Certificate of Insurance 2017

What is the Certificate Of Insurance

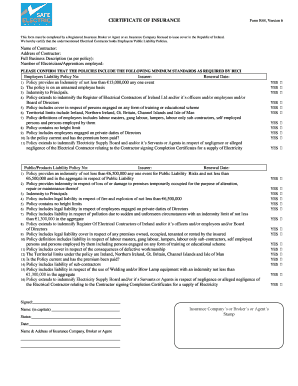

The Certificate Of Insurance (COI) is a document that provides evidence of insurance coverage. It outlines the types of insurance policies held by an individual or business, along with the limits of coverage. Typically, a COI is requested by a third party, such as a client or contractor, to verify that the insured party has adequate coverage for potential liabilities. This document is crucial in various industries, including construction, real estate, and healthcare, where proof of insurance is often a prerequisite for contracts or agreements.

How to use the Certificate Of Insurance

A Certificate Of Insurance serves several purposes in business transactions. It is primarily used to demonstrate compliance with contractual insurance requirements. When entering a contract, parties may request a COI to ensure that the other party has the necessary coverage to protect against risks. Additionally, a COI can help facilitate smoother business operations by providing reassurance to clients and partners that adequate insurance is in place. It is important to present an up-to-date COI that reflects current coverage details to maintain trust and transparency in business relationships.

Key elements of the Certificate Of Insurance

Understanding the key elements of a Certificate Of Insurance is essential for both issuers and recipients. A typical COI includes:

- Name of the insured: The individual or business that holds the insurance policy.

- Insurance company details: The name and contact information of the insurer providing the coverage.

- Policy numbers: Unique identifiers for each insurance policy listed.

- Coverage types: A description of the types of coverage provided, such as general liability, workers' compensation, or professional liability.

- Effective dates: The start and end dates of the insurance coverage.

- Limits of liability: The maximum amount the insurance company will pay for a claim under each type of coverage.

Steps to complete the Certificate Of Insurance

Completing a Certificate Of Insurance involves several steps to ensure accuracy and compliance. These steps typically include:

- Gather necessary information: Collect details about the insured party, insurance policies, and coverage limits.

- Contact the insurance provider: Reach out to the insurance company to request a COI or to obtain the required information.

- Fill out the COI form: Enter all relevant details accurately, ensuring that the information matches the insurance policies.

- Review for accuracy: Double-check all entries to avoid errors that could lead to disputes or compliance issues.

- Distribute the COI: Provide copies of the completed COI to all relevant parties, such as clients or contractors.

Legal use of the Certificate Of Insurance

The legal use of a Certificate Of Insurance is significant in establishing proof of coverage and compliance with contractual obligations. When a COI is presented, it serves as a legal document that can be referenced in case of disputes regarding insurance coverage. It is essential for businesses to understand that failing to provide a valid COI when required can lead to legal ramifications, including breach of contract claims. Therefore, maintaining accurate and up-to-date certificates is crucial for legal protection in business dealings.

How to obtain the Certificate Of Insurance

Obtaining a Certificate Of Insurance is a straightforward process. The insured party typically requests a COI from their insurance provider. This can often be done through the insurer's website, via email, or by phone. Some insurance companies offer online portals where clients can generate COIs directly. It is important to specify the details needed on the certificate, such as the coverage types and any additional insured parties, to ensure that the document meets the requirements of the requesting party.

Create this form in 5 minutes or less

Find and fill out the correct certificate of insurance 419965963

Create this form in 5 minutes!

How to create an eSignature for the certificate of insurance 419965963

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Certificate Of Insurance?

A Certificate Of Insurance is a document that provides proof of insurance coverage for a business or individual. It outlines the types of coverage, policy limits, and the insured parties. This document is often required by clients or partners to ensure that adequate insurance is in place.

-

How can airSlate SignNow help with managing Certificates Of Insurance?

airSlate SignNow simplifies the process of managing Certificates Of Insurance by allowing users to easily create, send, and eSign these documents. Our platform ensures that all necessary information is included and securely stored, making it easy to access and share when needed. This streamlines the workflow and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Certificates Of Insurance?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans include features specifically designed for managing Certificates Of Insurance, ensuring you get the best value for your investment. You can choose a plan that fits your needs and budget, with options for monthly or annual billing.

-

What features does airSlate SignNow offer for Certificates Of Insurance?

airSlate SignNow provides a range of features for managing Certificates Of Insurance, including customizable templates, secure eSigning, and automated reminders. These features help ensure that your documents are completed accurately and on time. Additionally, our platform allows for easy tracking and management of all your insurance documents.

-

Are there any benefits to using airSlate SignNow for Certificates Of Insurance?

Using airSlate SignNow for Certificates Of Insurance offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick turnaround times, ensuring that your insurance documents are processed swiftly. This not only saves time but also helps maintain compliance with industry standards.

-

Can I integrate airSlate SignNow with other software for managing Certificates Of Insurance?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage Certificates Of Insurance alongside your existing tools. Whether you use CRM systems, project management software, or accounting platforms, our integrations ensure a seamless workflow. This enhances productivity and keeps all your documents organized.

-

How secure is airSlate SignNow for handling Certificates Of Insurance?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Certificates Of Insurance. Our platform employs advanced encryption and secure storage solutions to protect your data. Additionally, we comply with industry standards to ensure that your information remains confidential and secure.

Get more for Certificate Of Insurance

- Computer networking a top down approach 7th edition pdf download form

- Of new hampshire limited liability company sos nh form

- Ct 1040x 2016 form

- Rotary club ridgefield park new jersey 07660 rpps form

- Revised form 22d nccourts

- Severe financial hardship application form lesf super

- Contribution and loan repayment remittance bformb

- Backflow prevention assembly test city of kyle form

Find out other Certificate Of Insurance

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now