Ms 7 Form

What is the Ms 7

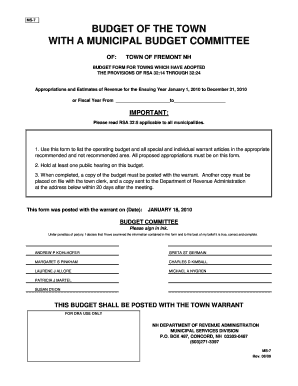

The Ms 7 form is a specific document used in various contexts, often related to tax or legal matters. It serves as a means for individuals or businesses to provide necessary information to government agencies. Understanding the purpose and requirements of the Ms 7 is essential for compliance and proper documentation. This form may be required for various applications, including tax filings or other regulatory submissions.

How to use the Ms 7

Using the Ms 7 involves several key steps to ensure accurate completion and submission. First, gather all necessary information and documents required to fill out the form. This may include personal identification, financial records, or other relevant data. Next, carefully complete each section of the form, ensuring that all information is accurate and up to date. Once completed, review the form for any errors before submission. Depending on the requirements, the Ms 7 can often be submitted electronically or via mail.

Steps to complete the Ms 7

Completing the Ms 7 requires attention to detail. Follow these steps for successful completion:

- Gather required documents, including identification and financial records.

- Review the instructions for the Ms 7 to understand each section.

- Fill out the form accurately, ensuring all fields are completed.

- Double-check for any errors or omissions.

- Submit the form according to the provided guidelines, either online or by mail.

Legal use of the Ms 7

The Ms 7 must be used in accordance with applicable laws and regulations. It is essential to ensure that the information provided is truthful and complete, as inaccuracies can lead to legal penalties. Understanding the legal implications of submitting the Ms 7 is crucial for individuals and businesses alike. Compliance with federal and state laws ensures that the form serves its intended purpose without complications.

Required Documents

When preparing to complete the Ms 7, certain documents are typically required. These may include:

- Personal identification, such as a driver's license or social security card.

- Financial statements or tax returns, depending on the context of the form.

- Any additional documentation specified in the form instructions.

Having these documents ready will facilitate a smoother completion process.

Filing Deadlines / Important Dates

It is important to be aware of any filing deadlines associated with the Ms 7. Missing these deadlines can result in penalties or complications with your submission. Typically, deadlines may vary based on the purpose of the form, so it is advisable to check the specific guidelines related to the Ms 7. Keeping a calendar of important dates can help ensure timely filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ms 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ms 7 and how does it relate to airSlate SignNow?

Ms 7 is a powerful feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send, sign, and manage documents efficiently. With Ms 7, businesses can improve their productivity and reduce turnaround times.

-

How much does airSlate SignNow with Ms 7 cost?

The pricing for airSlate SignNow with Ms 7 is competitive and designed to fit various business needs. We offer flexible subscription plans that cater to different user requirements, ensuring that you get the best value for your investment. For detailed pricing information, please visit our pricing page.

-

What features does Ms 7 offer in airSlate SignNow?

Ms 7 includes a range of features such as customizable templates, advanced security options, and real-time tracking of document status. These features are designed to enhance user experience and ensure that your documents are handled securely and efficiently. With Ms 7, you can also integrate with other tools to further streamline your processes.

-

What are the benefits of using Ms 7 in airSlate SignNow?

Using Ms 7 in airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and improved collaboration among team members. It simplifies the signing process, allowing users to complete transactions faster. Additionally, Ms 7 helps businesses maintain compliance with legal standards.

-

Can Ms 7 integrate with other software applications?

Yes, Ms 7 in airSlate SignNow is designed to integrate seamlessly with various software applications, including CRM systems, project management tools, and cloud storage services. This integration capability allows businesses to create a cohesive workflow, enhancing overall productivity. Check our integrations page for a full list of compatible applications.

-

Is there a free trial available for Ms 7 in airSlate SignNow?

Absolutely! We offer a free trial for Ms 7 in airSlate SignNow, allowing you to explore its features and benefits without any commitment. This trial period gives you the opportunity to see how Ms 7 can transform your document management processes before making a purchase decision.

-

How secure is Ms 7 in airSlate SignNow?

Ms 7 in airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents. We adhere to industry standards to ensure that your data remains confidential and secure. With Ms 7, you can trust that your sensitive information is in safe hands.

Get more for Ms 7

- Payson roundup 101014 by payson roundup issuu form

- Estates powers ampampamp trusts part 6 7 69 manner of form

- Nomination of custodian a a person having the right to form

- Name mailing address city state zip code daytime form

- Two joint tenants to two individuals form

- One individual to a trust form

- Trust to one individual form

- Waiver of liability template oversea insurance agency form

Find out other Ms 7

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe