Rev 488 2009

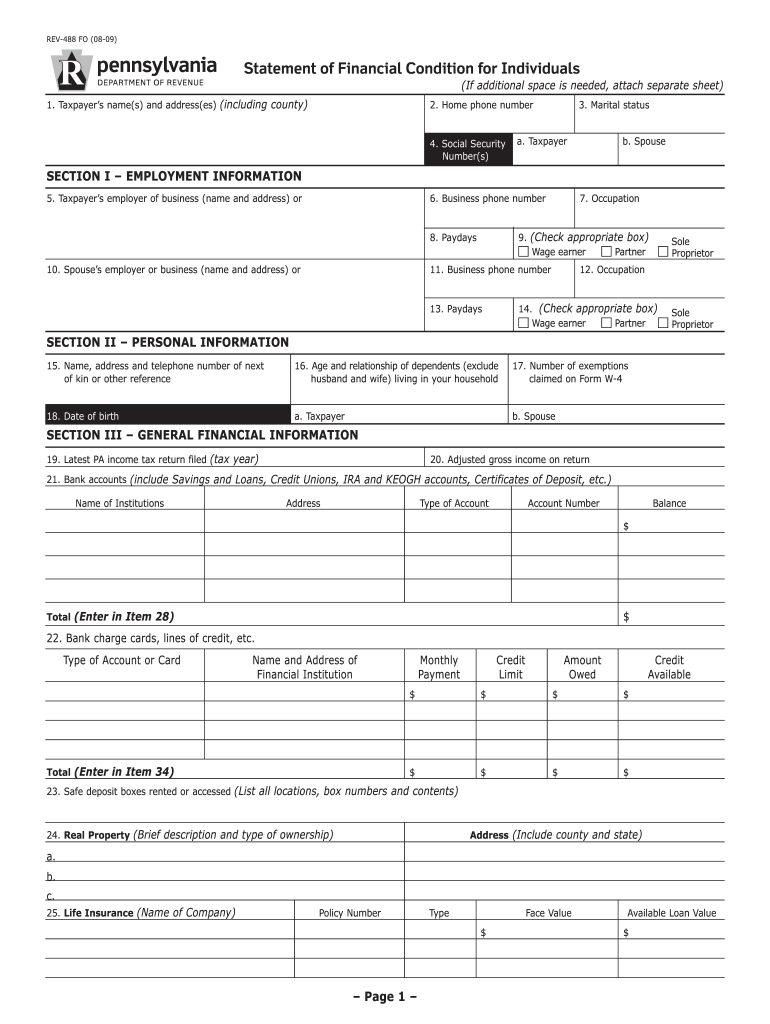

What is the Rev 488?

The Rev 488 form, also known as the Pennsylvania Revocation of Election, is a critical document used by individuals in Pennsylvania to revoke their previously filed election for a specific tax status. This form is essential for taxpayers who wish to change their tax election status, which can impact their tax liabilities and obligations. Understanding the purpose and implications of the Rev 488 is crucial for maintaining compliance with state tax regulations.

How to use the Rev 488

Using the Rev 488 form involves several key steps to ensure proper completion and submission. Taxpayers must first download the form from the Pennsylvania Department of Revenue's website or access it through a reliable source. After obtaining the form, individuals should carefully fill out the required information, including personal details and the specific election being revoked. It is important to review the form for accuracy before submitting it to avoid delays or complications with the tax authority.

Steps to complete the Rev 488

Completing the Rev 488 form requires attention to detail. Follow these steps:

- Obtain the Rev 488 form from an official source.

- Fill in your personal information, including name, address, and Social Security number.

- Specify the election you are revoking and provide any necessary details related to that election.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your request.

- Submit the completed form to the Pennsylvania Department of Revenue via the preferred submission method.

Legal use of the Rev 488

The Rev 488 form is legally recognized under Pennsylvania tax law, allowing individuals to formally revoke their election status. It is important for taxpayers to understand that submitting this form does not automatically change their tax obligations; rather, it serves as a notification to the tax authority of the intent to revoke a prior election. Proper use of the Rev 488 ensures compliance with state regulations and helps avoid potential penalties associated with incorrect tax filings.

Filing Deadlines / Important Dates

Timely submission of the Rev 488 form is crucial to avoid penalties or complications with tax obligations. Taxpayers should be aware of specific deadlines related to their tax year and the elections they are revoking. Generally, the form should be filed as soon as the decision to revoke an election is made, ideally before the close of the tax year to ensure proper processing. Staying informed about these deadlines can help maintain compliance and avoid unnecessary issues with the Pennsylvania Department of Revenue.

Form Submission Methods

Taxpayers have several options for submitting the Rev 488 form. The form can be submitted electronically through the Pennsylvania Department of Revenue's online portal, which is a fast and efficient method. Alternatively, individuals may choose to mail the completed form to the appropriate address provided by the Department of Revenue. In-person submissions may also be possible at designated offices. Each method has its own processing times, so it is advisable to choose the one that best fits the taxpayer's needs.

Quick guide on how to complete what is the next form after filling i 488 2009 2019

Your assistance manual on how to prepare your Rev 488

If you’re curious about how to finalize and submit your Rev 488, here are some brief instructions to simplify tax declaration.

To initiate, you just need to set up your airSlate SignNow profile to change your approach to managing documents online. airSlate SignNow is an incredibly user-friendly and effective document solution that allows you to modify, generate, and complete your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, as well as return to adjust information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Rev 488 in just a few minutes:

- Create your account and start working on PDFs shortly.

- Utilize our library to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to open your Rev 488 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting a paper version can lead to errors and delays in refunds. Additionally, before e-filing your taxes, ensure to check the IRS website for the filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct what is the next form after filling i 488 2009 2019

FAQs

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

-

After filling out the application form of DU, what is the next step for getting admission into DU?

Once you've filled the online registration form, check out the dates for cutoffs ,and when the cutoff is released ,just check which colleges does your percentage falls on as per the course you want to opt for.Going to seek admission in any college you have to carry an application form of that particular college, with mentioned course,which will be available online .you can take its printout from any cyber cafe.

-

What should be the next step after filling out the CA form?

If you have passed your 12th and filled your CA Foundation form, then start preparing as the exam will held in the month of may itself.The time is limited and you have a new subject named law.So don't waste time and prepare yourself for foundation exam.CA process in summary form:After passing foundation you have to register yourself with intermediate and then there qill be 2 groups. After passing any 1 group you can start your articleship. After completing your 3 year articleship you are eligible for final exam. There are 2 groups in final too.Hope it helps.Do upvote if it helps and follow me for more ca related queries.

-

After how many days of filling out the JEE Main 2019 form will I be allotted a test centre?

The date and shift for Paper-1 and Paper-2 will be available by 5th October, 2018.However, the exact City of examination for Paper-1 and Paper-2 will be available by 21st October, 2018 on NTA’s website.

Create this form in 5 minutes!

How to create an eSignature for the what is the next form after filling i 488 2009 2019

How to make an electronic signature for the What Is The Next Form After Filling I 488 2009 2019 in the online mode

How to create an electronic signature for the What Is The Next Form After Filling I 488 2009 2019 in Chrome

How to create an electronic signature for signing the What Is The Next Form After Filling I 488 2009 2019 in Gmail

How to create an electronic signature for the What Is The Next Form After Filling I 488 2009 2019 straight from your smart phone

How to generate an electronic signature for the What Is The Next Form After Filling I 488 2009 2019 on iOS

How to make an electronic signature for the What Is The Next Form After Filling I 488 2009 2019 on Android devices

People also ask

-

What is Rev 488 in airSlate SignNow?

Rev 488 refers to a specific version of the airSlate SignNow platform that enhances document management and eSignature capabilities. With Rev 488, users can streamline their workflows, making it easier to send, sign, and track documents in real-time.

-

How does Rev 488 improve document signing efficiency?

Rev 488 improves document signing efficiency by offering advanced features like bulk sending and customizable templates. These tools allow businesses to manage multiple documents effortlessly, reducing the time spent on manual processes and ensuring quicker turnaround times.

-

What are the pricing options for Rev 488?

The pricing for Rev 488 is competitive and designed to cater to businesses of all sizes. airSlate SignNow offers flexible subscription plans, including monthly and annual options, ensuring that users can select a plan that best fits their budget and usage needs.

-

Can Rev 488 integrate with other software?

Yes, Rev 488 seamlessly integrates with a variety of popular software applications, including CRM systems and cloud storage platforms. These integrations enhance the functionality of airSlate SignNow, allowing users to incorporate eSigning into their existing workflows smoothly.

-

What are the key benefits of using Rev 488?

Rev 488 offers numerous benefits, including improved compliance, enhanced security features, and user-friendly interfaces. These advantages help businesses reduce operational risks and ensure that documents are signed and stored securely.

-

Is Rev 488 suitable for small businesses?

Absolutely! Rev 488 is designed to be scalable, making it an ideal solution for small businesses as well as large enterprises. Its cost-effective pricing and easy-to-use features help small businesses manage their document processes efficiently.

-

How does Rev 488 enhance document security?

Rev 488 enhances document security through advanced encryption and authentication measures. Users can ensure that their sensitive documents remain protected, as the platform complies with industry standards for data security and privacy.

Get more for Rev 488

- Pfms generated payment form

- Snysa physical form hometeamsonline

- Carrier profile sheet form

- Transit order t1ncts porath customs agents form

- Plate tectonics earthquakes volcanoes review packet berkleyschools form

- Natops instrument rating request ref opnavinst 37107 form

- Fragebogen zur auslandsreise krankenversicherung sparkasse oberhessen form

- Lithium battery template form

Find out other Rev 488

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document