Exemption Conveyance Fee Form 2014-2026

What is the Exemption Conveyance Fee Form

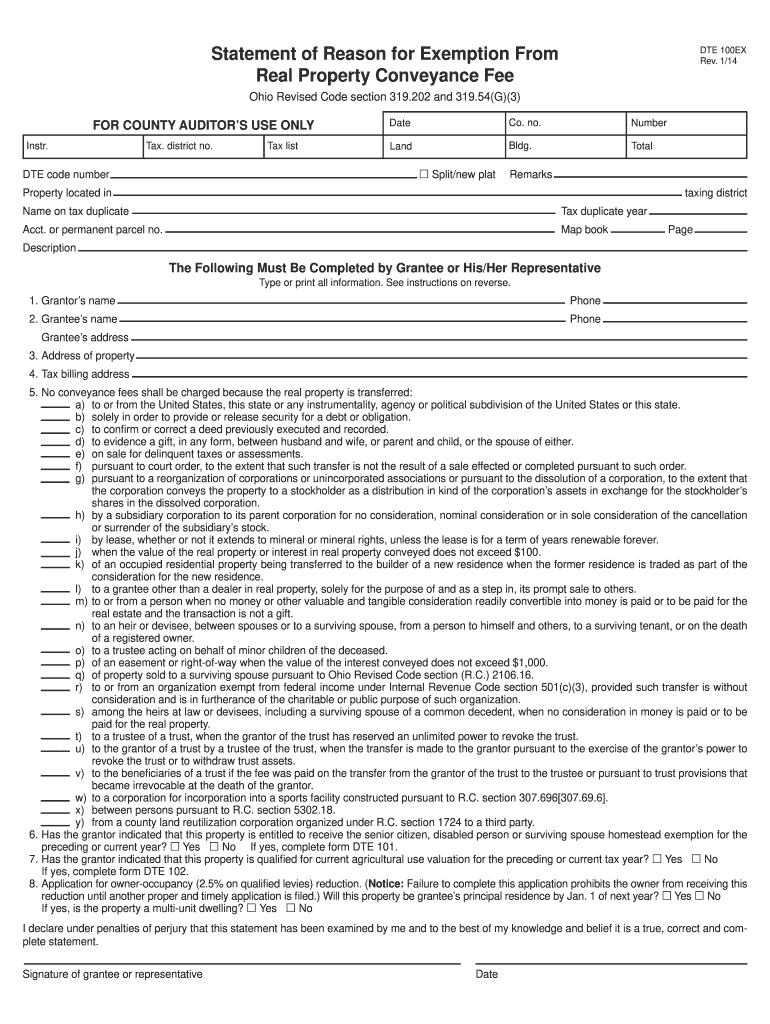

The Exemption Conveyance Fee Form is a document used in real estate transactions to exempt certain transfers from the conveyance fee typically imposed by state or local governments. This form is essential for property owners who qualify for exemptions, allowing them to avoid unnecessary fees during property transfers. Understanding the specific criteria for exemption is crucial, as it varies by jurisdiction and may involve specific conditions that must be met. The form typically requires details about the property, the parties involved, and the reason for the exemption.

How to use the Exemption Conveyance Fee Form

Using the Exemption Conveyance Fee Form involves several key steps to ensure compliance and proper submission. First, gather all necessary information regarding the property and the parties involved in the transaction. Next, accurately complete the form, ensuring that all required fields are filled out. It is important to provide clear and truthful information to avoid delays or issues with processing. Once completed, the form should be submitted as per the local jurisdiction's guidelines, which may include electronic submission, mailing, or in-person delivery.

Steps to complete the Exemption Conveyance Fee Form

Completing the Exemption Conveyance Fee Form requires careful attention to detail. Follow these steps:

- Identify the correct form version for your state or locality.

- Provide the property details, including address and parcel number.

- List the names and contact information of all parties involved in the transaction.

- Clearly state the reason for the exemption, referencing applicable laws or regulations.

- Sign and date the form, ensuring that all signatures are obtained from relevant parties.

- Review the completed form for accuracy before submission.

Legal use of the Exemption Conveyance Fee Form

The legal use of the Exemption Conveyance Fee Form is governed by state and local laws. It is essential to ensure that the form is filled out correctly and submitted within the required timeframes to maintain its validity. Failure to adhere to legal guidelines can result in penalties or the denial of the exemption. Additionally, the form must be accompanied by any supporting documentation as required by local authorities, which may include proof of eligibility for the exemption.

State-specific rules for the Exemption Conveyance Fee Form

State-specific rules for the Exemption Conveyance Fee Form can vary significantly. Each state has its own regulations regarding exemptions, including the types of transactions that qualify and the necessary documentation. It is important to consult the local real estate authority or legal counsel to understand the specific requirements in your state. This ensures that all criteria are met and that the form is completed in accordance with local laws.

Required Documents

When submitting the Exemption Conveyance Fee Form, certain documents may be required to support the exemption claim. Commonly required documents include:

- Proof of ownership, such as a deed or title.

- Identification for all parties involved in the transaction.

- Any relevant legal documents that substantiate the exemption claim.

- Previous tax statements or assessments related to the property.

Form Submission Methods

The Exemption Conveyance Fee Form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local government’s website.

- Mailing the completed form to the appropriate office.

- In-person delivery to the local real estate or tax authority.

It is advisable to confirm the preferred submission method with local authorities to ensure compliance and timely processing.

Quick guide on how to complete exemption conveyance fee 2014 form

Complete Exemption Conveyance Fee Form effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without any holdups. Handle Exemption Conveyance Fee Form on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and eSign Exemption Conveyance Fee Form with ease

- Locate Exemption Conveyance Fee Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Exemption Conveyance Fee Form and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exemption conveyance fee 2014 form

How to create an eSignature for your Exemption Conveyance Fee 2014 Form online

How to create an eSignature for your Exemption Conveyance Fee 2014 Form in Google Chrome

How to generate an eSignature for putting it on the Exemption Conveyance Fee 2014 Form in Gmail

How to make an eSignature for the Exemption Conveyance Fee 2014 Form straight from your smart phone

How to create an eSignature for the Exemption Conveyance Fee 2014 Form on iOS devices

How to create an electronic signature for the Exemption Conveyance Fee 2014 Form on Android devices

People also ask

-

What is the Exemption Conveyance Fee Form?

The Exemption Conveyance Fee Form is a document used to claim exemptions from certain conveyance fees associated with property transfers. This form helps individuals and businesses streamline their transaction processes by providing the necessary exemptions as legally required.

-

How can I fill out the Exemption Conveyance Fee Form using airSlate SignNow?

Filling out the Exemption Conveyance Fee Form using airSlate SignNow is straightforward. Our platform allows you to upload the form, add the required information, and electronically sign it, ensuring a quick and seamless process for you and your counterparties.

-

Are there any costs associated with using airSlate SignNow for the Exemption Conveyance Fee Form?

airSlate SignNow offers various pricing plans to fit different business needs, which include the creation and eSigning of documents like the Exemption Conveyance Fee Form. We provide a cost-effective solution with scalable options to accommodate growing businesses.

-

What are the benefits of using airSlate SignNow for handling the Exemption Conveyance Fee Form?

Using airSlate SignNow to manage the Exemption Conveyance Fee Form allows for increased efficiency and reduced paper clutter. With our easy-to-use platform, you can track the status of your documents in real-time and maintain secure storage for future reference.

-

Can I integrate airSlate SignNow with other software for the Exemption Conveyance Fee Form?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your workflow when dealing with the Exemption Conveyance Fee Form. You can connect with CRMs, document management systems, and other business tools to streamline your document processes.

-

Is it possible to send the Exemption Conveyance Fee Form to multiple signers?

Absolutely! airSlate SignNow allows you to send the Exemption Conveyance Fee Form to multiple signers easily. You can specify the signing order and keep track of who has completed their part, ensuring a smooth transaction process.

-

How does airSlate SignNow ensure the security of the Exemption Conveyance Fee Form?

airSlate SignNow prioritizes the security of your documents, including the Exemption Conveyance Fee Form. We employ industry-standard encryption and secure access protocols to protect your sensitive information and ensure your documents are safe during the signing process.

Get more for Exemption Conveyance Fee Form

- Ag990 form

- Form co 1

- Zach symons amda form

- Difference calculus finite difference form

- Orange county ca fillable small claims forms

- Form adopted for mandatory use judicial council of california fl 110 rev july 12009

- Dissolution legal separation or nullity superior court riverside riverside courts ca form

- Nys certified mwbes contact list new york state office of form

Find out other Exemption Conveyance Fee Form

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed