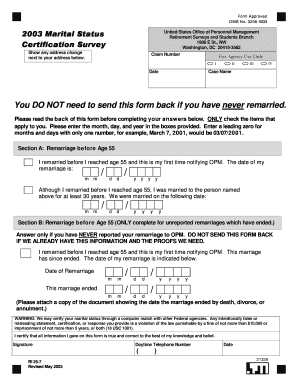

Ri 25 7 2003

What is the Ri 25 7

The Ri 25 7 is a specific form used for reporting certain financial information. It is primarily utilized in various business and tax-related contexts within the United States. This form is crucial for ensuring compliance with federal regulations and helps individuals and businesses accurately report their financial activities.

How to use the Ri 25 7

Using the Ri 25 7 requires careful attention to detail. Users must fill out the form with accurate information, ensuring all sections are completed as required. It is important to follow the guidelines provided by the issuing authority to avoid errors that could lead to delays or penalties. The completed form can be submitted electronically or via traditional mail, depending on the specific requirements set forth.

Steps to complete the Ri 25 7

To complete the Ri 25 7, follow these steps:

- Gather all necessary financial documents and information relevant to the reporting period.

- Carefully read the instructions accompanying the form to understand the requirements.

- Fill out each section of the form, ensuring accuracy and completeness.

- Review the completed form for any errors or omissions.

- Submit the form using the preferred method, whether online or by mail.

Legal use of the Ri 25 7

The Ri 25 7 must be used in accordance with U.S. laws and regulations. This form is designed to meet specific legal requirements for reporting financial information. Proper use of the form helps individuals and businesses avoid legal complications and ensures compliance with tax obligations. It is advisable to consult with a legal or tax professional if there are any uncertainties regarding its use.

Key elements of the Ri 25 7

Several key elements are essential when dealing with the Ri 25 7. These include:

- Identification of the filer, including name and taxpayer identification number.

- Details of the financial transactions being reported.

- Accurate reporting of income and expenses related to the reporting period.

- Signature and date to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Ri 25 7 vary depending on the specific context in which it is used. It is crucial to be aware of these dates to ensure timely submission and avoid penalties. Generally, forms are due at the end of the tax year or as specified by the issuing authority. Keeping a calendar of important dates related to form submission can help maintain compliance.

Create this form in 5 minutes or less

Find and fill out the correct ri 25 7

Create this form in 5 minutes!

How to create an eSignature for the ri 25 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ri 25 7 and how does it relate to airSlate SignNow?

Ri 25 7 refers to a specific feature set within airSlate SignNow that enhances document signing and management. This feature allows users to streamline their eSigning processes, making it easier to send and sign documents securely and efficiently.

-

How much does airSlate SignNow cost with the Ri 25 7 feature?

The pricing for airSlate SignNow with the Ri 25 7 feature varies based on the subscription plan you choose. We offer flexible pricing options that cater to different business needs, ensuring that you get the best value for your investment in document management.

-

What are the key benefits of using Ri 25 7 in airSlate SignNow?

Using Ri 25 7 in airSlate SignNow provides numerous benefits, including increased efficiency in document workflows and enhanced security for sensitive information. This feature also simplifies the signing process, allowing users to complete transactions faster and with greater ease.

-

Can I integrate Ri 25 7 with other applications?

Yes, Ri 25 7 can be seamlessly integrated with various applications to enhance your workflow. airSlate SignNow supports integrations with popular tools such as CRM systems, project management software, and cloud storage services, making it a versatile solution for businesses.

-

Is Ri 25 7 suitable for small businesses?

Absolutely! Ri 25 7 is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses. With its intuitive interface and powerful features, small businesses can manage their document signing needs without the complexity of larger systems.

-

How does Ri 25 7 ensure the security of my documents?

Ri 25 7 incorporates advanced security measures, including encryption and secure access controls, to protect your documents. airSlate SignNow prioritizes data security, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

What types of documents can I sign using Ri 25 7?

With Ri 25 7, you can sign a wide variety of documents, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, allowing you to easily manage and sign any document type you need for your business.

Get more for Ri 25 7

- Tf350 18 2 r e unit pre execution checklist army stewart army form

- Mlse reciprocal program 2017 form

- Dar application ogsconference form

- Vt plus training briefing checklist active iq activeiq co form

- Hershey lodge reservation form november 11 12 2016 penndelwomenofpurpose

- Kybella consent form

- Rapid response team chaplain application billygraham org form

- Requirements amp application department of commerce and bb form

Find out other Ri 25 7

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF