other documents.

-

How secure is my information when using airSlate SignNow?

Your information is highly secure when using airSlate SignNow. We implement advanced security measures, including encryption and secure storage, to protect your documents and personal data. If wanting to designate beneficiaries for a non-IRA account, please submit a Transfer On Death Agreement Beneficiary TOD Agreement with confidence in our security protocols.

Get more for If Wanting To Designate Beneficiaries For A Non IRA Account, Please Submit A Transfer On Death Agreement Beneficiary TOD Agreeme

- Omb number 1810 0021 form

- Cpl firearm dealer application cover 09 19 docx form

- New residential service provider application inland regional bb inlandrc form

- Ultrasound order form 436869037

- Deed in lieu of foreclosure florida form pdf

- Sample food pantry application form

- Support program kpp rx com form

- Linde ucc 305 manual pdf form

Find out other If Wanting To Designate Beneficiaries For A Non IRA Account, Please Submit A Transfer On Death Agreement Beneficiary TOD Agreeme

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter