Servicemembers Civil Relief Act You May Use This Form to Request that Your Loan Holder Limit the Interest Rate to 6% on Your Dir 2016

Understanding the Servicemembers Civil Relief Act

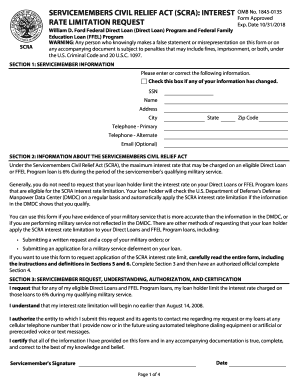

The Servicemembers Civil Relief Act (SCRA) is a significant piece of legislation designed to protect the financial and legal rights of military personnel. This act allows servicemembers to request that their loan holders limit the interest rate on their direct loans and Federal Family Education Loan (FFEL) Program loans to six percent during periods of active duty military service. This protection is crucial for ensuring that military members can focus on their duties without the added stress of escalating debt due to high-interest rates.

Steps to Complete the SCRA Request Form

Completing the SCRA request form involves several key steps. First, gather all necessary information, including your loan details and proof of active duty status. Next, accurately fill out the form, ensuring that all sections are completed. It is essential to provide your loan holder with any required documentation, such as a copy of your military orders. Finally, submit the form according to the instructions provided, either online, by mail, or in person, depending on your loan holder's preferences.

Eligibility Criteria for SCRA Benefits

To qualify for the interest rate reduction under the SCRA, you must be an active duty servicemember. This includes members of the Army, Navy, Air Force, Marine Corps, and Coast Guard, as well as members of the commissioned corps of the Public Health Service and the National Oceanic and Atmospheric Administration. Additionally, the loans must have originated before your active duty service began. It is important to check that your specific loans are covered under the SCRA to ensure you receive the benefits.

Required Documentation for the SCRA Request

When submitting your request to limit the interest rate, you must provide certain documentation to support your claim. This typically includes a copy of your military orders, which serve as proof of your active duty status. Additionally, you may need to include details about your loans, such as account numbers and the names of the loan holders. Ensuring that you have all required documents ready will facilitate a smoother application process.

Submission Methods for the SCRA Request Form

You can submit your SCRA request form through various methods, depending on the policies of your loan holder. Common submission methods include online portals, where you can upload your documents directly, mailing a physical copy of the form and supporting documents, or delivering them in person to your loan holder's office. It is advisable to verify the preferred submission method with your loan holder to ensure timely processing.

Legal Protections Under the SCRA

The SCRA provides several legal protections beyond interest rate reduction. These protections include the ability to postpone or suspend certain legal proceedings, such as foreclosure or eviction, while you are on active duty. The act also allows for the possibility of terminating leases without penalty and provides safeguards against default judgments. Understanding these protections can help servicemembers navigate their financial obligations during active duty.

Create this form in 5 minutes or less

Find and fill out the correct servicemembers civil relief act you may use this form to request that your loan holder limit the interest rate to 6 on your

Create this form in 5 minutes!

How to create an eSignature for the servicemembers civil relief act you may use this form to request that your loan holder limit the interest rate to 6 on your

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Servicemembers Civil Relief Act?

The Servicemembers Civil Relief Act (SCRA) is a federal law that provides various protections for military members, including the ability to limit the interest rate on certain loans. You may use this form to request that your loan holder limit the interest rate to 6% on your Direct Loans and FFEL Program Loans during periods of active duty military service.

-

How can I use airSlate SignNow to submit my SCRA request?

With airSlate SignNow, you can easily fill out and eSign the necessary forms to submit your Servicemembers Civil Relief Act request. Our platform streamlines the process, ensuring that you can quickly request that your loan holder limit the interest rate to 6% on your Direct Loans and FFEL Program Loans during periods of active duty military service.

-

What are the benefits of using airSlate SignNow for my SCRA request?

Using airSlate SignNow for your Servicemembers Civil Relief Act request offers numerous benefits, including a user-friendly interface, secure document handling, and the ability to track your submission. This ensures that your request to limit the interest rate to 6% on your Direct Loans and FFEL Program Loans during periods of active duty military service is processed efficiently.

-

Is there a cost associated with using airSlate SignNow for SCRA requests?

airSlate SignNow offers a cost-effective solution for managing your documents, including SCRA requests. While there may be subscription plans available, the value provided in terms of ease of use and efficiency makes it a worthwhile investment for those needing to request that their loan holder limit the interest rate to 6% on their Direct Loans and FFEL Program Loans during periods of active duty military service.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications to enhance your document management experience. This allows you to seamlessly manage your Servicemembers Civil Relief Act requests and other documents, ensuring that you can easily request that your loan holder limit the interest rate to 6% on your Direct Loans and FFEL Program Loans during periods of active duty military service.

-

What types of documents can I eSign with airSlate SignNow?

You can eSign a wide range of documents with airSlate SignNow, including forms related to the Servicemembers Civil Relief Act. This makes it easy to submit your request to limit the interest rate to 6% on your Direct Loans and FFEL Program Loans during periods of active duty military service, all from one convenient platform.

-

How secure is my information when using airSlate SignNow?

airSlate SignNow prioritizes the security of your information, employing advanced encryption and security measures to protect your documents. When you submit your Servicemembers Civil Relief Act request to limit the interest rate to 6% on your Direct Loans and FFEL Program Loans during periods of active duty military service, you can trust that your data is safe.

Get more for Servicemembers Civil Relief Act You May Use This Form To Request That Your Loan Holder Limit The Interest Rate To 6% On Your Dir

- Direct certification sample letter form

- Independent candidate petition illinois form

- We the undersigned qualified voters in the of in the county of and form

- Hospital form

- Iema flm001m a form

- 69 15 sample notification letter direct certification isbe form

- Fillable online azaap informationregister the arizona

- For office use only 502 new or added commercial form

Find out other Servicemembers Civil Relief Act You May Use This Form To Request That Your Loan Holder Limit The Interest Rate To 6% On Your Dir

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online