OFFICE of the TAX ASSESSOR COLLECTOR 2020

What is the OFFICE OF THE TAX ASSESSOR COLLECTOR

The OFFICE OF THE TAX ASSESSOR COLLECTOR is a governmental entity responsible for assessing property values and collecting property taxes within a specific jurisdiction. This office plays a crucial role in local government finance, ensuring that property assessments are fair and accurate. The office manages various tax-related functions, including maintaining tax records, processing tax payments, and providing information to taxpayers about their obligations. Understanding the role of this office is essential for property owners, as it directly impacts their tax liabilities and local funding for services.

How to use the OFFICE OF THE TAX ASSESSOR COLLECTOR

Utilizing the OFFICE OF THE TAX ASSESSOR COLLECTOR involves several steps that property owners should follow to ensure compliance with local tax regulations. First, individuals can visit the office's website or physical location to access resources and information about property assessments. This includes checking property tax rates, understanding assessment procedures, and finding deadlines for payments. Additionally, taxpayers can inquire about exemptions or reductions for which they may qualify, such as homestead exemptions or senior citizen discounts. Engaging with this office helps taxpayers stay informed about their rights and responsibilities regarding property taxes.

Steps to complete the OFFICE OF THE TAX ASSESSOR COLLECTOR

Completing tasks related to the OFFICE OF THE TAX ASSESSOR COLLECTOR generally involves the following steps:

- Gather necessary documentation, such as property deeds and previous tax statements.

- Visit the office's website to access forms or additional information.

- Complete any required forms accurately, ensuring all information is up to date.

- Submit the forms either online, by mail, or in person, depending on the office's guidelines.

- Keep a copy of submitted documents for your records.

- Monitor your property tax status through the office's online portal or by contacting them directly.

Required Documents

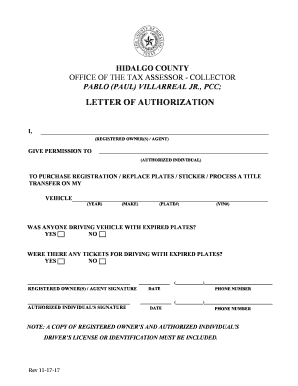

When interacting with the OFFICE OF THE TAX ASSESSOR COLLECTOR, certain documents are typically required to facilitate processes such as property assessment or tax payment. Commonly required documents include:

- Property deed or title

- Previous tax statements

- Proof of residency, if applicable

- Documentation for any exemptions claimed

- Identification, such as a driver's license or state ID

Having these documents ready can streamline interactions with the office and help ensure compliance with local tax regulations.

Penalties for Non-Compliance

Failing to comply with the requirements set forth by the OFFICE OF THE TAX ASSESSOR COLLECTOR can result in various penalties. These may include:

- Late fees on unpaid property taxes

- Interest charges accruing on overdue amounts

- Potential liens placed on the property

- Legal action for non-payment

Understanding these penalties emphasizes the importance of timely compliance and proactive engagement with the office to avoid financial repercussions.

Eligibility Criteria

Eligibility criteria for various programs and exemptions offered by the OFFICE OF THE TAX ASSESSOR COLLECTOR can vary by jurisdiction. Generally, criteria may include:

- Ownership of the property in question

- Residency requirements for certain exemptions

- Income limits for qualifying for tax relief programs

- Age or disability status for senior citizen or disabled veteran exemptions

Reviewing these criteria is essential for property owners to determine their eligibility for potential tax benefits.

Create this form in 5 minutes or less

Find and fill out the correct office of the tax assessor collector

Create this form in 5 minutes!

How to create an eSignature for the office of the tax assessor collector

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the OFFICE OF THE TAX ASSESSOR COLLECTOR provide?

The OFFICE OF THE TAX ASSESSOR COLLECTOR is responsible for assessing property values and collecting property taxes. They ensure that tax assessments are fair and accurate, providing essential services to the community. Utilizing airSlate SignNow can streamline document management for these processes.

-

How can airSlate SignNow benefit the OFFICE OF THE TAX ASSESSOR COLLECTOR?

airSlate SignNow offers an easy-to-use platform for sending and eSigning documents, which can signNowly enhance the efficiency of the OFFICE OF THE TAX ASSESSOR COLLECTOR. By digitizing document workflows, it reduces processing time and improves accuracy in tax-related communications. This leads to better service for taxpayers.

-

What are the pricing options for airSlate SignNow for government offices like the OFFICE OF THE TAX ASSESSOR COLLECTOR?

airSlate SignNow provides flexible pricing plans tailored to the needs of organizations, including government offices such as the OFFICE OF THE TAX ASSESSOR COLLECTOR. These plans are designed to be cost-effective, ensuring that even budget-conscious departments can access essential eSigning features. Contact us for a customized quote.

-

Is airSlate SignNow secure for use by the OFFICE OF THE TAX ASSESSOR COLLECTOR?

Yes, airSlate SignNow prioritizes security, making it a reliable choice for the OFFICE OF THE TAX ASSESSOR COLLECTOR. The platform employs advanced encryption and compliance measures to protect sensitive tax documents. This ensures that all transactions are secure and confidential.

-

Can the OFFICE OF THE TAX ASSESSOR COLLECTOR integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions that the OFFICE OF THE TAX ASSESSOR COLLECTOR may already be using. This capability allows for a more cohesive workflow, enabling staff to manage documents efficiently across different platforms.

-

What features does airSlate SignNow offer that are beneficial for the OFFICE OF THE TAX ASSESSOR COLLECTOR?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking, which are particularly beneficial for the OFFICE OF THE TAX ASSESSOR COLLECTOR. These tools help streamline the document signing process, ensuring that tax documents are processed quickly and accurately.

-

How does airSlate SignNow improve customer service for the OFFICE OF THE TAX ASSESSOR COLLECTOR?

By utilizing airSlate SignNow, the OFFICE OF THE TAX ASSESSOR COLLECTOR can enhance customer service through faster document processing and improved communication. The platform allows for quick responses to taxpayer inquiries and facilitates timely updates on tax assessments. This leads to higher satisfaction among constituents.

Get more for OFFICE OF THE TAX ASSESSOR COLLECTOR

- Va form 28 8606

- Periodic table relationships worksheet answers form

- Amsco chapter 15 answer key form

- Conversion factor worksheet form

- Ifly waiver form

- School site and child day care facility pesticide use reporting form

- Courier service level agreement template form

- Courier service agreement template form

Find out other OFFICE OF THE TAX ASSESSOR COLLECTOR

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors