Supplemental Local Sales and Use Tax Schedule Dfa Arkansas Form

What is the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas

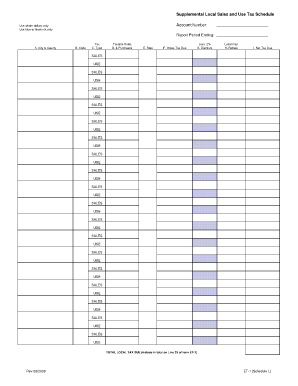

The Supplemental Local Sales And Use Tax Schedule Dfa Arkansas is a specific form used by businesses operating within Arkansas to report local sales and use taxes. This schedule is essential for ensuring compliance with state tax regulations and helps local governments collect the appropriate taxes on sales made within their jurisdictions. The form captures details regarding the local tax rates applicable to various transactions and assists in the accurate calculation of taxes owed to local authorities.

How to use the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas

To effectively use the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas, businesses should first familiarize themselves with the local tax rates in their area. The form requires the reporting of sales made, the applicable local tax rates, and the total tax collected. Businesses must accurately fill out each section, ensuring that all information corresponds with their sales records. Once completed, the form should be submitted according to the specified filing methods, which may include online submission, mailing, or in-person delivery.

Steps to complete the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas

Completing the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas involves several key steps:

- Gather all relevant sales records for the reporting period.

- Identify the local tax rates applicable to your business location.

- Fill out the form by entering total sales, tax rates, and calculated taxes.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, ensuring it meets any deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas vary based on the reporting period. Typically, businesses must submit their schedules on a monthly or quarterly basis. It is crucial to stay informed about specific due dates to avoid penalties. Marking these dates on a calendar can help ensure timely submissions, as late filings may result in additional fees or interest on unpaid taxes.

Key elements of the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas

The key elements of the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas include:

- Identification of the business and reporting period.

- Detailed breakdown of sales transactions.

- Applicable local tax rates for each transaction type.

- Total local sales and use tax collected.

- Signature of the authorized representative affirming the accuracy of the information.

Legal use of the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas

The legal use of the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas is mandated by state law. Businesses are required to report their local sales and use taxes to ensure compliance with tax regulations. Failure to use the form correctly can result in legal repercussions, including fines or audits. It is essential for businesses to maintain accurate records and submit the form in accordance with state guidelines to avoid any legal issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the supplemental local sales and use tax schedule dfa arkansas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas?

The Supplemental Local Sales And Use Tax Schedule Dfa Arkansas is a form used by businesses to report local sales and use taxes in Arkansas. It helps ensure compliance with state tax regulations and allows for accurate reporting of local tax obligations. Understanding this schedule is crucial for businesses operating in multiple jurisdictions within Arkansas.

-

How can airSlate SignNow assist with the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas?

airSlate SignNow provides an efficient platform for businesses to prepare, sign, and manage documents related to the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas. With its user-friendly interface, businesses can easily create and eSign necessary documents, ensuring compliance and reducing the risk of errors. This streamlines the tax reporting process signNowly.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses, including those needing to manage the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas. Each plan includes features that facilitate document management and eSigning, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas. These integrations allow for easy data transfer and document management across different systems, making it easier to maintain compliance and streamline your workflow. Popular integrations include CRM systems and cloud storage services.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas, offers numerous benefits. It simplifies the eSigning process, reduces paperwork, and enhances document security. Additionally, it allows for quick access to signed documents, which is essential for timely tax reporting and compliance.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive tax documents, including the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas. With features like encryption, secure cloud storage, and user authentication, you can trust that your documents are safe and compliant with industry standards. This ensures peace of mind when managing your tax obligations.

-

Can I track the status of my documents in airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your documents, including those related to the Supplemental Local Sales And Use Tax Schedule Dfa Arkansas. You can see when documents are sent, viewed, and signed, which helps you stay organized and ensures timely completion of your tax filings. This feature enhances accountability and efficiency in your document management process.

Get more for Supplemental Local Sales And Use Tax Schedule Dfa Arkansas

- Huron county medical care facility form

- Samson bolpdf samson tug amp barge form

- Pharmacy council ghana application form pdf

- Rec bylaws form

- Application to change child and spousal support alberta courts form

- Lesson 3 problem solving practice side and angle relationships of triangles form

- Therapeutic community client assessment inventory for form

- Form 418 stipulationmotion for continuance state of vermont superior court criminal division superior court civil division

Find out other Supplemental Local Sales And Use Tax Schedule Dfa Arkansas

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast