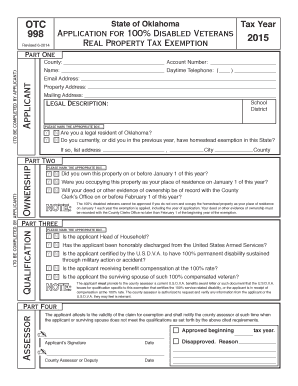

OTC Form 998 Oklahoma Tax Commission State of Oklahoma

What is the OTC Form 998 Oklahoma Tax Commission State Of Oklahoma

The OTC Form 998 is a document issued by the Oklahoma Tax Commission, specifically designed for taxpayers in the State of Oklahoma. This form is utilized for various tax-related purposes, including reporting and claiming specific tax credits or exemptions. It serves as a formal declaration to ensure compliance with state tax laws and regulations. Understanding the purpose and requirements of this form is essential for individuals and businesses to accurately fulfill their tax obligations in Oklahoma.

How to use the OTC Form 998 Oklahoma Tax Commission State Of Oklahoma

Using the OTC Form 998 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information that pertain to your tax situation. Next, download the form from the Oklahoma Tax Commission’s website or obtain a physical copy. Carefully fill out the form, ensuring all required fields are completed accurately. After completing the form, review it for any errors before submitting it to the appropriate tax authority. This can typically be done online, by mail, or in person, depending on your preference and the specific requirements of the Oklahoma Tax Commission.

Steps to complete the OTC Form 998 Oklahoma Tax Commission State Of Oklahoma

Completing the OTC Form 998 requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Obtain the form from the Oklahoma Tax Commission website or a local office.

- Read the instructions carefully to understand the requirements.

- Fill in your personal and financial information accurately.

- Provide any necessary supporting documentation as indicated on the form.

- Review your entries for accuracy and completeness.

- Submit the completed form through the designated method (online, by mail, or in person).

Key elements of the OTC Form 998 Oklahoma Tax Commission State Of Oklahoma

The OTC Form 998 contains several key elements that are crucial for its validity and effectiveness. These elements include:

- Taxpayer Information: This section requires your name, address, and identification number.

- Tax Year: Indicate the specific tax year for which the form is being submitted.

- Claimed Credits or Exemptions: Clearly outline any tax credits or exemptions you are claiming.

- Signature: A signature is required to validate the form and confirm the accuracy of the information provided.

Legal use of the OTC Form 998 Oklahoma Tax Commission State Of Oklahoma

The legal use of the OTC Form 998 is governed by Oklahoma state tax laws. When filled out correctly, this form serves as a legally binding document that can be used to support claims for tax credits or exemptions. It is essential to ensure that all information is accurate and truthful, as providing false information can lead to penalties or legal repercussions. Compliance with the legal requirements surrounding this form is crucial for maintaining good standing with the Oklahoma Tax Commission.

Filing Deadlines / Important Dates

Filing deadlines for the OTC Form 998 vary depending on the specific tax year and the nature of the claim being made. Generally, it is advisable to submit the form by the state tax filing deadline to avoid any potential penalties. Be aware of any changes in deadlines that may occur due to state regulations or specific circumstances. Keeping track of these important dates ensures timely compliance with Oklahoma tax laws.

Quick guide on how to complete otc form 998 oklahoma tax commission state of oklahoma

Prepare OTC Form 998 Oklahoma Tax Commission State Of Oklahoma effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly and without delays. Manage OTC Form 998 Oklahoma Tax Commission State Of Oklahoma on any device using airSlate SignNow's Android or iOS applications and simplify your document-centric processes today.

The easiest way to modify and eSign OTC Form 998 Oklahoma Tax Commission State Of Oklahoma effortlessly

- Locate OTC Form 998 Oklahoma Tax Commission State Of Oklahoma and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize necessary parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign OTC Form 998 Oklahoma Tax Commission State Of Oklahoma and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the otc form 998 oklahoma tax commission state of oklahoma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OTC Form 998 for the Oklahoma Tax Commission?

The OTC Form 998 is a crucial form provided by the Oklahoma Tax Commission that assists taxpayers in the State of Oklahoma with various tax-related processes. With this form, individuals can ensure compliance with state tax regulations, thereby simplifying their tax obligations.

-

How can airSlate SignNow help with OTC Form 998 submissions?

AirSlate SignNow offers an efficient platform for businesses to send, eSign, and manage their OTC Form 998 submissions securely. Our easy-to-use interface ensures that users can fill out and sign the form electronically, streamlining the submission process signNowly.

-

Is there a fee for using airSlate SignNow to eSign OTC Form 998 in Oklahoma?

Yes, while airSlate SignNow provides a cost-effective solution for managing your documents, there are subscription plans available. Pricing depends on the features you need, but rest assured that signing OTC Form 998 via airSlate SignNow remains budget-friendly for your eSignature needs.

-

What features are available in airSlate SignNow for handling OTC Form 998?

AirSlate SignNow includes a range of features designed for managing OTC Form 998 efficiently, such as customizable templates, collaboration tools, and secure cloud storage. These features make it easier for users in the State of Oklahoma to track the status of their forms and ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for OTC Form 998 processing?

Absolutely! AirSlate SignNow supports integrations with various third-party applications, allowing for seamless processing of OTC Form 998 alongside your existing business tools. This integration capability enhances workflow efficiency and ensures all your documents are organized in one place.

-

What are the advantages of using airSlate SignNow for OTC Form 998?

Using airSlate SignNow for your OTC Form 998 offers several benefits, including increased efficiency, reduced paperwork, and enhanced security for your sensitive information. The user-friendly platform simplifies document management, helping you focus more on your core business activities in the State of Oklahoma.

-

How secure is the airSlate SignNow platform for handling sensitive OTC Form 998 data?

Security is a top priority at airSlate SignNow, especially for sensitive data like that contained in the OTC Form 998. The platform uses advanced encryption and secure servers to ensure that your information is protected at all times, allowing you to sign and submit documents with peace of mind.

Get more for OTC Form 998 Oklahoma Tax Commission State Of Oklahoma

- Legal last will and testament form for married person with adult children from prior marriage california

- Legal last will and testament form for divorced person not remarried with adult children california

- Legal last will and testament form for domestic partner with adult children from prior marriage california

- Legal last will and testament form for divorced person not remarried with no children california

- Legal last will and testament form for divorced person not remarried with minor children california

- Legal last will and testament form for domestic partner with adult children california

- Ca last form

- Ca legal partner form

Find out other OTC Form 998 Oklahoma Tax Commission State Of Oklahoma

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple