Whitney Bank Personal Financial Statement Form

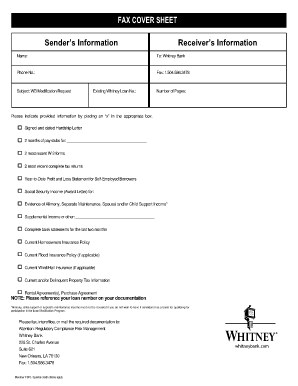

Understanding the Whitney Bank Personal Financial Statement

The Whitney Bank Personal Financial Statement is a crucial document that outlines an individual's financial status. It typically includes details about assets, liabilities, income, and expenses. This form is often required when applying for loans or credit, as it provides lenders with a comprehensive view of a borrower's financial health. By summarizing financial information, it helps in assessing creditworthiness and making informed lending decisions.

How to Utilize the Whitney Bank Personal Financial Statement

Utilizing the Whitney Bank Personal Financial Statement involves gathering relevant financial information and accurately filling out the form. Start by listing all assets, such as bank accounts, real estate, and investments. Next, detail liabilities, including mortgages, loans, and credit card debts. It is essential to ensure that all figures are current and accurately reflect your financial situation. Once completed, this statement can be submitted to lenders or financial institutions as part of the application process.

Obtaining the Whitney Bank Personal Financial Statement

The Whitney Bank Personal Financial Statement can be obtained directly from Whitney Bank's website or by visiting a local branch. Many financial institutions provide downloadable versions of the form for convenience. It is advisable to check for the most recent version to ensure compliance with any updated requirements. If assistance is needed, bank representatives can provide guidance on how to fill out the form correctly.

Steps to Complete the Whitney Bank Personal Financial Statement

Completing the Whitney Bank Personal Financial Statement involves several key steps:

- Gather all necessary financial documents, including bank statements, tax returns, and pay stubs.

- List all assets, categorizing them into liquid assets, real estate, and other investments.

- Detail all liabilities, ensuring to include any outstanding debts and obligations.

- Calculate net worth by subtracting total liabilities from total assets.

- Review the completed statement for accuracy before submission.

Key Components of the Whitney Bank Personal Financial Statement

The Whitney Bank Personal Financial Statement comprises several key components that provide a complete picture of an individual's financial situation:

- Assets: This section includes cash, investments, real estate, and personal property.

- Liabilities: Here, borrowers list all debts, including loans, credit card balances, and mortgages.

- Income: Document all sources of income, such as salaries, rental income, and dividends.

- Expenses: Include regular monthly expenses, such as housing costs, utilities, and insurance.

Legal Considerations for the Whitney Bank Personal Financial Statement

When submitting the Whitney Bank Personal Financial Statement, it is important to be aware of legal considerations. The information provided must be accurate and truthful, as any discrepancies can lead to legal repercussions, including fraud charges. Additionally, some lenders may have specific requirements regarding the format and content of the statement, so it is essential to comply with these guidelines to avoid complications during the application process.

Examples of Using the Whitney Bank Personal Financial Statement

The Whitney Bank Personal Financial Statement can be used in various scenarios:

- Applying for a mortgage or personal loan, where lenders require a detailed overview of financial health.

- Seeking investment opportunities, as potential investors may request a financial statement to assess risk.

- Planning for retirement, where individuals can analyze their financial position to ensure they meet their future needs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the whitney bank personal financial statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Whitney Bank Personal Financial Statement?

A Whitney Bank Personal Financial Statement is a comprehensive document that outlines an individual's financial position, including assets, liabilities, and net worth. It is often required for loan applications and financial assessments. Using airSlate SignNow, you can easily create and eSign your Whitney Bank Personal Financial Statement online.

-

How can I create a Whitney Bank Personal Financial Statement using airSlate SignNow?

Creating a Whitney Bank Personal Financial Statement with airSlate SignNow is simple. You can start by selecting a template or creating a document from scratch. Our platform allows you to fill in your financial details and eSign the document securely, ensuring a smooth process.

-

What are the benefits of using airSlate SignNow for my Whitney Bank Personal Financial Statement?

Using airSlate SignNow for your Whitney Bank Personal Financial Statement offers several benefits, including ease of use, cost-effectiveness, and secure eSigning capabilities. You can complete your financial statement quickly and efficiently, saving time and reducing paperwork. Additionally, our platform ensures that your sensitive information is protected.

-

Is there a cost associated with creating a Whitney Bank Personal Financial Statement on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for individuals and businesses. We offer various pricing plans that cater to different needs, ensuring you can create your Whitney Bank Personal Financial Statement without breaking the bank. Check our website for the latest pricing details.

-

Can I integrate airSlate SignNow with other applications for my Whitney Bank Personal Financial Statement?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage your Whitney Bank Personal Financial Statement alongside your other financial tools. Whether you use accounting software or CRM systems, our platform can seamlessly connect to enhance your workflow.

-

How secure is my Whitney Bank Personal Financial Statement when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your Whitney Bank Personal Financial Statement is protected with advanced encryption and secure access controls. We comply with industry standards to ensure that your sensitive financial information remains confidential and safe from unauthorized access.

-

Can I edit my Whitney Bank Personal Financial Statement after eSigning it?

Once you eSign your Whitney Bank Personal Financial Statement, it is considered a finalized document. However, if you need to make changes, you can create a new version or use our editing tools before signing. airSlate SignNow allows you to manage your documents efficiently, ensuring you have the flexibility you need.

Get more for Whitney Bank Personal Financial Statement

Find out other Whitney Bank Personal Financial Statement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors