Ct 1096 2018

What is the CT-1096 Form?

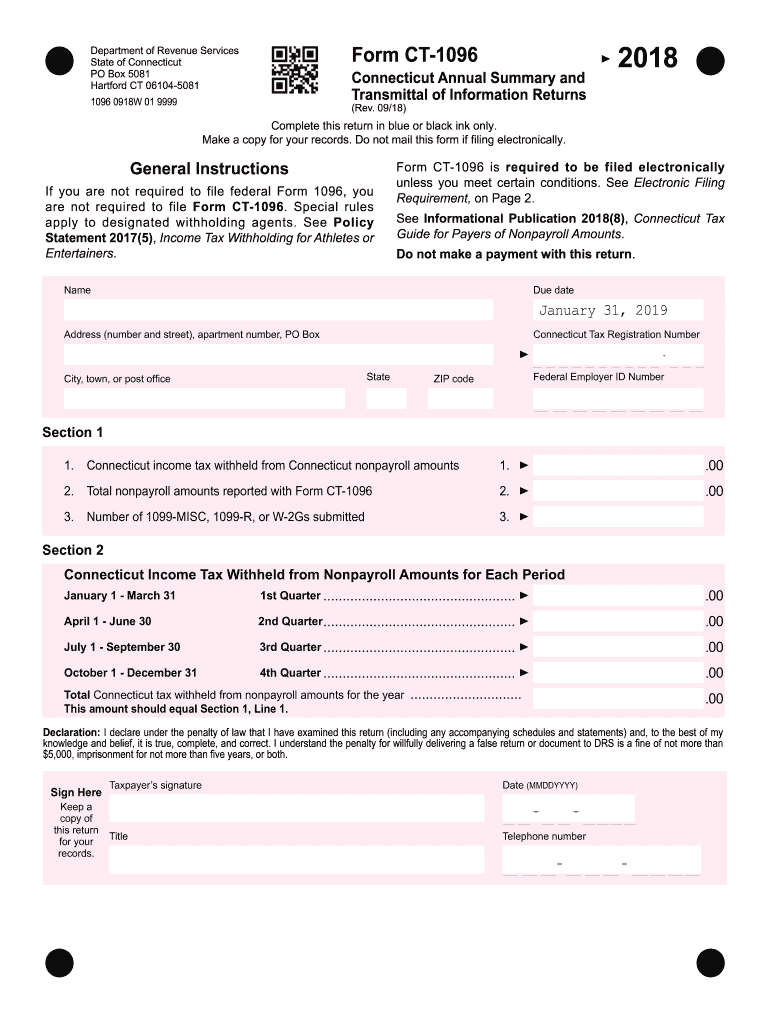

The CT-1096 form, also known as the Connecticut Annual Summary and Transmittal of Information Returns, is a crucial document for businesses operating in Connecticut. This form must be submitted to the Connecticut Department of Revenue Services (DRS) when a business has filed more than 25 W-2, 1099-MISC, or 1099-R forms in a calendar year. It serves as a summary of all the information returns filed and must be submitted by January 31 of the following year. If the deadline falls on a weekend, it is extended to the next business day.

Steps to Complete the CT-1096

Completing the CT-1096 form involves several key steps to ensure accuracy and compliance. Begin by obtaining the form, which is available online. Fill in your name, address, state, and ZIP code. Next, provide your Connecticut Tax Registration Number and Federal Employer ID Number. In Section 1, detail the income tax withheld from nonpayroll amounts and the total nonpayroll reported amounts. Section 2 requires you to list the Connecticut income tax withheld from nonpayroll amounts for each period. Finally, sign the document, including your title, date, and telephone number.

Filing Deadlines / Important Dates

The CT-1096 form must be filed by January 31 each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential for businesses to adhere to this timeline to avoid penalties. Additionally, keep in mind that the information returns that accompany the CT-1096 must also be filed by this date.

Legal Use of the CT-1096

The CT-1096 form is legally required for businesses that meet the filing threshold of 25 or more information returns. Failure to submit this form can result in penalties imposed by the Connecticut Department of Revenue Services. It is important for businesses to understand their obligations under state law and ensure that they comply with all filing requirements to avoid legal repercussions.

How to Obtain the CT-1096

The CT-1096 form can be easily obtained online through the Connecticut Department of Revenue Services website. It is available as a fillable PDF, allowing businesses to complete the form digitally. Alternatively, businesses can request a paper copy from the DRS if needed. Ensuring you have the most current version of the form is essential for compliance.

Form Submission Methods

The CT-1096 can be submitted electronically or via mail. For electronic submissions, businesses can use the DRS online services to file their forms securely. If opting for mail, ensure that the completed form is sent to the appropriate address provided by the DRS. It is advisable to keep a copy of the submitted form for your records.

Quick guide on how to complete ct 1096 2018 2019 form

Your assistance manual on how to prepare your Ct 1096

If you wish to learn how to generate and submit your Ct 1096, here are some straightforward instructions to facilitate tax processing.

To begin, you simply need to establish your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document platform that enables you to modify, generate, and finalize your tax documents effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures, and revisit to amend information as required. Streamline your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finalize your Ct 1096 in a matter of minutes:

- Set up your account and begin working on PDFs within minutes.

- Refer to our catalog to obtain any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Ct 1096 in our editor.

- Populate the necessary fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting in paper form can heighten return inaccuracies and stall refunds. Naturally, before e-filing your taxes, verify the IRS website for declaring guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 1096 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the ct 1096 2018 2019 form

How to create an electronic signature for your Ct 1096 2018 2019 Form in the online mode

How to create an eSignature for your Ct 1096 2018 2019 Form in Google Chrome

How to generate an electronic signature for signing the Ct 1096 2018 2019 Form in Gmail

How to make an electronic signature for the Ct 1096 2018 2019 Form right from your smart phone

How to create an eSignature for the Ct 1096 2018 2019 Form on iOS devices

How to generate an electronic signature for the Ct 1096 2018 2019 Form on Android devices

People also ask

-

What is CT Form 1096 2018 and why is it important?

CT Form 1096 2018 is the annual summary and transmittal of information returns, which businesses file with the IRS. It's essential for companies to accurately report their payments made to contractors, ensuring compliance with tax regulations. Failing to file this form correctly can lead to penalties and issues with the IRS.

-

How can airSlate SignNow help with filing CT Form 1096 2018?

airSlate SignNow streamlines the process of filling and filing CT Form 1096 2018 by providing easy-to-use electronic forms. Our platform allows users to create, sign, and store documents securely, simplifying the paperwork associated with tax filing. This reduces the risk of errors and ensures timely submissions.

-

Is there a cost associated with using airSlate SignNow for CT Form 1096 2018?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when filing CT Form 1096 2018. Our plans are designed to be cost-effective, offering features that enhance productivity without breaking the bank. You can choose a plan that best fits your volume of document handling.

-

What features does airSlate SignNow offer for CT Form 1096 2018?

With airSlate SignNow, you can easily create, edit, and send CT Form 1096 2018 for eSigning. Our platform includes features such as template creation, automated workflows, and document tracking to ensure you have the tools necessary to manage your filings efficiently. All features are aimed at making tax documentation hassle-free.

-

Are there integrations available for CT Form 1096 2018 in airSlate SignNow?

Yes, airSlate SignNow supports integrations with various accounting software, enhancing your ability to manage CT Form 1096 2018 submissions. You can link our eSignature solution with platforms like QuickBooks and others, allowing seamless imports and exports of financial data needed for your filings. This integration boosts your overall efficiency.

-

Can I use airSlate SignNow for bulk processing of CT Form 1096 2018?

Absolutely! airSlate SignNow allows for the bulk processing of CT Form 1096 2018, making it easy to send multiple forms for eSignature at once. This is particularly beneficial for businesses dealing with numerous contractors, as it accelerates the filing process without compromising on accuracy or compliance.

-

How does airSlate SignNow ensure the security of my CT Form 1096 2018?

Security is a top priority at airSlate SignNow. We use advanced encryption methods to safeguard your CT Form 1096 2018 and other documents during transmission and storage. Our compliance with industry standards ensures that your data remains confidential and secure throughout the filing process.

Get more for Ct 1096

- Owners information casa del mar beach resort

- Alcohol tax return city of elgin form

- Substance abuse crossword form

- Client information form diane gehart

- Imm 5713 pdf form

- Interpreting and constructing cladograms biology by napier form

- Chocolate chip mining shellys science spot form

- Nw nbha finals september 18 20 moses lake nwnbhacom form

Find out other Ct 1096

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter