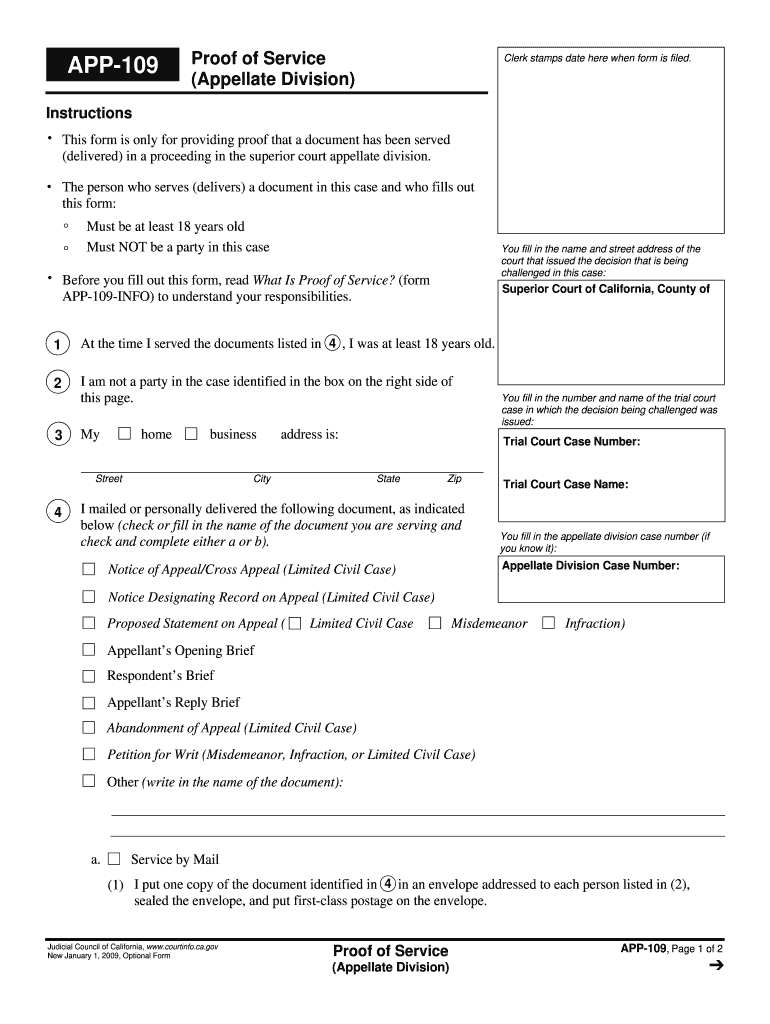

Form App 109 2009

What is the Form App 109

The Form App 109 is a crucial document used primarily for reporting various types of income and transactions to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately report income received throughout the tax year. This form is often utilized by employers, financial institutions, and other entities to provide necessary information about payments made to individuals or organizations. Understanding the purpose and requirements of the Form App 109 is vital for compliance with U.S. tax laws.

How to use the Form App 109

Using the Form App 109 involves several steps to ensure accurate reporting. First, gather all relevant information, including the recipient's name, address, and taxpayer identification number. Next, determine the type of income being reported, as different variants of the Form App 109 cater to various income types, such as interest, dividends, or non-employee compensation. After filling out the form with precise details, it is essential to submit it to the IRS and provide a copy to the recipient by the specified deadlines.

Steps to complete the Form App 109

Completing the Form App 109 requires attention to detail. Start by selecting the correct variant of the form based on the type of income. Fill in the payer's information, including name, address, and taxpayer identification number. Next, input the recipient's details accurately. Specify the amount of income paid and any federal income tax withheld, if applicable. Review the form for accuracy before submitting it to ensure compliance with IRS regulations.

Legal use of the Form App 109

The legal use of the Form App 109 is governed by IRS guidelines, which mandate accurate reporting of income to avoid penalties. This form must be filed by the payer by the deadline to ensure that the income is reported correctly to the IRS. Failure to file or inaccuracies can lead to penalties for both the payer and the recipient. It is crucial to maintain compliance with all applicable regulations to uphold the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form App 109 vary depending on the specific type of income reported. Generally, the form must be submitted to the IRS by the end of January for the previous tax year. Recipients should also receive their copies by this date. It is important to keep track of these deadlines to avoid late filing penalties and ensure that all income is reported in a timely manner.

Required Documents

When preparing to complete the Form App 109, several documents are required to ensure accuracy. These include the payer's and recipient's taxpayer identification numbers, payment records, and any relevant financial statements. Having these documents on hand will facilitate the completion of the form and help ensure compliance with IRS requirements.

Examples of using the Form App 109

Examples of using the Form App 109 include situations where businesses report non-employee compensation to freelancers or contractors. Financial institutions may use the form to report interest payments made to account holders. Additionally, it can be used to report dividends paid to shareholders. Each scenario highlights the importance of accurate reporting to maintain compliance with tax regulations.

Quick guide on how to complete form app 109 2009

Effortlessly prepare Form App 109 on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without any hold-ups. Manage Form App 109 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign Form App 109 with ease

- Find Form App 109 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select how you wish to share your form, whether through email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Edit and eSign Form App 109 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form app 109 2009

Create this form in 5 minutes!

How to create an eSignature for the form app 109 2009

How to generate an electronic signature for the Form App 109 2009 in the online mode

How to generate an eSignature for your Form App 109 2009 in Google Chrome

How to make an electronic signature for putting it on the Form App 109 2009 in Gmail

How to generate an electronic signature for the Form App 109 2009 straight from your smart phone

How to make an electronic signature for the Form App 109 2009 on iOS devices

How to generate an electronic signature for the Form App 109 2009 on Android devices

People also ask

-

What is the Form App 109 and how does it work?

The Form App 109 is a powerful tool offered by airSlate SignNow that allows users to create, send, and eSign IRS Form 109 documents digitally. This app streamlines the process, enabling businesses to manage their tax documents efficiently and securely. With its user-friendly interface, the Form App 109 simplifies compliance and ensures that all necessary information is accurately captured.

-

Is the Form App 109 easy to use for beginners?

Yes, the Form App 109 is designed with simplicity in mind, making it accessible for users of all skill levels. Its intuitive layout guides users through the process of filling out and signing documents without any prior experience needed. Whether you're a small business owner or an individual, the Form App 109 makes eSigning easy and hassle-free.

-

What are the pricing options for the Form App 109?

airSlate SignNow offers competitive pricing plans for the Form App 109, ensuring that businesses of all sizes can find a suitable option. Plans typically include a range of features, from basic eSignature capabilities to advanced document management tools. Additionally, you can try the Form App 109 with a free trial to see how it fits your needs before committing.

-

Can I integrate the Form App 109 with other software?

Absolutely! The Form App 109 integrates seamlessly with various third-party applications, enhancing your workflow and increasing productivity. Whether you're using CRM systems, cloud storage solutions, or productivity tools, the Form App 109 can connect with your existing software to streamline document management.

-

What are the benefits of using the Form App 109 for businesses?

Using the Form App 109 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive documents. By digitizing the signing process, businesses can save time and resources, ensuring that they remain compliant with tax regulations. The Form App 109 also allows for easy tracking and management of documents.

-

Is the Form App 109 secure for handling sensitive information?

Yes, the Form App 109 prioritizes security, employing industry-standard encryption and compliance measures to protect sensitive information. airSlate SignNow is designed to keep your data safe while ensuring that your documents are easily accessible. You can trust the Form App 109 to handle your tax documents securely.

-

How can I get started with the Form App 109?

Getting started with the Form App 109 is simple! Just sign up for an airSlate SignNow account, and you can access the Form App 109 and its features immediately. The platform provides helpful tutorials and customer support to assist you in navigating the app and making the most of its capabilities.

Get more for Form App 109

Find out other Form App 109

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe