SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R 2025-2026

Understanding the Servicemembers Civil Relief Act (SCRA) Interest Rate

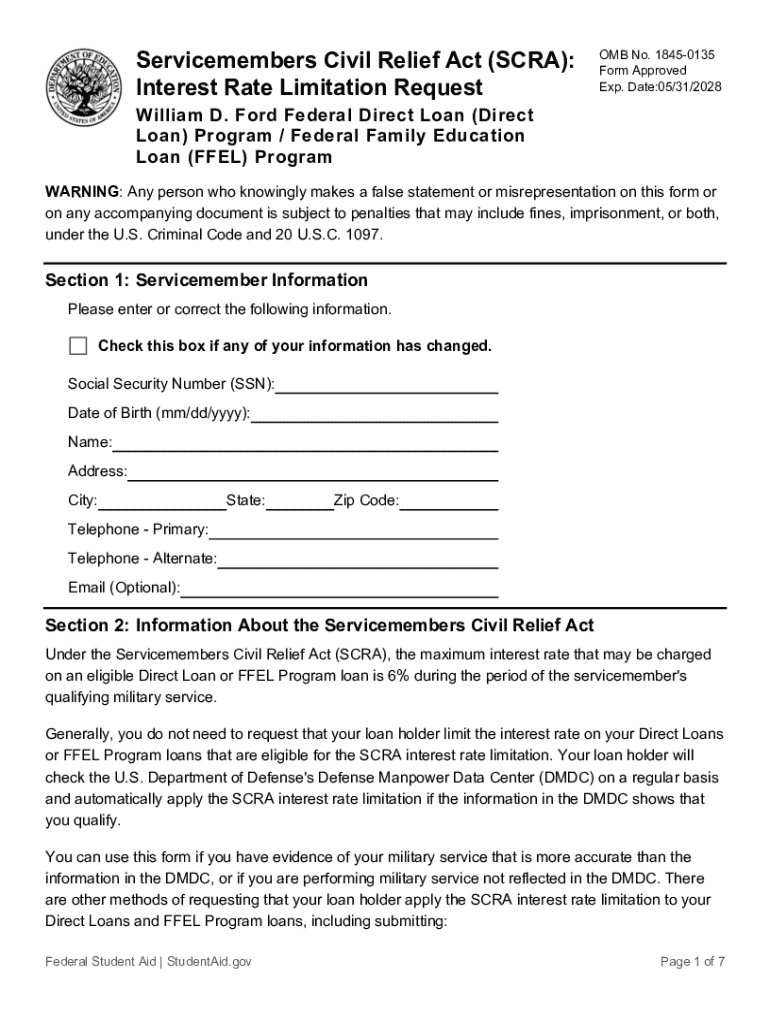

The Servicemembers Civil Relief Act (SCRA) provides important protections for military members and their families, particularly regarding financial obligations. One of the key provisions of the SCRA is the limitation on interest rates for certain debts incurred before military service. Under this act, interest rates on loans and other financial obligations can be capped at six percent per year for servicemembers during their active duty period. This applies to various types of debts, including mortgages, credit cards, and auto loans, ensuring that military personnel are not financially burdened while serving their country.

How to Utilize the SCRA Interest Rate Benefits

To take advantage of the SCRA interest rate provisions, servicemembers must notify their creditors of their military status. This typically involves providing a copy of military orders or a written request to the lender. Once the creditor is informed, they are required to adjust the interest rate accordingly. It is essential for servicemembers to keep records of all communications and documentation submitted to ensure that their rights under the SCRA are upheld. Understanding these steps can help in managing financial obligations effectively while on active duty.

Eligibility Criteria for SCRA Interest Rate Relief

Eligibility for the SCRA interest rate relief is generally extended to active duty servicemembers, including members of the Army, Navy, Air Force, Marine Corps, and Coast Guard, as well as members of the Merchant Marine and Commissioned Corps of the Public Health Service and the National Oceanic and Atmospheric Administration. The debts must have been incurred before the servicemember's active duty status began. Additionally, the request for interest rate reduction must be made during the period of active duty to qualify for the six percent cap.

Steps to Complete the SCRA Interest Rate Request

To complete the request for SCRA interest rate relief, servicemembers should follow these steps:

- Gather necessary documentation, including military orders and any relevant loan agreements.

- Contact the lender or creditor to inform them of your active duty status.

- Submit a written request for the interest rate reduction, including copies of military orders.

- Keep copies of all correspondence and documentation sent to the creditor.

- Follow up with the creditor to confirm that the interest rate has been adjusted.

Legal Implications of the SCRA Interest Rate

Failure to comply with the SCRA provisions can lead to serious legal consequences for creditors. If a lender does not honor the interest rate cap, they may face penalties, including potential lawsuits from servicemembers. The SCRA is designed to protect the financial interests of military personnel, and any violations can result in significant repercussions for those who do not adhere to its requirements. Servicemembers are encouraged to seek legal advice if they encounter issues with creditors regarding their rights under the SCRA.

Examples of SCRA Interest Rate Applications

Practical examples of how the SCRA interest rate provisions work can help clarify their application. For instance, if a servicemember has a credit card balance of $5,000 with an interest rate of fifteen percent, they can request a reduction to six percent upon providing proof of active duty. This reduction can significantly decrease the amount of interest paid over time. Similarly, for a mortgage with a higher interest rate, the SCRA can provide substantial savings, allowing servicemembers to manage their finances more effectively during their service period.

Create this form in 5 minutes or less

Find and fill out the correct servicemembers civil relief act scra interest r

Create this form in 5 minutes!

How to create an eSignature for the servicemembers civil relief act scra interest r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R?

The SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R is a federal law that provides various protections to active-duty military members, including the ability to reduce interest rates on loans. This act ensures that servicemembers can focus on their duties without the burden of excessive financial obligations. Understanding this act is crucial for those looking to manage their finances effectively while serving.

-

How can airSlate SignNow help with the SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R?

airSlate SignNow offers a streamlined platform for managing documents related to the SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R. With our eSigning capabilities, servicemembers can quickly sign and send necessary documents, ensuring compliance with the act. This efficiency helps reduce stress and allows servicemembers to focus on their service.

-

What features does airSlate SignNow provide for managing SCRA-related documents?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for documents related to the SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R. These features enhance the document management process, making it easier for users to stay organized and compliant. Additionally, our platform supports multiple file formats for added convenience.

-

Is airSlate SignNow cost-effective for servicemembers needing SCRA assistance?

Yes, airSlate SignNow is designed to be a cost-effective solution for servicemembers needing assistance with the SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R. Our pricing plans are competitive and tailored to meet the needs of individuals and businesses alike. By using our platform, servicemembers can save time and money while ensuring their documents are handled efficiently.

-

Can airSlate SignNow integrate with other tools for SCRA compliance?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can assist with compliance related to the SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R. This includes CRM systems, document management software, and more. These integrations help streamline workflows and ensure that all necessary documentation is easily accessible.

-

What are the benefits of using airSlate SignNow for SCRA-related tasks?

Using airSlate SignNow for tasks related to the SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows users to manage their documents from anywhere, ensuring that they can respond quickly to any SCRA-related needs. This flexibility is essential for active-duty servicemembers.

-

How does airSlate SignNow ensure the security of SCRA documents?

airSlate SignNow prioritizes the security of all documents, including those related to the SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R. We utilize advanced encryption methods and secure cloud storage to protect sensitive information. Our commitment to security ensures that servicemembers can trust our platform with their important documents.

Get more for SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R

- Fillable idaho voter registration form

- Minor tenant improvement submittal checklist form

- Groundwater hazard statement a solid waste disposal check form

- Iowa secretary of state oath of office form

- Hawaii subcontractor agreement template form

- Appendix c dewatering bdischarge formsb municipality of anchorage muni

- Alabama subcontractor agreement template form

- Contact us alsdeedu form

Find out other SERVICEMEMBERS CIVIL RELIEF ACT SCRA INTEREST R

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure