Fnif Form 2011

What is the Fnif Form

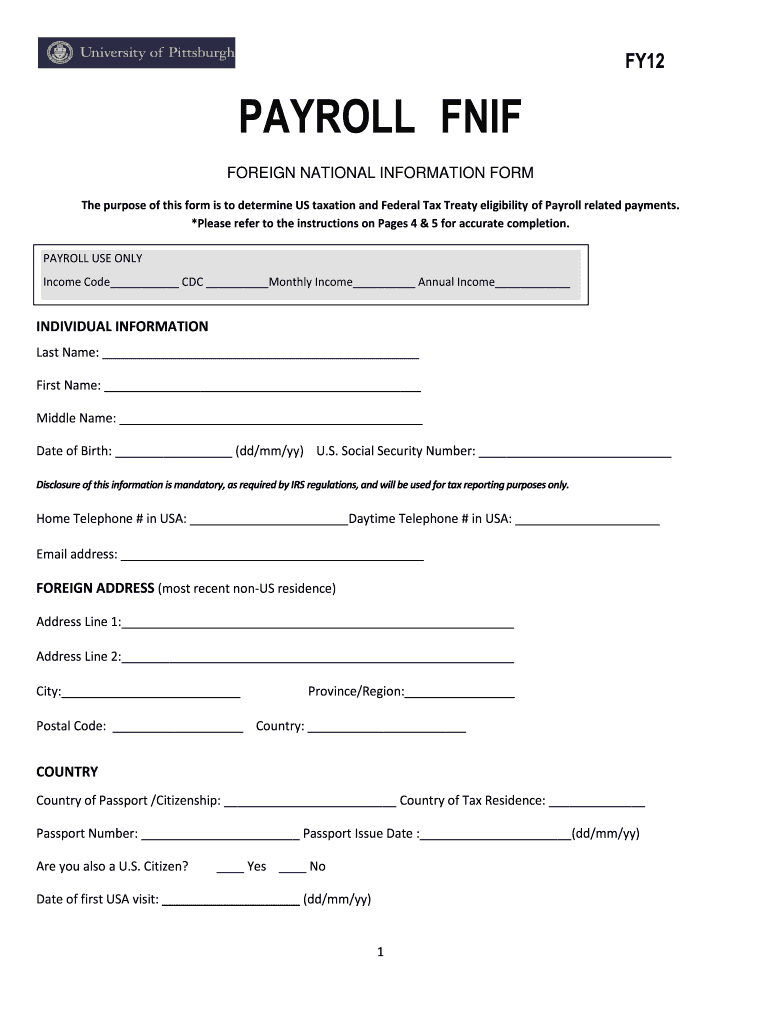

The Fnif Form, or Form FNIF, is a document used primarily for reporting foreign financial interests and accounts to the Internal Revenue Service (IRS). This form is essential for U.S. taxpayers who have financial interests in foreign entities or accounts, ensuring compliance with U.S. tax laws. By filing the Fnif Form, taxpayers disclose their foreign assets, helping the IRS monitor and prevent tax evasion related to offshore accounts.

How to use the Fnif Form

Using the Fnif Form involves several steps to ensure accurate reporting of foreign financial interests. Taxpayers must first gather all necessary information regarding their foreign accounts, including account numbers, balances, and the names of financial institutions. Once this information is compiled, individuals can fill out the form, providing detailed information about each foreign account. After completing the form, taxpayers must submit it to the IRS by the designated deadline, ensuring they have met all compliance requirements.

Steps to complete the Fnif Form

Completing the Fnif Form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant information about foreign accounts, including account numbers and balances.

- Obtain the latest version of the Fnif Form from the IRS website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the Fnif Form

The legal use of the Fnif Form is critical for U.S. taxpayers with foreign financial interests. Failing to file this form can result in significant penalties, including fines and potential legal action. The IRS mandates that taxpayers disclose foreign accounts to promote transparency and compliance with tax laws. By using the Fnif Form correctly, individuals fulfill their legal obligations and avoid complications with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Fnif Form are crucial for compliance. Typically, the form must be submitted by April fifteenth of the following tax year. However, taxpayers may request an extension, which could extend the deadline to October fifteenth. It is important to note that extensions do not apply to any taxes owed, so taxpayers should ensure that any tax liabilities are settled by the original deadline to avoid penalties.

Required Documents

To complete the Fnif Form, taxpayers need several documents to provide accurate information. These include:

- Bank statements from foreign accounts.

- Documentation of account ownership.

- Tax identification numbers for foreign entities, if applicable.

- Any previous filings related to foreign financial interests.

Having these documents ready will streamline the process of completing the Fnif Form and ensure accurate reporting.

Create this form in 5 minutes or less

Find and fill out the correct fnif form

Create this form in 5 minutes!

How to create an eSignature for the fnif form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fnif Form and how does it work?

The Fnif Form is a digital document designed for efficient data collection and electronic signatures. With airSlate SignNow, users can easily create, send, and manage Fnif Forms, streamlining their workflow and ensuring compliance. This tool simplifies the process of obtaining signatures and collecting information from clients or team members.

-

How can I create a Fnif Form using airSlate SignNow?

Creating a Fnif Form with airSlate SignNow is straightforward. Simply log in to your account, select the 'Create Document' option, and choose the Fnif Form template. You can customize it to fit your needs, adding fields for signatures, dates, and other necessary information.

-

Is there a cost associated with using the Fnif Form feature?

Yes, there is a cost associated with using the Fnif Form feature on airSlate SignNow. However, the pricing is competitive and offers various plans to suit different business needs. You can choose a plan that provides the best value based on your usage and required features.

-

What are the benefits of using the Fnif Form for my business?

Using the Fnif Form can signNowly enhance your business operations by reducing paperwork and speeding up the signing process. It allows for real-time tracking of document status and ensures that all signatures are legally binding. This efficiency can lead to improved customer satisfaction and faster transaction times.

-

Can I integrate the Fnif Form with other applications?

Absolutely! airSlate SignNow allows seamless integration of the Fnif Form with various applications such as CRM systems, cloud storage services, and project management tools. This integration helps streamline your workflow and ensures that all your documents are easily accessible and manageable.

-

Is the Fnif Form secure for sensitive information?

Yes, the Fnif Form is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to protect your sensitive information. You can confidently use the Fnif Form knowing that your data is safe and compliant with industry standards.

-

How can I track the status of my Fnif Form?

Tracking the status of your Fnif Form is easy with airSlate SignNow. The platform provides real-time updates on document status, allowing you to see when it has been viewed, signed, or completed. This feature helps you stay informed and manage your documents effectively.

Get more for Fnif Form

- Irs form 8453 eo 2017

- Schedule h 2017 form

- Missouri tax registration 2016 form

- Red dot optic form

- Petition regarding real estatedwelling michigan courts state form

- Ftb 3582 2017 form

- Initial psychiatric assessment form contra costa health services

- Attorney resource filing direct appeals of new york city form

Find out other Fnif Form

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form