No Known Loss Letter Insurance Template Form

What is the No Known Loss Letter Insurance Template

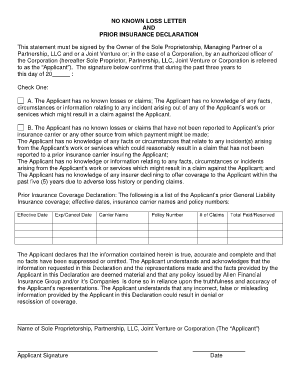

The No Known Loss Letter Insurance Template is a formal document used in the insurance industry to affirm that there have been no known losses or claims related to a specific policy or property. This letter is often required during transactions such as property sales, refinancing, or when applying for new insurance coverage. By providing this letter, the policyholder assures the insurer or third parties that there are no undisclosed claims or losses that could affect the risk assessment or underwriting process.

How to use the No Known Loss Letter Insurance Template

To effectively use the No Known Loss Letter Insurance Template, begin by filling in the necessary details, including the policyholder's name, policy number, and the property address. Clearly state that there have been no known losses or claims during the specified period. It is essential to sign and date the document to validate its authenticity. Once completed, the letter can be submitted to the relevant parties, such as lenders or new insurers, as part of the documentation required for processing transactions or applications.

Steps to complete the No Known Loss Letter Insurance Template

Completing the No Known Loss Letter Insurance Template involves several key steps:

- Gather relevant information, including your insurance policy details and property information.

- Open the template and enter your name, address, and contact information.

- Include the policy number and the effective dates of coverage.

- Clearly state that there have been no known losses or claims during the specified period.

- Sign and date the document to confirm its accuracy.

- Distribute the completed letter to the necessary parties, such as lenders or insurers.

Key elements of the No Known Loss Letter Insurance Template

The key elements of the No Known Loss Letter Insurance Template include:

- Policyholder Information: Name, address, and contact details of the individual or entity holding the insurance policy.

- Policy Details: The insurance policy number and effective dates.

- Statement of No Known Losses: A clear declaration that there have been no known losses or claims during the specified period.

- Signature: The signature of the policyholder or authorized representative, along with the date of signing.

Legal use of the No Known Loss Letter Insurance Template

The No Known Loss Letter is legally significant as it serves as a formal declaration regarding the status of an insurance policy. It can be used in various legal contexts, such as real estate transactions or when applying for new insurance coverage. Providing a false statement in this letter can lead to legal repercussions, including potential fraud charges. Therefore, it is crucial to ensure that the information contained in the letter is accurate and truthful.

Examples of using the No Known Loss Letter Insurance Template

There are several scenarios where the No Known Loss Letter Insurance Template is commonly used:

- When selling a property, the seller may need to provide this letter to the buyer's lender to confirm that there are no undisclosed claims.

- During the refinancing process, lenders may require the letter to assess the risk associated with the property.

- Individuals applying for new insurance coverage may need to submit this letter to demonstrate a clean claims history.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the no known loss letter insurance template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a No Known Loss Letter Insurance Template?

A No Known Loss Letter Insurance Template is a document used by insurance companies to confirm that there have been no known losses or claims against a property or asset. This template helps streamline the process of providing assurance to stakeholders and can be customized to fit specific needs.

-

How can airSlate SignNow help with No Known Loss Letter Insurance Templates?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning No Known Loss Letter Insurance Templates. With our solution, you can quickly generate professional documents and ensure they are securely signed, saving time and reducing paperwork.

-

Is there a cost associated with using the No Known Loss Letter Insurance Template?

Yes, airSlate SignNow offers various pricing plans that include access to the No Known Loss Letter Insurance Template. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can benefit from our document management solutions.

-

What features are included with the No Known Loss Letter Insurance Template?

The No Known Loss Letter Insurance Template includes features such as customizable fields, eSignature capabilities, and secure document storage. These features enhance the efficiency of your workflow and ensure that your documents are both professional and compliant.

-

Can I integrate the No Known Loss Letter Insurance Template with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly incorporate the No Known Loss Letter Insurance Template into your existing workflows. This flexibility helps improve productivity and ensures a smooth document management process.

-

What are the benefits of using a No Known Loss Letter Insurance Template?

Using a No Known Loss Letter Insurance Template can signNowly reduce the time spent on document preparation and enhance accuracy. It provides a standardized format that ensures all necessary information is included, which can help in maintaining compliance and improving communication with clients.

-

How secure is the No Known Loss Letter Insurance Template on airSlate SignNow?

Security is a top priority at airSlate SignNow. The No Known Loss Letter Insurance Template is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential and safe from unauthorized access.

Get more for No Known Loss Letter Insurance Template

Find out other No Known Loss Letter Insurance Template

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free