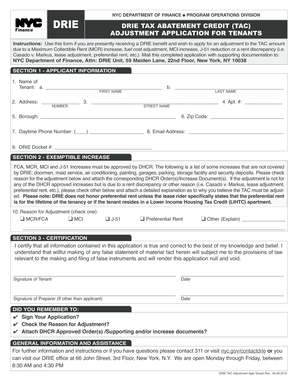

DRIE Tax Abatement Credit NYC Gov Form

What is the DRIE Tax Abatement Credit NYC gov

The DRIE Tax Abatement Credit, offered by NYC government, is a financial relief program designed to assist eligible senior citizens and disabled individuals with property tax burdens. This program provides a reduction in property taxes for those who meet specific income and residency criteria. The DRIE program aims to ensure that individuals on fixed incomes can afford to remain in their homes, promoting stability within communities. The credit is applied directly to the property tax bill, reducing the amount owed to the city.

Eligibility Criteria

To qualify for the DRIE Tax Abatement Credit, applicants must meet several criteria:

- Applicants must be at least sixty-two years old or have a disability.

- They must reside in the property for which they are applying for the credit.

- Household income must not exceed the established limit, which is adjusted annually.

- Property must be a primary residence and cannot be a co-op or condo owned by a corporation.

Steps to complete the DRIE Tax Abatement Credit NYC gov

The process to complete the DRIE Tax Abatement Credit involves several key steps:

- Gather necessary documentation, including proof of age or disability, income verification, and residency evidence.

- Obtain the application form from the NYC Department of Finance website or local offices.

- Complete the application form accurately, ensuring all required fields are filled out.

- Submit the application along with the required documents by the specified deadline.

- Await confirmation from the NYC Department of Finance regarding the approval status of your application.

Required Documents

Applicants must provide specific documents to support their application for the DRIE Tax Abatement Credit. These documents typically include:

- Proof of age or disability, such as a birth certificate or disability award letter.

- Income documentation, including tax returns or pay stubs.

- Proof of residency, such as a utility bill or lease agreement.

Application Process & Approval Time

The application process for the DRIE Tax Abatement Credit is straightforward but requires careful attention to detail. Once the application is submitted, the NYC Department of Finance reviews it to ensure all criteria are met. The approval time can vary, but applicants typically receive notification within a few weeks. It is advisable to apply well before the tax deadline to ensure timely processing and avoid penalties.

Form Submission Methods

Applicants can submit their DRIE Tax Abatement Credit application through various methods:

- Online submission via the NYC Department of Finance website.

- Mailing the completed application and documents to the designated office.

- In-person submission at local NYC Department of Finance offices.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the drie tax abatement credit nyc gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DRIE Tax Abatement Credit NYC gov?

The DRIE Tax Abatement Credit NYC gov is a program designed to provide tax relief to eligible senior citizens and disabled individuals in New York City. This credit helps reduce property taxes, making housing more affordable for those who qualify. Understanding this program can signNowly benefit eligible residents.

-

How can I apply for the DRIE Tax Abatement Credit NYC gov?

To apply for the DRIE Tax Abatement Credit NYC gov, you need to complete the application form available on the NYC government website. Ensure you meet the eligibility criteria, including age and income limits. Submitting your application on time is crucial to receive the benefits.

-

What are the eligibility requirements for the DRIE Tax Abatement Credit NYC gov?

Eligibility for the DRIE Tax Abatement Credit NYC gov includes being a senior citizen or a person with disabilities, owning or renting a home in NYC, and meeting specific income thresholds. It's essential to review the detailed criteria on the NYC government website to confirm your eligibility.

-

How much can I save with the DRIE Tax Abatement Credit NYC gov?

The savings from the DRIE Tax Abatement Credit NYC gov can vary based on your property taxes and eligibility. Generally, the program can signNowly reduce your annual property tax bill, providing substantial financial relief. For exact figures, consult the NYC government resources or a tax professional.

-

Is the DRIE Tax Abatement Credit NYC gov renewable?

Yes, the DRIE Tax Abatement Credit NYC gov is renewable annually, provided you continue to meet the eligibility requirements. It’s important to reapply or confirm your status each year to ensure you maintain your benefits. Keep track of deadlines to avoid losing your credit.

-

What documents do I need for the DRIE Tax Abatement Credit NYC gov application?

When applying for the DRIE Tax Abatement Credit NYC gov, you will need to provide proof of age, income documentation, and proof of residency. Ensure all documents are current and accurately reflect your situation to avoid delays in processing your application.

-

Can I receive assistance with my DRIE Tax Abatement Credit NYC gov application?

Yes, there are various resources available to assist you with your DRIE Tax Abatement Credit NYC gov application. Many community organizations and local government offices offer help in completing the application process. Don’t hesitate to signNow out for support to ensure your application is submitted correctly.

Get more for DRIE Tax Abatement Credit NYC gov

- Dss 8110 form

- Application for the grant or renewal of an air police scotland form

- Culinarians code form

- Methealth claim submission cover sheet form

- Health questionnaire questionario de salud southerncompanions form

- Newindia griha suvidha claim form

- Counseling treatment plan form

- Manageyourleague comssllsiteslittle league player registration form manage your league

Find out other DRIE Tax Abatement Credit NYC gov

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter