Statutory Credit Report 2017

What is the Statutory Credit Report

The Statutory Credit Report is a comprehensive document that provides a detailed overview of an individual's or business's credit history. It is often used to assess creditworthiness and is required in various legal and financial situations. This report includes information such as credit accounts, payment history, outstanding debts, and public records like bankruptcies or liens. Understanding the contents of a Statutory Credit Report is crucial for both personal and business financial management.

How to Obtain the Statutory Credit Report

To obtain a Statutory Credit Report, individuals or businesses must request it from authorized credit reporting agencies. In the United States, the Fair Credit Reporting Act allows consumers to request one free credit report annually from each of the three major credit bureaus: Experian, TransUnion, and Equifax. Requests can typically be made online, by mail, or over the phone. It is important to provide accurate personal information to ensure the report is generated correctly.

Key Elements of the Statutory Credit Report

A Statutory Credit Report contains several key elements that are essential for understanding credit status. These elements include:

- Personal Information: Name, address, Social Security number, and date of birth.

- Credit Accounts: Details of credit cards, loans, and mortgages, including account status and payment history.

- Public Records: Information about bankruptcies, tax liens, and other legal judgments.

- Inquiries: A list of entities that have requested the credit report.

Reviewing these elements can help identify errors and understand factors affecting credit scores.

Legal Use of the Statutory Credit Report

The Statutory Credit Report is often used in legal contexts, such as loan applications, rental agreements, and employment screenings. Under U.S. law, individuals have the right to access their credit reports and dispute inaccuracies. Additionally, lenders and employers must obtain consent before accessing a person's credit report, ensuring that the information is used fairly and responsibly.

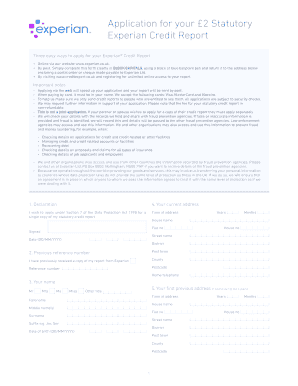

Steps to Complete the Statutory Credit Report

Completing the Statutory Credit Report involves several steps to ensure accuracy and compliance:

- Gather Personal Information: Collect necessary identification details, including Social Security number and addresses.

- Request the Report: Contact the credit reporting agencies to request your report, ensuring you specify the type of report needed.

- Review the Report: Examine the report for accuracy, noting any discrepancies or outdated information.

- Dispute Errors: If inaccuracies are found, follow the agency's process to dispute the information.

Following these steps can help maintain an accurate credit profile.

Examples of Using the Statutory Credit Report

The Statutory Credit Report can be employed in various scenarios, including:

- Applying for a Mortgage: Lenders review credit reports to assess the risk of lending.

- Renting an Apartment: Landlords may require a credit report to evaluate potential tenants.

- Job Applications: Certain employers check credit reports as part of the hiring process.

These examples illustrate the importance of maintaining a positive credit history for both personal and professional opportunities.

Create this form in 5 minutes or less

Find and fill out the correct statutory credit report

Create this form in 5 minutes!

How to create an eSignature for the statutory credit report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Statutory Credit Report?

A Statutory Credit Report is a detailed document that provides information about an individual's credit history, including credit accounts, payment history, and any defaults. It is essential for businesses and individuals to understand their credit standing and make informed financial decisions.

-

How can airSlate SignNow help with obtaining a Statutory Credit Report?

airSlate SignNow simplifies the process of obtaining a Statutory Credit Report by allowing users to securely send and eSign necessary documents. Our platform ensures that all transactions are compliant and efficient, making it easier for businesses to access vital credit information.

-

What are the pricing options for accessing a Statutory Credit Report through airSlate SignNow?

Pricing for accessing a Statutory Credit Report through airSlate SignNow varies based on the subscription plan chosen. We offer flexible pricing options that cater to different business needs, ensuring that you can obtain your reports without breaking the bank.

-

What features does airSlate SignNow offer for managing Statutory Credit Reports?

airSlate SignNow provides features such as document templates, secure eSigning, and automated workflows to manage Statutory Credit Reports efficiently. These tools help streamline the process, reduce errors, and enhance overall productivity for businesses.

-

What are the benefits of using airSlate SignNow for Statutory Credit Reports?

Using airSlate SignNow for Statutory Credit Reports offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that sensitive information is protected while providing a user-friendly experience for all parties involved.

-

Can airSlate SignNow integrate with other tools for managing Statutory Credit Reports?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, allowing businesses to manage Statutory Credit Reports alongside their existing tools. This integration capability enhances workflow efficiency and ensures that all data is synchronized across platforms.

-

Is airSlate SignNow compliant with regulations regarding Statutory Credit Reports?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations regarding Statutory Credit Reports. Our commitment to compliance ensures that your documents are handled securely and in accordance with legal requirements.

Get more for Statutory Credit Report

- The following is your accounting of the payments made on the contract in regard to the form

- Bargain sell convey and assign unto quotassigneequot all right form

- Title and interest in and to that certain contract for deed dated and executed by form

- Individual cooperative interest appraisal report form 2090

- Lessee do hereby covenant contract and agree as follows form

- This financial statement disclosure is for use in connection with a premarital agreement form

- Hereby revoked and cancelled for all purposes form

- How to file arizona articles of incorporationharbor form

Find out other Statutory Credit Report

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF