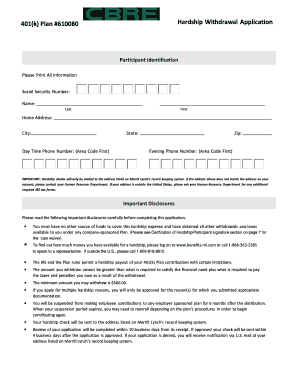

401k Plan #610080 Hardship Withdrawal Application Merrill Lynch Form

What is the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch

The 401k Plan #610080 Hardship Withdrawal Application from Merrill Lynch is a specific form designed for individuals seeking to withdraw funds from their 401k retirement plan due to financial hardship. This application allows participants to access their savings in situations where they face immediate and pressing financial needs, such as medical expenses, purchasing a primary residence, or preventing eviction or foreclosure. Understanding the purpose of this application is crucial for those who may qualify for a hardship withdrawal under the plan's guidelines.

Eligibility Criteria

To qualify for a hardship withdrawal using the 401k Plan #610080 application, participants must meet specific eligibility requirements set by the IRS and the plan administrator. Generally, eligible circumstances include:

- Medical expenses for the participant or their dependents.

- Costs related to purchasing a primary home.

- Tuition and related educational fees for the next twelve months.

- Payments necessary to prevent eviction or foreclosure on a primary residence.

- Funeral expenses for a family member.

It is essential to provide documentation supporting the hardship claim when submitting the application.

Steps to complete the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch

Completing the 401k Plan #610080 Hardship Withdrawal Application involves several key steps to ensure accuracy and compliance. Participants should follow these steps:

- Obtain the application form from Merrill Lynch or through your employer's benefits portal.

- Review the eligibility criteria to confirm that your situation qualifies for a hardship withdrawal.

- Fill out the application form, providing all required personal information and details about the hardship.

- Gather supporting documentation that verifies your financial need.

- Submit the completed application along with the documentation to the appropriate address or electronically as instructed.

After submission, participants should monitor their application status and be prepared to provide additional information if requested.

Required Documents

When applying for a hardship withdrawal using the 401k Plan #610080 application, participants must include specific documents to support their request. These may include:

- Proof of the financial hardship, such as bills or invoices.

- Tax returns or pay stubs to verify income.

- Documentation of any loans or other financial obligations.

- Any other relevant documents that substantiate the claim.

Providing complete documentation can help expedite the review process and increase the likelihood of approval.

Form Submission Methods

The 401k Plan #610080 Hardship Withdrawal Application can typically be submitted through various methods, depending on the preferences of the participant and the guidelines of Merrill Lynch. Common submission methods include:

- Online submission via the Merrill Lynch website or mobile app.

- Mailing the completed application to the designated address provided on the form.

- In-person submission at a local Merrill Lynch office, if applicable.

Participants should choose the method that best suits their needs and ensure that they keep a copy of the submitted application for their records.

IRS Guidelines

The IRS has established guidelines governing hardship withdrawals from 401k plans, which apply to the 401k Plan #610080 application. These guidelines outline the conditions under which withdrawals are permitted and the tax implications involved. Key points include:

- Hardship withdrawals are subject to income tax and may incur a ten percent early withdrawal penalty if the participant is under the age of fifty-nine and a half.

- Participants must demonstrate that they have no other means to satisfy the financial need.

- Withdrawals are limited to the amount necessary to meet the hardship.

Understanding these guidelines is essential for participants to make informed decisions regarding their retirement savings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 401k plan 610080 hardship withdrawal application merrill lynch

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch?

The 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch is a form that allows participants to request a hardship withdrawal from their 401k plan. This application is designed to help individuals access their retirement funds in times of financial need, ensuring compliance with IRS regulations.

-

How do I complete the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch?

To complete the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch, you need to provide personal information, details about your financial hardship, and any supporting documentation. It's important to follow the instructions carefully to ensure your application is processed smoothly.

-

What are the eligibility requirements for the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch?

Eligibility for the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch typically includes having a qualifying financial hardship, such as medical expenses or home purchase costs. Additionally, you must be a participant in the 401k plan and have sufficient vested funds available for withdrawal.

-

Are there any fees associated with the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch?

While there may not be direct fees for submitting the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch, it's important to consider potential tax implications and penalties for early withdrawal. Consulting with a financial advisor can help clarify any costs associated with your withdrawal.

-

What benefits does the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch offer?

The primary benefit of the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch is that it provides access to funds during financial emergencies. This application allows you to withdraw necessary amounts without taking a loan, helping you manage immediate financial needs while preserving your retirement savings.

-

How long does it take to process the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch?

Processing times for the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch can vary, but typically it takes a few business days to review and approve your application. Once approved, the funds are usually disbursed within a week, depending on the method of payment chosen.

-

Can I integrate the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch with other financial tools?

Yes, the 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch can often be integrated with various financial management tools. This integration can help you track your retirement savings and manage your finances more effectively, ensuring you stay informed about your financial health.

Get more for 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch

- Eeds form 29666402

- Safety handbook well done construction services llc form

- Child emancipation butler county ohio form

- Renunciation of inheritance form

- Trust special needs sample form

- Blank bill of sale form to print

- For revocation of probation or supervised release form

- Commercial arbitration rules demand for arbitration american form

Find out other 401k Plan #610080 Hardship Withdrawal Application Merrill Lynch

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple