Dcb Bank Passbook 2011

What is the Dcb Bank Passbook

The Dcb Bank Passbook is a financial document that serves as a record of transactions for account holders at DCB Bank. It provides a detailed history of deposits, withdrawals, and interest accrued, allowing customers to track their account activity. The passbook is particularly useful for individuals who prefer a tangible record of their banking transactions rather than relying solely on digital statements.

How to use the Dcb Bank Passbook

Using the Dcb Bank Passbook involves regularly updating it with transaction details. Customers can present their passbook at any DCB Bank branch to have it updated with the latest transactions. Additionally, account holders can manually record deposits and withdrawals in the passbook, ensuring they maintain an accurate account of their finances. This method provides a clear overview of account balances and transaction history.

How to obtain the Dcb Bank Passbook

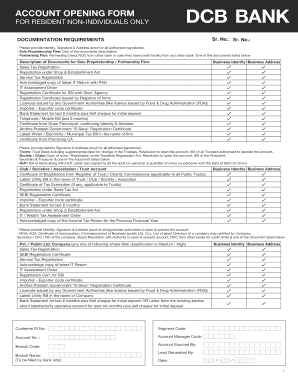

To obtain a Dcb Bank Passbook, customers must first open an account with DCB Bank. During the account opening process, they can request a passbook. If a passbook is not provided initially, customers can visit a local branch and request one. Identification and account details may be required to process the request. It is advisable to check with the bank for any specific requirements or fees associated with obtaining a passbook.

Key elements of the Dcb Bank Passbook

The Dcb Bank Passbook includes several key elements that are essential for tracking account activity. These elements typically consist of:

- Account holder's name: The name of the individual or entity that owns the account.

- Account number: A unique identifier for the account.

- Transaction details: A record of deposits, withdrawals, and transfers, including dates and amounts.

- Balance information: The current balance after each transaction.

- Interest details: Information about interest earned on the account, if applicable.

Legal use of the Dcb Bank Passbook

The Dcb Bank Passbook is a legally recognized document that serves as proof of account ownership and transaction history. It can be used in various legal contexts, such as verifying financial status for loan applications or during audits. Account holders should ensure that their passbook is kept up-to-date to reflect accurate information, as discrepancies may lead to complications in legal matters.

Examples of using the Dcb Bank Passbook

Account holders can utilize the Dcb Bank Passbook in several practical scenarios. For instance, when applying for a mortgage, individuals may present their passbook to demonstrate their savings history. Additionally, small business owners can use the passbook to track daily cash flow and manage expenses effectively. By maintaining an organized record of transactions, users can make informed financial decisions based on their passbook entries.

Create this form in 5 minutes or less

Find and fill out the correct dcb bank passbook

Create this form in 5 minutes!

How to create an eSignature for the dcb bank passbook

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Dcb Bank Passbook?

A Dcb Bank Passbook is a physical or digital record that provides a summary of your bank account transactions. It allows you to track deposits, withdrawals, and your current balance. With airSlate SignNow, you can easily manage and eSign documents related to your Dcb Bank Passbook.

-

How can I access my Dcb Bank Passbook online?

You can access your Dcb Bank Passbook online through the Dcb Bank mobile app or website. Simply log in to your account, and you will find your passbook details readily available. This digital access ensures you can manage your finances conveniently.

-

What are the benefits of using a Dcb Bank Passbook?

Using a Dcb Bank Passbook helps you maintain a clear record of your financial transactions. It provides transparency and helps in budgeting by tracking your spending habits. Additionally, it can be easily integrated with airSlate SignNow for document management.

-

Is there a fee for obtaining a Dcb Bank Passbook?

Typically, there is no fee for obtaining a Dcb Bank Passbook when you open an account with Dcb Bank. However, it's best to check with the bank for any specific charges related to account maintenance or additional services.

-

Can I eSign documents related to my Dcb Bank Passbook?

Yes, with airSlate SignNow, you can eSign documents related to your Dcb Bank Passbook. This feature allows you to securely sign and send important documents without the need for printing or physical signatures, streamlining your banking experience.

-

How does the Dcb Bank Passbook integrate with airSlate SignNow?

The Dcb Bank Passbook can be integrated with airSlate SignNow to facilitate the electronic signing of banking documents. This integration enhances efficiency by allowing users to manage their passbook-related documents seamlessly within the airSlate platform.

-

What features should I look for in a Dcb Bank Passbook?

When choosing a Dcb Bank Passbook, look for features such as transaction history, balance updates, and easy access through mobile or online banking. Additionally, consider the ability to integrate with tools like airSlate SignNow for enhanced document management.

Get more for Dcb Bank Passbook

- Experience attestation 2013 form

- Pdffiller death certificate 2003 form

- Parent acknowledgement form texas 2004

- Fl doh and sw registered intern form

- Florida doh adult hiv confidential case report 2013 form

- Vfc vaccine usage worksheet form

- Form lcca

- Florida legislature employment application online form

Find out other Dcb Bank Passbook

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile