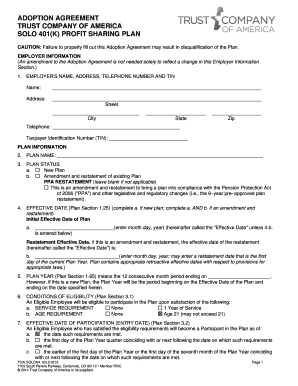

ADOPTION AGREEMENT TRUST COMPANY of AMERICA SOLO 401K PROFIT SHARING PLAN CAUTION Failure to Properly Fill Out This Adoption Agr 2015

Understanding the Adoption Agreement for the Trust Company of America Solo 401k Profit Sharing Plan

The Adoption Agreement for the Trust Company of America Solo 401k Profit Sharing Plan outlines the terms and conditions under which the plan operates. This document is essential for establishing a Solo 401k plan, which allows self-employed individuals and small business owners to save for retirement. It is crucial to understand that any errors in filling out this agreement can lead to the disqualification of the plan, potentially resulting in significant tax implications.

Steps to Complete the Adoption Agreement

Completing the Adoption Agreement requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather necessary information, including personal identification and business details.

- Review the plan provisions to understand your options and obligations.

- Fill out each section of the agreement, ensuring all required fields are completed.

- Consult with a financial advisor or tax professional if you have questions.

- Double-check all entries for accuracy before submission.

Key Elements of the Adoption Agreement

Several key elements must be included in the Adoption Agreement to ensure compliance and functionality:

- Identification of the plan sponsor and the plan name.

- Details regarding contributions, including employee and employer contributions.

- Eligibility criteria for participants in the plan.

- Distribution options and rules for withdrawals.

- Provisions for plan amendments and termination procedures.

Legal Considerations for the Adoption Agreement

The Adoption Agreement must comply with federal regulations set forth by the IRS. It is important to understand the legal implications of the agreement, including:

- Adherence to the Employee Retirement Income Security Act (ERISA) guidelines.

- Understanding fiduciary responsibilities associated with managing the plan.

- Awareness of penalties for non-compliance, which can include disqualification of the plan.

Obtaining the Adoption Agreement

The Adoption Agreement can typically be obtained through the Trust Company of America or authorized financial institutions. Ensure that you are using the most current version to avoid issues with compliance. It may also be available through various financial service providers that offer Solo 401k plans.

IRS Guidelines for the Adoption Agreement

The IRS provides specific guidelines regarding the structure and content of the Adoption Agreement. Familiarizing yourself with these guidelines can help prevent errors that could lead to disqualification. Key points include:

- Requirements for plan documentation and record-keeping.

- Timelines for adopting and amending the plan.

- Reporting requirements for contributions and distributions.

Create this form in 5 minutes or less

Find and fill out the correct adoption agreement trust company of america solo 401k profit sharing plan caution failure to properly fill out this adoption

Create this form in 5 minutes!

How to create an eSignature for the adoption agreement trust company of america solo 401k profit sharing plan caution failure to properly fill out this adoption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN?

The ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN is a retirement plan designed for self-employed individuals and small business owners. It allows for signNow tax-deferred savings and investment opportunities. However, it is crucial to understand that CAUTION Failure To Properly Fill Out This Adoption Agreement May Result In Disqualification Of The Plan.

-

What are the benefits of using the ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN?

This plan offers numerous benefits, including higher contribution limits compared to traditional IRAs and the ability to borrow against your retirement savings. Additionally, it provides flexibility in investment choices. Remember, CAUTION Failure To Properly Fill Out This Adoption Agreement May Result In Disqualification Of The Plan, so ensure accuracy in your application.

-

How much does the ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN cost?

The costs associated with the ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN can vary based on the provider and specific features chosen. Typically, there may be setup fees and annual maintenance fees. Always review the terms carefully to avoid issues, as CAUTION Failure To Properly Fill Out This Adoption Agreement May Result In Disqualification Of The Plan.

-

What features are included in the ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN?

Key features of this plan include flexible contribution options, loan provisions, and a wide range of investment choices. It is designed to cater to the unique needs of self-employed individuals. Ensure you fill out the adoption agreement correctly, as CAUTION Failure To Properly Fill Out This Adoption Agreement May Result In Disqualification Of The Plan.

-

How do I fill out the ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN?

Filling out the adoption agreement requires careful attention to detail. You will need to provide personal and business information, as well as select your contribution options. Be mindful that CAUTION Failure To Properly Fill Out This Adoption Agreement May Result In Disqualification Of The Plan, so double-check your entries.

-

Can I integrate the ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN with other financial tools?

Yes, many providers allow integration with various financial tools and accounting software. This can streamline your financial management and reporting processes. However, ensure that all integrations comply with the plan's requirements, as CAUTION Failure To Properly Fill Out This Adoption Agreement May Result In Disqualification Of The Plan.

-

What happens if I make a mistake on the ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN?

If you make a mistake on the adoption agreement, it could lead to serious consequences, including disqualification of the plan. It is essential to review all information thoroughly before submission. Remember, CAUTION Failure To Properly Fill Out This Adoption Agreement May Result In Disqualification Of The Plan, so seek assistance if needed.

Get more for ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN CAUTION Failure To Properly Fill Out This Adoption Agr

- Wilsonita collegiate purchase program form

- 1248 form

- Home equity loan application form

- Spes form 1

- Non disclosure for employees agreement template form

- Non disclosure for financial ination agreement template form

- Non disclosure for idea agreement template form

- Music artist management contract template form

Find out other ADOPTION AGREEMENT TRUST COMPANY OF AMERICA SOLO 401K PROFIT SHARING PLAN CAUTION Failure To Properly Fill Out This Adoption Agr

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation