KYC SELF DECLARATION 2013-2026

Understanding the KYC Self Declaration

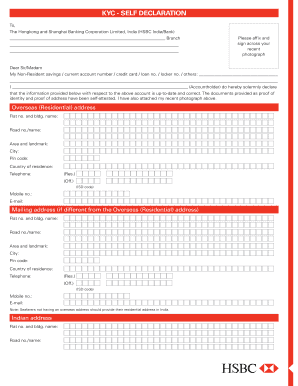

The KYC Self Declaration is a crucial document used by financial institutions and businesses to verify the identity of their clients. KYC stands for "Know Your Customer," and the self-declaration form serves as a means for individuals to provide personal information and confirm their identity. This process helps institutions comply with regulatory requirements aimed at preventing fraud, money laundering, and other illicit activities. The form typically requests details such as name, address, date of birth, and identification numbers, ensuring that the information provided is accurate and up-to-date.

Steps to Complete the KYC Self Declaration

Completing the KYC Self Declaration involves several straightforward steps. First, gather all necessary personal information, including identification documents. Next, fill out the form by providing accurate details in each section, ensuring that there are no errors or omissions. After completing the form, review it carefully to confirm that all information is correct. Finally, submit the form as instructed, whether online, by mail, or in person, depending on the requirements of the institution requesting it.

Key Elements of the KYC Self Declaration

The KYC Self Declaration includes several key elements that are essential for identity verification. These typically encompass:

- Personal Information: Full name, date of birth, and address.

- Identification Numbers: Social Security Number (SSN) or other relevant ID numbers.

- Signature: A declaration that the information provided is true and correct.

- Document Verification: Details about the identification documents submitted.

These elements work together to ensure that the institution can effectively verify the identity of the individual submitting the form.

Legal Use of the KYC Self Declaration

The KYC Self Declaration is legally significant as it helps financial institutions comply with various regulations, including the Bank Secrecy Act (BSA) and the USA PATRIOT Act. These laws require institutions to establish the identity of their clients to prevent financial crimes. By submitting a KYC Self Declaration, individuals provide a legal affirmation of their identity, which can be used in case of any disputes or legal inquiries regarding their identity verification.

Obtaining the KYC Self Declaration

To obtain the KYC Self Declaration form, individuals can typically request it directly from the financial institution or business requiring the declaration. Many institutions also provide the form on their websites, allowing for easy access and download. It is important to ensure that the correct version of the form is used, as requirements may vary by institution or state.

Form Submission Methods

Submitting the KYC Self Declaration can be done through various methods based on the preferences of the institution. Common submission methods include:

- Online Submission: Many institutions allow users to complete and submit the form digitally through their secure portals.

- Mail: Individuals may print the completed form and send it via postal mail to the designated address.

- In-Person Submission: Some institutions may require or allow individuals to submit the form in person at a local branch.

Choosing the appropriate submission method is essential to ensure timely processing of the KYC Self Declaration.

Create this form in 5 minutes or less

Find and fill out the correct kyc self declaration

Create this form in 5 minutes!

How to create an eSignature for the kyc self declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is KYC SELF DECLARATION?

KYC SELF DECLARATION is a process that allows individuals to verify their identity and provide necessary information to comply with regulatory requirements. This declaration is essential for businesses to ensure they are engaging with legitimate customers. By using airSlate SignNow, you can easily create and manage KYC SELF DECLARATION documents.

-

How does airSlate SignNow facilitate KYC SELF DECLARATION?

airSlate SignNow streamlines the KYC SELF DECLARATION process by providing an intuitive platform for creating, sending, and signing documents electronically. Our solution ensures that all necessary information is captured accurately and securely. This efficiency helps businesses maintain compliance while enhancing customer experience.

-

What are the pricing options for using airSlate SignNow for KYC SELF DECLARATION?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Our plans include features specifically designed for KYC SELF DECLARATION, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for KYC SELF DECLARATION?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to incorporate KYC SELF DECLARATION into your existing workflows. This capability allows for seamless data transfer and enhances overall efficiency. You can connect with CRM systems, document management tools, and more.

-

What are the benefits of using airSlate SignNow for KYC SELF DECLARATION?

Using airSlate SignNow for KYC SELF DECLARATION offers numerous benefits, including improved compliance, faster processing times, and enhanced security. Our platform ensures that sensitive information is protected while allowing for quick and easy document management. This leads to a better experience for both businesses and their customers.

-

Is airSlate SignNow secure for handling KYC SELF DECLARATION documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all KYC SELF DECLARATION documents are handled with the utmost care. We utilize advanced encryption and security protocols to protect your data. You can trust that your sensitive information is safe with us.

-

How can I get started with KYC SELF DECLARATION on airSlate SignNow?

Getting started with KYC SELF DECLARATION on airSlate SignNow is simple. You can sign up for an account, choose a pricing plan, and begin creating your KYC SELF DECLARATION documents right away. Our user-friendly interface makes it easy to navigate and utilize all available features.

Get more for KYC SELF DECLARATION

- Scheda semplificata di rilievo delle sedi com dipartimento della anci lombardia form

- Standard tusla form

- Program resources consignment order form 2015 unitedmethodistwomen

- Vendor bapplicationb gaston county schools form

- Required acceptance tests form

- 309i form

- Contractor registration the city of mandeville form

- Indiana immediate possession form

Find out other KYC SELF DECLARATION

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy