City Tax Forms KCMO Gov City of Kansas City, MO 2022-2026

Understanding the Kansas City Earnings Tax Form

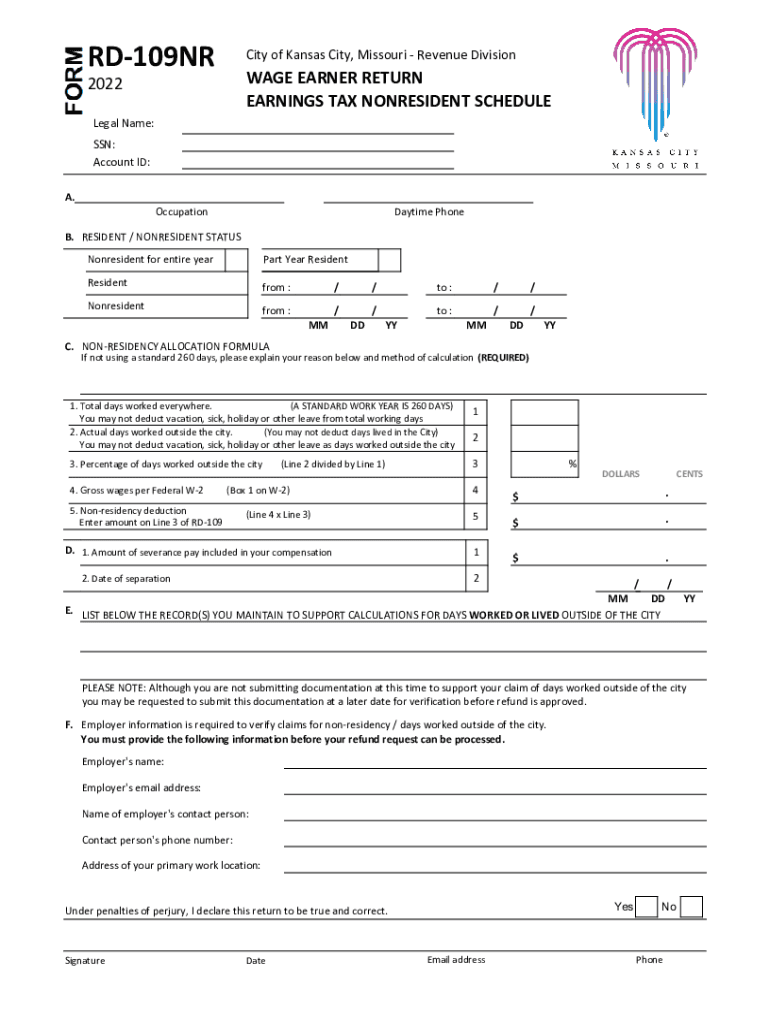

The Kansas City earnings tax form, commonly referred to as the RD 109, is essential for individuals and businesses operating within the city limits of Kansas City, Missouri. This form is specifically designed to report earnings for tax purposes and is applicable to both residents and non-residents earning income in the city. Understanding the nuances of this form is crucial for compliance with local tax regulations.

Steps to Complete the Kansas City RD 109 Form

Completing the Kansas City RD 109 form involves several key steps to ensure accuracy and compliance. Below are the fundamental steps:

- Gather necessary documentation, including W-2s and 1099s.

- Determine your residency status to identify if you need to file as a resident or non-resident.

- Fill out the form accurately, providing all required personal and financial information.

- Calculate your earnings and any applicable deductions or credits.

- Review the completed form for accuracy before submission.

Legal Use of the Kansas City RD 109 Form

The Kansas City RD 109 form must be filled out and submitted in accordance with local tax laws to be considered legally valid. Electronic signatures on the form are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing a trusted electronic signature solution ensures that your submission is secure and legally binding.

Filing Deadlines for the Kansas City RD 109 Form

Timely filing of the Kansas City RD 109 form is crucial to avoid penalties. The typical deadline for submission is April fifteenth of each year for the previous tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check for any updates or changes to filing deadlines annually.

Required Documents for the Kansas City RD 109 Form

To complete the Kansas City RD 109 form accurately, certain documents are necessary. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Proof of residency, if applicable.

- Any additional documentation supporting deductions or credits claimed.

Penalties for Non-Compliance with the Kansas City Earnings Tax

Failure to file the Kansas City RD 109 form or inaccuracies in reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete city tax forms kcmogov city of kansas city mo

Effortlessly prepare City Tax Forms KCMO gov City Of Kansas City, MO on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, enabling you to find the correct form and securely store it online. airSlate SignNow supplies all the necessary tools to create, modify, and eSign your documents promptly without any delays. Handle City Tax Forms KCMO gov City Of Kansas City, MO on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The easiest way to adjust and eSign City Tax Forms KCMO gov City Of Kansas City, MO without hassle

- Find City Tax Forms KCMO gov City Of Kansas City, MO and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Craft your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside the worry of lost or mislaid documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign City Tax Forms KCMO gov City Of Kansas City, MO and ensure excellent communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city tax forms kcmogov city of kansas city mo

Create this form in 5 minutes!

How to create an eSignature for the city tax forms kcmogov city of kansas city mo

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form rd 109 and how can it be used?

Form rd 109 is a document template that allows users to collect necessary information efficiently. With airSlate SignNow, you can easily fill out, sign, and send form rd 109, streamlining your workflow and ensuring compliance.

-

How does airSlate SignNow simplify the process of completing form rd 109?

AirSlate SignNow offers an intuitive interface that allows users to quickly complete form rd 109. Features like pre-filled fields, e-signatures, and automatic reminders help reduce turnaround time and minimize errors.

-

What are the pricing options available for using form rd 109 with airSlate SignNow?

AirSlate SignNow offers a variety of pricing plans to suit different business needs. Each plan provides access to features that can help you work with form rd 109, including e-signatures, cloud storage, and integration capabilities.

-

Can I integrate form rd 109 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows users to integrate form rd 109 with various applications such as CRM systems and cloud storage services. This integration ensures that your data flows seamlessly across different platforms, making document management more efficient.

-

What benefits does airSlate SignNow offer when using form rd 109?

Using form rd 109 with airSlate SignNow enhances your document workflow by providing fast e-signature capabilities, secure storage, and the ability to track document status. This improves communication and increases productivity within your organization.

-

Is form rd 109 compliant with legal standards?

Yes, form rd 109 processed through airSlate SignNow meets legal e-signature standards, ensuring that all signed documents are legally binding. This compliance helps safeguard your business and reduces the risk associated with digital document signing.

-

How can I customize form rd 109 in airSlate SignNow?

AirSlate SignNow provides customizable templates that allow you to tailor form rd 109 to your specific needs. You can add branding, modify fields, and set permissions for better control over how the form is completed and signed.

Get more for City Tax Forms KCMO gov City Of Kansas City, MO

Find out other City Tax Forms KCMO gov City Of Kansas City, MO

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed