Taxpayer Signature Page Form

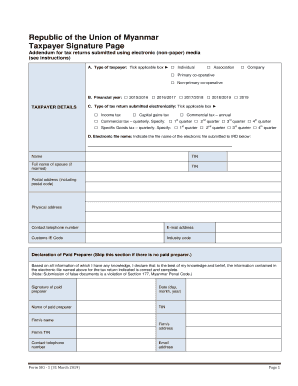

What is the Taxpayer Signature Page

The Taxpayer Signature Page is a crucial document used primarily in the context of tax filings in the United States. It serves as a formal declaration by the taxpayer, affirming the accuracy and completeness of the information provided in their tax return. This page is often required for various tax forms, ensuring that the taxpayer acknowledges their responsibility for the information submitted to the Internal Revenue Service (IRS).

How to use the Taxpayer Signature Page

Using the Taxpayer Signature Page involves a few straightforward steps. First, ensure that all relevant tax information is accurately filled out in the accompanying tax form. After completing the necessary sections, the taxpayer must sign and date the signature page. This signature indicates that the taxpayer agrees to the terms and conditions outlined by the IRS. It is essential to review the entire document for accuracy before submission to avoid any potential issues with the IRS.

Steps to complete the Taxpayer Signature Page

Completing the Taxpayer Signature Page requires careful attention to detail. Follow these steps:

- Gather all necessary tax documents and forms.

- Complete the main tax form accurately.

- Locate the Taxpayer Signature Page associated with your tax form.

- Sign and date the page where indicated.

- Review the entire submission for completeness.

- Submit the forms according to the guidelines provided by the IRS.

Legal use of the Taxpayer Signature Page

The Taxpayer Signature Page has legal significance as it serves as a binding statement of the taxpayer’s intent and responsibility. By signing this page, the taxpayer affirms that the information provided is true and correct to the best of their knowledge. This legal acknowledgment is essential for compliance with IRS regulations and can be used as evidence in case of audits or disputes regarding tax filings.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Taxpayer Signature Page. Taxpayers must ensure that they are using the correct version of the signature page that corresponds with their tax form. Additionally, the IRS mandates that all signatures be original unless electronic signatures are permitted under specific circumstances. Familiarizing oneself with these guidelines can help prevent errors and ensure a smooth filing process.

Filing Deadlines / Important Dates

Filing deadlines for tax returns, including the Taxpayer Signature Page, are critical for compliance. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to avoid penalties and ensure timely submission of their tax documents.

Required Documents

To complete the Taxpayer Signature Page, several documents may be required. These typically include:

- The main tax form (e.g., Form 1040, Form 1065).

- Supporting documentation such as W-2s, 1099s, and other income statements.

- Any additional forms relevant to deductions or credits claimed.

Having all necessary documents ready can streamline the process and reduce the likelihood of errors.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer signature page

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Taxpayer Signature Page?

A Taxpayer Signature Page is a document that requires a taxpayer's signature to validate tax-related forms. With airSlate SignNow, you can easily create and manage these pages, ensuring compliance and accuracy in your tax submissions.

-

How does airSlate SignNow simplify the Taxpayer Signature Page process?

airSlate SignNow streamlines the Taxpayer Signature Page process by allowing users to send, sign, and store documents electronically. This eliminates the need for physical paperwork, making it faster and more efficient to obtain necessary signatures.

-

Is there a cost associated with using airSlate SignNow for Taxpayer Signature Pages?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that facilitate the creation and management of Taxpayer Signature Pages, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for managing Taxpayer Signature Pages?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage for Taxpayer Signature Pages. These tools enhance the signing experience and ensure that all documents are easily accessible and compliant.

-

Can I integrate airSlate SignNow with other software for Taxpayer Signature Pages?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage Taxpayer Signature Pages alongside your existing tools. This integration enhances workflow efficiency and keeps all your documents organized.

-

What are the benefits of using airSlate SignNow for Taxpayer Signature Pages?

Using airSlate SignNow for Taxpayer Signature Pages offers numerous benefits, including reduced turnaround times, improved accuracy, and enhanced security. These advantages help businesses streamline their tax processes and maintain compliance with regulations.

-

How secure is the information on my Taxpayer Signature Page with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Taxpayer Signature Page information. This ensures that your sensitive data remains confidential and secure throughout the signing process.

Get more for Taxpayer Signature Page

- Jd cv 86 form

- Multistate bar examination certification request form

- Request exclusion form

- Form 1e application

- Writ of habeas corpus ad testificandum form

- Application for referral of case to the individual jud ct form

- First order of notice upon attachment of estate of nonresident jud ct form

- Ct request waiver form

Find out other Taxpayer Signature Page

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure