Form 8879

What is the Form 8879

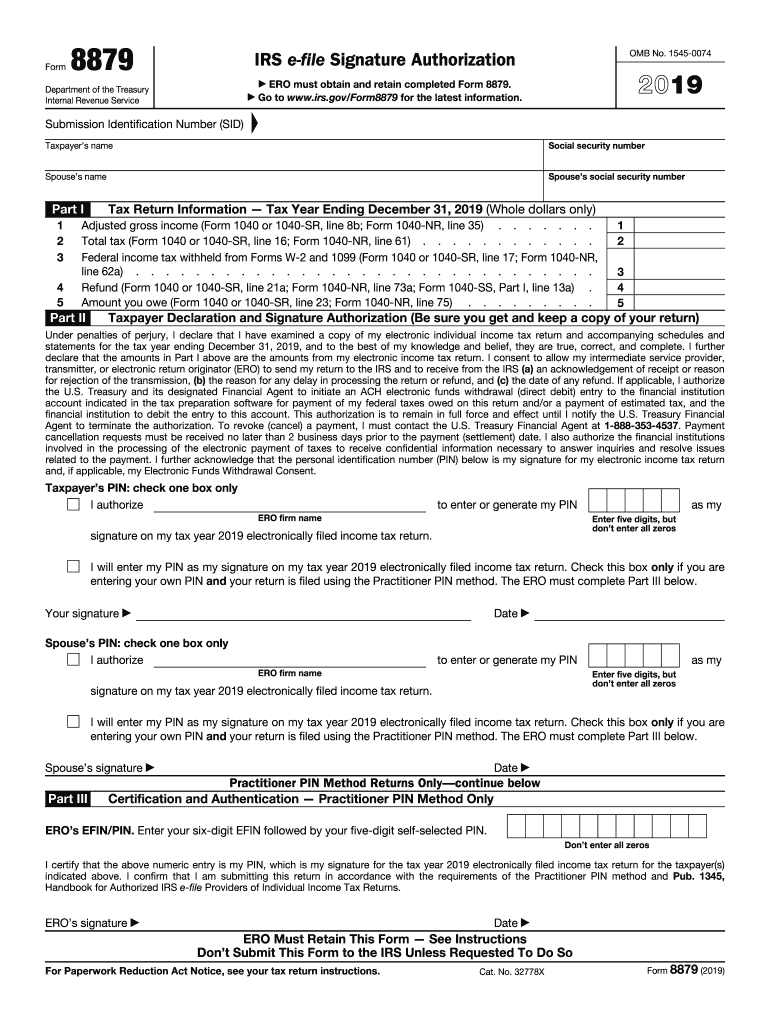

The Form 8879, known as the IRS e-file Signature Authorization, is a crucial document for taxpayers who file their federal tax returns electronically. This form authorizes an electronic return originator (ERO) to file your tax return on your behalf. It serves as a digital signature, confirming that the taxpayer has reviewed the return and agrees to its submission to the IRS. The form is especially important for those who utilize tax preparation software or services to ensure compliance with IRS regulations.

How to use the Form 8879

Using the Form 8879 involves a few straightforward steps. First, the taxpayer must complete their federal tax return using an ERO or tax preparation software. Once the return is ready for submission, the ERO will generate the Form 8879 for the taxpayer to review. The taxpayer must then sign the form electronically, which validates their identity and consent for the ERO to file the return. After signing, the ERO can proceed with the electronic filing process, ensuring that the return is submitted to the IRS promptly.

Steps to complete the Form 8879

Completing the Form 8879 requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your Social Security number, the tax year, and details from your completed tax return.

- Review your tax return for accuracy, ensuring all information is correct before signing.

- Access the Form 8879 through your ERO or tax software, which will automatically populate relevant fields.

- Sign the form electronically, confirming your agreement with the information provided.

- Submit the form to your ERO, who will then file your tax return electronically with the IRS.

Legal use of the Form 8879

The legal use of the Form 8879 is governed by IRS regulations. It acts as a digital signature, which holds the same weight as a handwritten signature on paper forms. To ensure its legality, the form must be completed accurately, and the taxpayer must provide their consent through an electronic signature. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act is essential, as it outlines the validity of electronic signatures in the United States. By using a secure platform for signing, taxpayers can ensure that their Form 8879 meets all legal requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 8879 is crucial for timely tax submissions. Typically, the deadline for filing individual federal tax returns is April 15 of the following year. If you are unable to meet this deadline, you may request an extension, which generally extends the filing date to October 15. However, it's important to note that an extension to file does not extend the deadline for any taxes owed. Ensure that your Form 8879 is submitted in accordance with these deadlines to avoid penalties.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the Form 8879 can lead to significant penalties. If the IRS determines that a taxpayer has not properly authorized their electronic filing, they may face delays in processing their return, potential audits, or even fines. Additionally, if taxes owed are not paid by the due date, interest and penalties may accrue. It is essential for taxpayers to understand the importance of completing and submitting the Form 8879 accurately and on time to avoid these consequences.

Quick guide on how to complete 2019 form 8879 irs e file signature authorization

Prepare Form 8879 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow supplies you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage Form 8879 on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric operation today.

How to edit and eSign Form 8879 with ease

- Find Form 8879 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8879 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8879 irs e file signature authorization

How to make an eSignature for the 2019 Form 8879 Irs E File Signature Authorization online

How to generate an eSignature for your 2019 Form 8879 Irs E File Signature Authorization in Google Chrome

How to make an eSignature for signing the 2019 Form 8879 Irs E File Signature Authorization in Gmail

How to make an electronic signature for the 2019 Form 8879 Irs E File Signature Authorization from your smart phone

How to create an electronic signature for the 2019 Form 8879 Irs E File Signature Authorization on iOS devices

How to generate an electronic signature for the 2019 Form 8879 Irs E File Signature Authorization on Android devices

People also ask

-

What is 2019 e file and how does it work with airSlate SignNow?

The 2019 e file process allows businesses to electronically file and sign documents with ease. airSlate SignNow seamlessly supports this process, enabling users to prepare, send, and e-sign their 2019 e file documents without any hassle.

-

Are there any costs associated with using airSlate SignNow for 2019 e file?

Yes, while airSlate SignNow offers a cost-effective solution for managing your 2019 e file needs, pricing may vary depending on the chosen plan. You can choose from various subscription options that provide different features tailored to fit your business requirements.

-

What features does airSlate SignNow offer for managing 2019 e file documents?

airSlate SignNow provides a range of features for 2019 e file, such as document templates, real-time collaboration, and secure cloud storage. This ensures that your documents are always accessible and easy to manage throughout the e-filing process.

-

How can I ensure my 2019 e file documents are secure with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially for sensitive 2019 e file documents. Our platform uses bank-grade encryption and complies with industry standards to protect your data while maintaining efficiency and ease of use.

-

Can I integrate airSlate SignNow with other software for my 2019 e file tasks?

Absolutely! airSlate SignNow offers various integrations with popular applications, enhancing your workflow for 2019 e file tasks. This allows you to streamline processes and maintain seamless communication across different platforms.

-

What are the benefits of using airSlate SignNow for my 2019 e file needs?

Using airSlate SignNow for your 2019 e file needs offers numerous benefits, including increased efficiency, reduced paperwork, and cost savings. The easy-to-use interface allows users to complete their e-filing tasks quickly and accurately.

-

Is airSlate SignNow suitable for small businesses handling 2019 e file?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing their 2019 e file documents. Its affordability and user-friendly features make it an ideal solution for small enterprises looking to streamline their e-signature processes.

Get more for Form 8879

Find out other Form 8879

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement