Please Complete a Separate Profit Aand Loss Statement for Each Business Owned by the Borrowers Form

What is the Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers Form

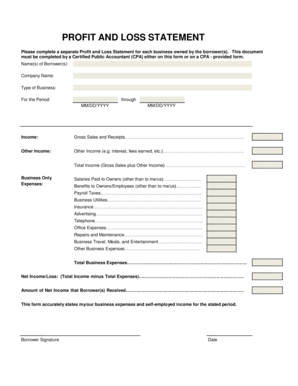

The form titled "Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers" is a crucial document used primarily in financial assessments and loan applications. It serves to provide lenders with a clear overview of the financial performance of each business owned by the borrowers. This form is essential for accurately evaluating the income and expenses associated with each business, which helps in determining the borrowers' ability to repay loans. By detailing the profit and loss for each entity, the form ensures that all financial information is transparent and organized, facilitating informed lending decisions.

How to use the Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers Form

Using the form effectively involves several key steps. First, gather all necessary financial documents related to each business, including income statements, expense reports, and any other relevant financial records. Next, fill out the form by entering the income and expenses for each business separately. It is important to be thorough and accurate, as lenders rely on this information to assess financial health. After completing the form, review it for any errors or omissions before submitting it as part of your loan application package.

Steps to complete the Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers Form

Completing the form requires careful attention to detail. Follow these steps for accuracy:

- Collect financial records for each business, including sales, costs, and other expenses.

- Begin with the first business, listing total income at the top of the form.

- Detail all expenses associated with that business, categorizing them as necessary.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Repeat the process for each additional business owned by the borrowers.

- Double-check all figures for accuracy before finalizing the form.

Key elements of the Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers Form

Several key elements must be included in the form to ensure it meets the requirements of lenders:

- Business Identification: Clearly state the name and type of each business.

- Income Details: Provide a comprehensive breakdown of all income sources for each business.

- Expense Breakdown: List all operating expenses, including fixed and variable costs.

- Net Profit or Loss: Calculate and present the net profit or loss for each business.

- Signature Section: Ensure that all borrowers sign the form to validate the information provided.

Legal use of the Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers Form

This form is legally significant in the context of financial transactions, particularly for loan applications. It must be filled out honestly and accurately, as any misrepresentation can lead to legal consequences, including loan denial or fraud charges. Lenders may use the information to comply with regulatory requirements and assess creditworthiness. Therefore, it is essential for borrowers to understand the legal implications of the information they provide in this form.

Examples of using the Please Complete A Separate Profit And Loss Statement For Each Business Owned By The Borrowers Form

There are various scenarios where this form is utilized. For instance, a small business owner applying for a loan to expand operations may need to present this form to demonstrate financial viability. Similarly, an entrepreneur seeking investment may use the form to provide potential investors with a clear picture of their business performance. In both cases, the form serves as a critical tool for financial transparency and credibility.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the please complete a separate profit aand loss statement for each business owned by the borrowers form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form'?

The 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form' is a document that helps borrowers provide detailed financial information for each business they own. This form is essential for lenders to assess the financial health of multiple businesses owned by a borrower.

-

How can airSlate SignNow help with the 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form'?

airSlate SignNow simplifies the process of completing and signing the 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form'. Our platform allows users to fill out, eSign, and send the form securely, ensuring a smooth workflow.

-

Is there a cost associated with using airSlate SignNow for this form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that facilitate the completion and signing of documents, including the 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form'.

-

What features does airSlate SignNow offer for completing this form?

airSlate SignNow provides features such as customizable templates, real-time collaboration, and secure eSigning. These tools make it easy to complete the 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form' efficiently and accurately.

-

Can I integrate airSlate SignNow with other applications for this form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow. You can easily connect with tools like Google Drive, Dropbox, and more to manage the 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form' seamlessly.

-

What are the benefits of using airSlate SignNow for this form?

Using airSlate SignNow for the 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form' enhances efficiency and accuracy. It reduces paperwork, speeds up the signing process, and provides a secure platform for document management.

-

Is it easy to use airSlate SignNow for completing this form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the 'Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form'. Our intuitive interface guides users through each step of the process.

Get more for Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form

- Contra costa county housing authority portability form

- Eclb 7 department of business and professional regulation form

- Declaration concerning the language of study outside canada form

- Otc form 998 oklahoma tax commission state of oklahoma

- Authorization for use and disclosure of individual information msc 2099

- City of johannesburg environmental health business licensing restaurant org form

- Temporary appointment requisition form department headchair 4

- Kwazulunatal department of educationec38applicati form

Find out other Please Complete A Separate Profit Aand Loss Statement For Each Business Owned By The Borrowers Form

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later