Employer Income Form 2005

Understanding the Employer Income Form

The Employer Income Form is a crucial document used primarily for reporting an employee's income to the Internal Revenue Service (IRS). This form serves as a record for both employers and employees, detailing wages, tips, and other compensation received during the tax year. It is essential for accurately completing tax returns and ensuring compliance with federal tax regulations.

How to Use the Employer Income Form

To effectively use the Employer Income Form, individuals should first gather all necessary information, including the employee's Social Security number, total earnings, and any taxes withheld. This form can be utilized by employers to report income for employees, which is then used by employees to file their tax returns. It is important to ensure that all information is accurate and complete to avoid any potential issues with the IRS.

Steps to Complete the Employer Income Form

Completing the Employer Income Form involves several key steps:

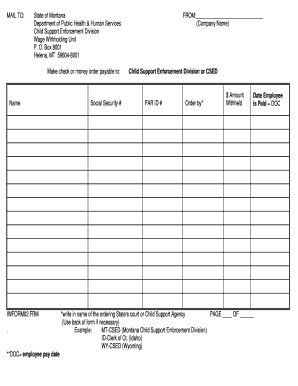

- Gather employee information, including name, address, and Social Security number.

- Calculate total earnings for the reporting period, including wages, bonuses, and tips.

- Determine the amount of federal, state, and local taxes withheld.

- Fill out the form accurately, ensuring all figures are correct.

- Review the form for any errors before submission.

Legal Use of the Employer Income Form

The Employer Income Form must be used in accordance with IRS regulations. Employers are legally required to provide this form to their employees and submit it to the IRS. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for employers to maintain accurate records and ensure timely submission of the form to avoid legal complications.

Required Documents for the Employer Income Form

When preparing the Employer Income Form, several documents may be required to ensure accuracy. These include:

- Employee's Social Security card or number.

- Records of all earnings paid to the employee.

- Documentation of any tax withholdings.

- Previous year's tax forms, if applicable.

Form Submission Methods

The Employer Income Form can be submitted to the IRS through various methods. Employers have the option to file electronically, which is often quicker and more efficient. Alternatively, forms can be mailed directly to the IRS or submitted in person at designated IRS offices. It is important to adhere to the submission deadlines to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct employer income form

Create this form in 5 minutes!

How to create an eSignature for the employer income form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Employer Income Form?

An Employer Income Form is a document used to verify an employee's income for various purposes, such as loan applications or rental agreements. With airSlate SignNow, you can easily create, send, and eSign these forms, ensuring a smooth and efficient process.

-

How can airSlate SignNow help with Employer Income Forms?

airSlate SignNow streamlines the process of managing Employer Income Forms by allowing users to create templates, send them for eSignature, and track their status in real-time. This saves time and reduces the hassle of paperwork, making it an ideal solution for businesses.

-

Is there a cost associated with using airSlate SignNow for Employer Income Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that simplify the creation and management of Employer Income Forms, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for Employer Income Forms?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities for Employer Income Forms. These features enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other applications for Employer Income Forms?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your existing tools with the Employer Income Form process. This flexibility helps streamline your workflow and enhances productivity.

-

How secure is the information on Employer Income Forms with airSlate SignNow?

Security is a top priority for airSlate SignNow. All data related to Employer Income Forms is encrypted and stored securely, ensuring that sensitive information remains protected throughout the signing process.

-

Can I track the status of my Employer Income Forms in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your Employer Income Forms. You can easily monitor who has signed the document and receive notifications when the signing process is complete, keeping you informed every step of the way.

Get more for Employer Income Form

- Toy and gift drive solicitation and reply indd form

- How to verify patient insurance in three easy steps form

- Medical records release form doctor care arizona

- Imm 45 form

- Www moorestownvna orgserviceshospicecamp fireflymoorestown visiting nurse association form

- Berezny chiropractic patient history and registration form

- Holmdel acupuncture amp herbal medicine center form

- Request for surgical clearance for bariatric surgery blossom form

Find out other Employer Income Form

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement