G 1450 Form 2017

What is the G 1450 Form

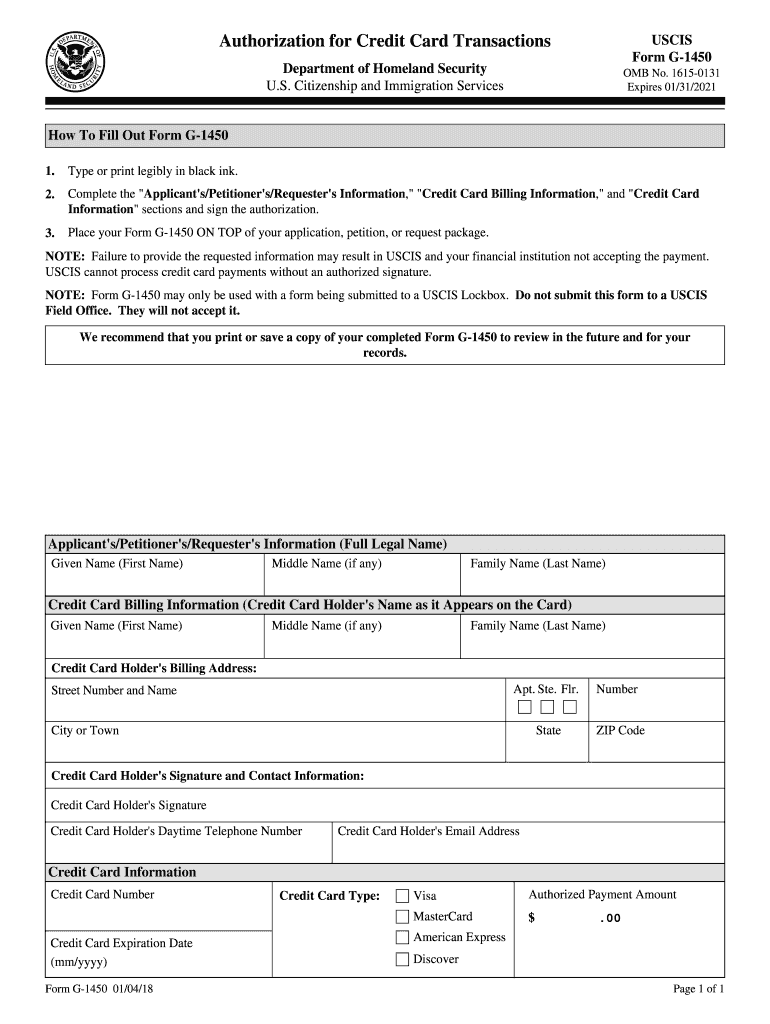

The G 1450 Form is a document issued by the Internal Revenue Service (IRS) that allows taxpayers to request a credit card payment for tax liabilities. This form is particularly useful for individuals and businesses looking to settle their tax obligations using a credit or debit card. It streamlines the payment process and provides a convenient alternative to traditional payment methods such as checks or electronic funds transfers.

How to use the G 1450 Form

To use the G 1450 Form, taxpayers must complete the document by providing essential information such as their name, address, and tax identification number. Additionally, the form requires details about the payment amount and the credit card information. After filling out the form, it should be submitted along with the tax return or payment. This ensures that the IRS processes the payment correctly and efficiently.

Steps to complete the G 1450 Form

Completing the G 1450 Form involves several straightforward steps:

- Begin by entering your personal information, including your name and address.

- Provide your taxpayer identification number, which is typically your Social Security number or Employer Identification Number.

- Indicate the amount you wish to pay using your credit or debit card.

- Fill in your credit card details, including the card number, expiration date, and security code.

- Sign and date the form to authorize the payment.

Legal use of the G 1450 Form

The G 1450 Form is legally recognized as a valid method for making tax payments to the IRS. When completed correctly, it serves as an official authorization for the IRS to charge the specified amount to the taxpayer's credit card. Compliance with the IRS guidelines ensures that the payment is processed without issues, helping taxpayers avoid penalties associated with late payments.

Form Submission Methods (Online / Mail / In-Person)

The G 1450 Form can be submitted through various methods, depending on the taxpayer's preference. Options include:

- Online: Submit the form electronically through the IRS e-file system, which is often the quickest method.

- Mail: Send the completed form along with your tax return to the designated IRS address.

- In-Person: Deliver the form directly to an IRS office if you prefer face-to-face interaction.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the G 1450 Form. Typically, payments should be made by the tax return due date to avoid penalties. For most individual taxpayers, this date falls on April 15. However, those with extensions may have until October 15 to file their returns, but payments made after April 15 may incur interest and penalties.

Quick guide on how to complete g 1450 2017 form

Complete G 1450 Form effortlessly on any device

Digital document management has become increasingly popular with companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, edit, and eSign your documents swiftly without delays. Manage G 1450 Form across any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign G 1450 Form without effort

- Locate G 1450 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign G 1450 Form and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct g 1450 2017 form

Create this form in 5 minutes!

How to create an eSignature for the g 1450 2017 form

How to make an eSignature for your G 1450 2017 Form in the online mode

How to create an eSignature for your G 1450 2017 Form in Chrome

How to create an electronic signature for putting it on the G 1450 2017 Form in Gmail

How to generate an electronic signature for the G 1450 2017 Form right from your smart phone

How to generate an electronic signature for the G 1450 2017 Form on iOS

How to generate an electronic signature for the G 1450 2017 Form on Android

People also ask

-

What is the G 1450 Form and how is it used?

The G 1450 Form is a payment form used by individuals to authorize credit card transactions for immigration services. This form simplifies the payment process, ensuring that fees are paid promptly and securely. With airSlate SignNow, you can easily fill out and eSign the G 1450 Form, streamlining your application process.

-

How does airSlate SignNow help with the G 1450 Form?

airSlate SignNow provides a user-friendly platform to easily manage the G 1450 Form. Users can fill out, sign, and send this form securely online, eliminating the need for paper-based transactions. Additionally, our platform ensures compliance and security for all your document needs.

-

Is there a cost associated with using the G 1450 Form on airSlate SignNow?

Using airSlate SignNow to handle the G 1450 Form is cost-effective and offers various pricing plans to cater to different business needs. While there may be a subscription fee, the efficiency gains and time savings can signNowly reduce overall costs. Explore our pricing options to find the best fit for your organization.

-

Can I integrate the G 1450 Form with other applications?

Yes, airSlate SignNow allows for seamless integration with various applications, enhancing your workflow. You can easily connect your existing systems with the G 1450 Form, ensuring that your payment processes are efficient and well-coordinated. Check our integration options for more details.

-

What are the benefits of using airSlate SignNow for the G 1450 Form?

Using airSlate SignNow for the G 1450 Form offers many benefits, including improved efficiency, enhanced security, and ease of use. Our platform allows for quick eSigning and document management, which can signNowly speed up your transactions. Additionally, you can store and access your forms securely in the cloud.

-

Is it safe to eSign the G 1450 Form with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures to protect your information when eSigning the G 1450 Form. Our platform includes encryption and compliance with legal standards, ensuring that your documents remain secure throughout the signing process.

-

How can I track the status of my G 1450 Form submission?

With airSlate SignNow, you can easily track the status of your G 1450 Form submission in real-time. Our platform provides updates and notifications, so you know exactly when your form has been signed and submitted. This feature enhances transparency and helps you manage your application process effectively.

Get more for G 1450 Form

Find out other G 1450 Form

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF