84901 Form 2011

What is the 84901 Form

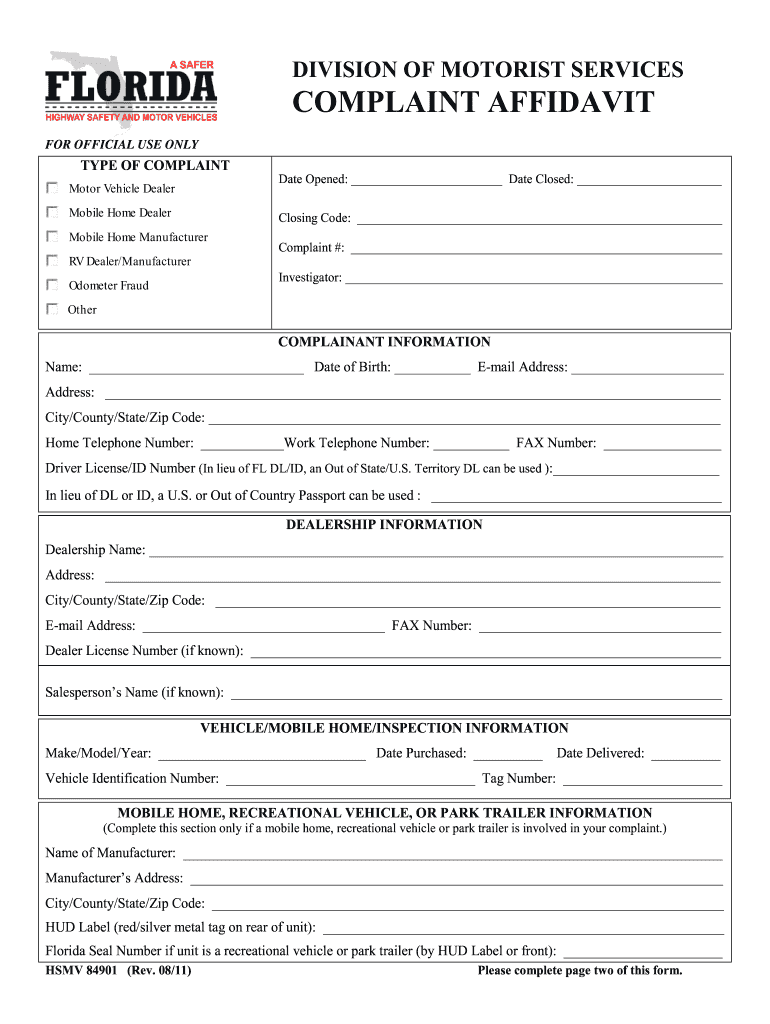

The 84901 Form is a specific document used primarily for tax purposes in the United States. This form serves as a declaration for certain financial transactions and is essential for ensuring compliance with federal tax regulations. It is important for individuals and businesses to understand the purpose of this form to avoid any potential legal issues related to tax filings.

How to use the 84901 Form

Using the 84901 Form involves several key steps. First, individuals or businesses must gather all necessary information required to complete the form accurately. This includes financial data relevant to the transactions being reported. Once the information is collected, users can fill out the form either digitally or on paper. After completing the form, it must be submitted to the appropriate tax authority, ensuring that all deadlines are met to avoid penalties.

Steps to complete the 84901 Form

Completing the 84901 Form involves a systematic approach:

- Gather necessary documentation: Collect all relevant financial records and information.

- Fill out the form: Enter the required information accurately, ensuring all fields are completed.

- Review the form: Check for any errors or omissions that could lead to complications.

- Submit the form: Send the completed form to the appropriate tax agency by the specified deadline.

Legal use of the 84901 Form

The legal use of the 84901 Form is critical for maintaining compliance with tax laws. When filled out correctly and submitted on time, this form can help individuals and businesses avoid legal repercussions. It is essential to understand the regulations governing this form, including any specific requirements set by the IRS, to ensure that it is used appropriately.

Form Submission Methods

The 84901 Form can be submitted through various methods, allowing flexibility for users. Common submission methods include:

- Online submission: Many users prefer to submit the form electronically for efficiency.

- Mail: The form can be printed and mailed to the appropriate tax authority.

- In-person submission: Some individuals may choose to deliver the form directly to a local tax office.

Filing Deadlines / Important Dates

Filing deadlines for the 84901 Form are crucial to avoid penalties. Typically, these deadlines align with the annual tax filing season. It is important for users to be aware of specific dates related to their circumstances, such as extensions or special provisions that may apply. Keeping track of these deadlines ensures timely compliance with tax obligations.

Quick guide on how to complete 84901 2011 form

Effortlessly Prepare 84901 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and store it safely online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Manage 84901 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 84901 Form with ease

- Obtain 84901 Form and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you'd like to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 84901 Form while ensuring excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 84901 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 84901 2011 form

How to make an eSignature for the 84901 2011 Form online

How to create an electronic signature for the 84901 2011 Form in Chrome

How to make an eSignature for signing the 84901 2011 Form in Gmail

How to create an electronic signature for the 84901 2011 Form right from your smartphone

How to make an electronic signature for the 84901 2011 Form on iOS devices

How to create an electronic signature for the 84901 2011 Form on Android OS

People also ask

-

What is the 84901 Form and how does airSlate SignNow help with it?

The 84901 Form is a specific document that can greatly benefit from electronic signatures. With airSlate SignNow, businesses can easily send, sign, and manage their 84901 Forms in a seamless, digital workflow. Our platform simplifies the signing process, making it faster and more efficient.

-

How much does it cost to use airSlate SignNow for the 84901 Form?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including those specifically for managing the 84901 Form. You can choose from monthly or annual subscriptions, all offering unlimited document signing capabilities. Our cost-effective solution ensures you get the best value for managing your 84901 Form efficiently.

-

Can I integrate airSlate SignNow with other applications for the 84901 Form?

Yes, airSlate SignNow allows for seamless integration with various applications to enhance your workflow for the 84901 Form. Whether you're using CRM systems or cloud storage services, our platform can connect with many popular tools, streamlining your document management process.

-

What are the security features of airSlate SignNow for handling the 84901 Form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the 84901 Form. Our platform uses industry-standard encryption, complies with GDPR and HIPAA regulations, and provides audit trails to ensure that every signature and document is secure and verifiable.

-

How can airSlate SignNow improve the efficiency of processing the 84901 Form?

airSlate SignNow signNowly enhances the efficiency of processing the 84901 Form by automating the entire signing process. With features like templates, bulk sending, and reminders, businesses can reduce turnaround times and eliminate manual errors. This results in a smoother workflow and faster completion of essential documents.

-

Is it easy to use airSlate SignNow for the 84901 Form?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to send and eSign the 84901 Form. Our intuitive interface requires no technical expertise, ensuring that users can navigate the platform effortlessly and complete their tasks quickly.

-

What types of businesses can benefit from using airSlate SignNow for the 84901 Form?

Any business that requires the use of the 84901 Form can benefit from airSlate SignNow, including small businesses, enterprises, and non-profits. Our versatile platform caters to various industries, helping organizations streamline their document processes and improve overall efficiency.

Get more for 84901 Form

- Georgia claim of lien sect44 14 3611 individual form

- Oregon notice of nonresponsibility individual form

- District of columbia bill of sale for automobile or vehicle including odometer statement and promissory note form

- California prenuptial premarital agreement with financial statements form

- Blank release paid in full form

- Life estate deed form

- California assumption agreement of deed of trust and release of original mortgagors form

- Az bill of sale form

Find out other 84901 Form

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney