Form 5310 1996

What is Form 5310

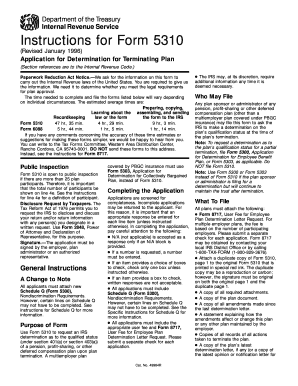

Form 5310 is a document used by employers to request a determination letter from the Internal Revenue Service (IRS) regarding the qualified status of their retirement plan. This form is specifically designed for plans that are being amended or terminated. The determination letter helps ensure that the plan complies with applicable tax laws and regulations, providing assurance to both the employer and plan participants.

How to Obtain Form 5310

To obtain Form 5310, individuals can visit the IRS website where the form is available for download. It can be found in the forms and publications section, typically in the area dedicated to retirement plans. Additionally, the form can be requested directly from the IRS by contacting their customer service or by visiting a local IRS office.

Steps to Complete Form 5310

Completing Form 5310 involves several key steps:

- Gather necessary information about the retirement plan, including plan documents and participant data.

- Fill out the form accurately, providing details about the plan sponsor, plan type, and any amendments or terminations.

- Review the completed form for accuracy and completeness, ensuring all required sections are filled.

- Sign and date the form, as required.

Legal Use of Form 5310

Form 5310 is legally required for employers seeking a determination letter when amending or terminating a retirement plan. Proper use of this form ensures compliance with IRS regulations, which can help avoid penalties and ensure that the plan remains qualified under tax laws. Employers should be aware of the legal implications of submitting this form and the importance of accuracy in the information provided.

Filing Deadlines / Important Dates

Filing deadlines for Form 5310 may vary depending on the specific circumstances of the retirement plan. Generally, the form should be filed within a specific timeframe after the plan is amended or terminated. Employers should consult the IRS guidelines or a tax professional to determine the exact deadlines applicable to their situation to avoid potential penalties.

Required Documents

When submitting Form 5310, employers must include several supporting documents. These may include:

- The plan document and any amendments.

- Trust agreement, if applicable.

- Summary plan description.

- Any prior determination letters received from the IRS.

Providing complete documentation is crucial for the IRS to process the request effectively.

Form Submission Methods

Form 5310 can be submitted to the IRS through various methods. Employers can choose to file the form by mail, ensuring it is sent to the correct IRS address based on their location. Additionally, electronic filing options may be available, allowing for a quicker submission process. Employers should check the IRS website for the latest information on submission methods.

Create this form in 5 minutes or less

Find and fill out the correct form 5310

Create this form in 5 minutes!

How to create an eSignature for the form 5310

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5310 and why is it important?

Form 5310 is a crucial document used by businesses to request a determination letter from the IRS regarding the qualified status of their retirement plans. Understanding Form 5310 is essential for ensuring compliance with tax regulations and maintaining the tax-qualified status of your plan.

-

How can airSlate SignNow help with completing Form 5310?

airSlate SignNow simplifies the process of completing Form 5310 by providing an intuitive platform for filling out and eSigning documents. With our user-friendly interface, you can easily manage and submit Form 5310, ensuring accuracy and compliance.

-

What features does airSlate SignNow offer for Form 5310 processing?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Form 5310. These tools enhance efficiency and ensure that your documents are processed quickly and securely.

-

Is there a cost associated with using airSlate SignNow for Form 5310?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling Form 5310. Our cost-effective solutions ensure that you get the best value while managing your document signing and processing needs.

-

Can I integrate airSlate SignNow with other software for Form 5310 management?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to manage Form 5310 alongside your existing tools. This integration enhances workflow efficiency and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for Form 5310?

Using airSlate SignNow for Form 5310 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and processed quickly, helping you stay compliant with IRS regulations.

-

How secure is airSlate SignNow when handling Form 5310?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Form 5310 and other sensitive documents. You can trust that your information is safe while using our platform.

Get more for Form 5310

- Home schooling participating in school programs philosophy rsu16 form

- In arlington county govdelivery form

- Saws2asar rights responsibilities and other important form

- Cdss ca form

- Laa1 limited alteration form

- 306 302 1 only one responsible source and no other form

- Community nursing home program oversight can the va form

- Form 760py virginia part year resident income tax return

Find out other Form 5310

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document