Kansas City Mo Rd 109nr Form 2018

What is the Kansas City Mo Rd 109nr Form

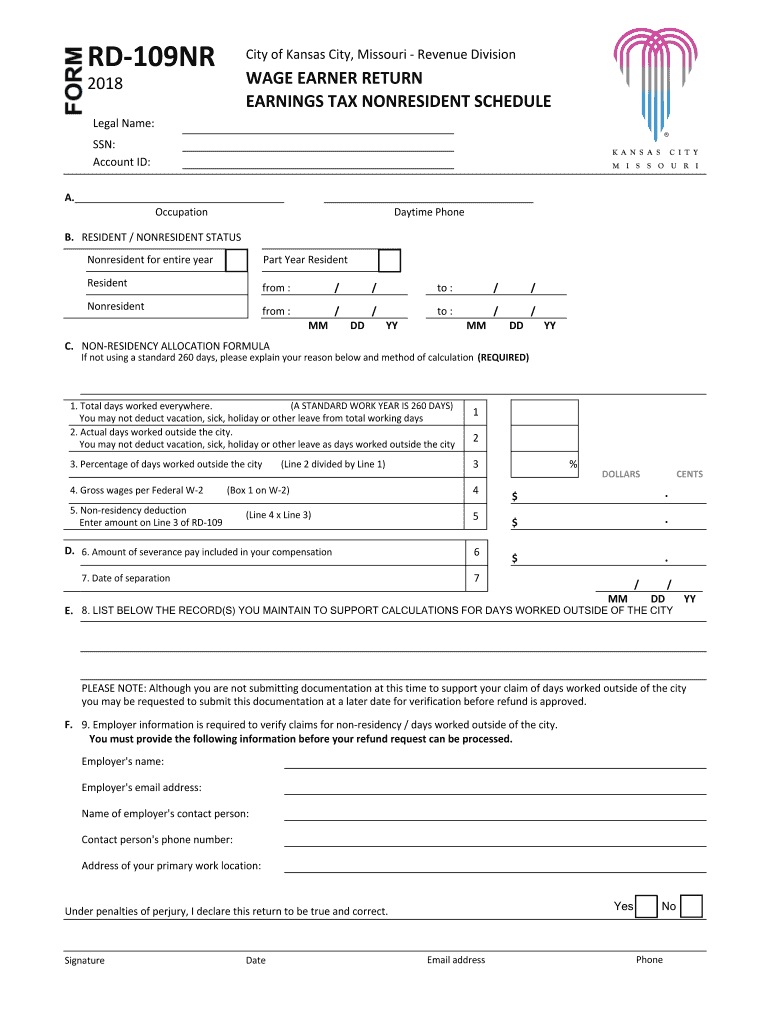

The Kansas City Mo Rd 109nr Form is a tax document specifically designed for nonresidents who earn income within Kansas City, Missouri. This form is essential for individuals who do not reside in Kansas City but have earned income from sources located in the city. It allows these individuals to report their earnings and calculate the appropriate city earnings tax owed. Understanding this form is crucial for compliance with local tax regulations.

Steps to complete the Kansas City Mo Rd 109nr Form

Completing the Kansas City Mo Rd 109nr Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total earnings from Kansas City sources, ensuring accuracy in calculations.

- Apply any applicable deductions or credits as outlined in the form instructions.

- Calculate the total city earnings tax owed based on the provided tax rates.

- Sign and date the form, certifying that the information provided is accurate.

How to obtain the Kansas City Mo Rd 109nr Form

The Kansas City Mo Rd 109nr Form can be obtained through several methods. It is available for download from the official Kansas City government website. Additionally, individuals can request a physical copy by contacting the Kansas City Finance Department. Local tax offices may also provide copies of the form for those who prefer in-person assistance.

Legal use of the Kansas City Mo Rd 109nr Form

The legal use of the Kansas City Mo Rd 109nr Form is governed by local tax laws. This form must be filed accurately and on time to avoid penalties. It serves as a declaration of income earned in Kansas City and is essential for compliance with the city's earnings tax regulations. Failure to file this form can result in fines and legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas City Mo Rd 109nr Form are typically aligned with federal tax deadlines. Nonresidents must ensure that their forms are submitted by April fifteenth of each year for income earned in the previous calendar year. It is crucial to stay informed about any changes to these deadlines, as they can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Kansas City Mo Rd 109nr Form can be submitted through various methods. Individuals have the option to file online using the Kansas City tax portal, which provides a streamlined process for electronic submission. Alternatively, forms can be mailed to the appropriate tax office address or submitted in person at designated locations. Each method has its own guidelines, so it is important to choose the one that best fits your needs.

Quick guide on how to complete mo rd 109nr kansas city 2018

Complete Kansas City Mo Rd 109nr Form effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Kansas City Mo Rd 109nr Form on any gadget using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Kansas City Mo Rd 109nr Form without stress

- Find Kansas City Mo Rd 109nr Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, frustrating form navigation, or errors that require reprinting new document copies. airSlate SignNow fulfills all your needs in document management within just a few clicks from any device of your choosing. Modify and eSign Kansas City Mo Rd 109nr Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo rd 109nr kansas city 2018

Create this form in 5 minutes!

How to create an eSignature for the mo rd 109nr kansas city 2018

How to create an eSignature for your Mo Rd 109nr Kansas City 2018 online

How to generate an electronic signature for your Mo Rd 109nr Kansas City 2018 in Google Chrome

How to create an electronic signature for signing the Mo Rd 109nr Kansas City 2018 in Gmail

How to create an electronic signature for the Mo Rd 109nr Kansas City 2018 straight from your mobile device

How to create an eSignature for the Mo Rd 109nr Kansas City 2018 on iOS devices

How to generate an eSignature for the Mo Rd 109nr Kansas City 2018 on Android devices

People also ask

-

What is the best way to manage wage nonresident documentation?

To effectively manage wage nonresident documentation, utilizing airSlate SignNow's eSigning features allows for quick and secure document processing. This ensures compliance and maintains a clear audit trail, which is critical for wage nonresident regulations. With templates and easy integrations, airSlate SignNow simplifies document management.

-

How does airSlate SignNow support wage nonresident payroll processing?

airSlate SignNow enhances wage nonresident payroll processing by providing a seamless platform for document eSigning and tracking. By digitizing forms and contracts needed for wage nonresident transactions, businesses can expedite payroll cycles and minimize errors. This ensures accuracy and efficiency in your payment processes.

-

What pricing options are available for services related to wage nonresident?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including features specifically designed for wage nonresident transactions. You can choose from a free trial to premium plans that include advanced features such as automated workflows. This ensures you get the best value for managing your wage nonresident documentation.

-

Can airSlate SignNow integrate with payroll systems for wage nonresident?

Yes, airSlate SignNow integrates seamlessly with various payroll systems, which is essential for handling wage nonresident transactions. These integrations allow for smooth data sharing and processing between platforms. This functionality helps streamline workflows and ensures that all wage nonresident documents are correctly aligned with payroll practices.

-

What features does airSlate SignNow offer to assist with wage nonresident compliance?

airSlate SignNow offers robust features that assist with wage nonresident compliance, including customizable templates and real-time tracking. These tools enable businesses to maintain compliance with tax regulations and documentation requirements. Additionally, the platform's security features protect sensitive information related to wage nonresident transactions.

-

How can airSlate SignNow help in reducing turnaround times for wage nonresident approvals?

airSlate SignNow signNowly reduces turnaround times for wage nonresident approvals through its fast and intuitive eSigning process. With features like electronic notifications and reminders, you can expedite document reviews and approvals. This efficiency helps you comply with payment schedules for wage nonresident transactions without unnecessary delays.

-

Is airSlate SignNow suitable for small businesses dealing with wage nonresident issues?

Absolutely, airSlate SignNow is designed to be user-friendly and affordable, making it ideal for small businesses facing wage nonresident issues. The platform's cost-effective solutions help small enterprises streamline their document processes without signNow investment. This empowers them to manage wage nonresident documentation effectively.

Get more for Kansas City Mo Rd 109nr Form

Find out other Kansas City Mo Rd 109nr Form

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template