Cbp 3461 Form 2015

What is the Cbp 3461 Form

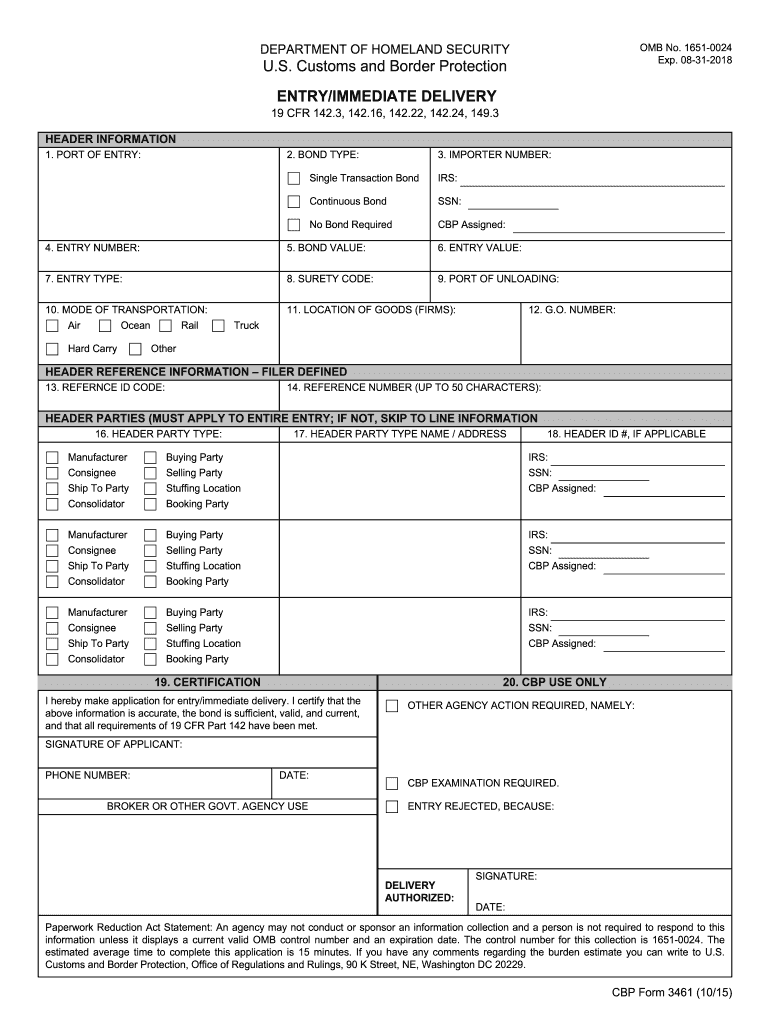

The Cbp 3461 Form, also known as the Entry Summary, is a crucial document used in the customs clearance process for goods entering the United States. This form is required by U.S. Customs and Border Protection (CBP) and serves to provide necessary information about the imported merchandise. It includes details such as the description of the goods, their value, and the country of origin. The Cbp 3461 Form is essential for ensuring compliance with U.S. trade regulations and for the assessment of duties and taxes on imported items.

How to use the Cbp 3461 Form

To effectively use the Cbp 3461 Form, importers must complete it accurately before their goods arrive at a U.S. port. The form can be submitted electronically or in paper format, depending on the importer's preference and the specific requirements of the CBP. Importers should ensure that all required fields are filled out, including the importer of record, consignee information, and details regarding the shipment. Proper use of the form helps facilitate a smooth customs clearance process and avoids potential delays.

Steps to complete the Cbp 3461 Form

Completing the Cbp 3461 Form involves several key steps:

- Gather Required Information: Collect all necessary details about the shipment, including the description of goods, Harmonized Tariff Schedule (HTS) codes, and the value of the merchandise.

- Fill Out the Form: Enter the required information into the Cbp 3461 Form, ensuring accuracy to prevent customs delays.

- Review for Completeness: Double-check all entries for accuracy and completeness, including signatures where necessary.

- Submit the Form: Send the completed form to CBP electronically or by mail, following the guidelines provided by the agency.

Legal use of the Cbp 3461 Form

The Cbp 3461 Form is legally binding and must be filled out in accordance with U.S. customs laws. Incorrect or incomplete information may lead to penalties or delays in the release of goods. Importers are responsible for ensuring that the information provided is truthful and accurate, as discrepancies can result in legal consequences, including fines or seizure of goods. Compliance with the regulations surrounding the Cbp 3461 Form is essential for lawful importation.

Key elements of the Cbp 3461 Form

Several key elements must be included in the Cbp 3461 Form to ensure its validity:

- Importer of Record: The individual or business responsible for the importation of goods.

- Consignee Information: Details about the party receiving the goods.

- Description of Goods: A detailed account of the items being imported, including quantity and value.

- HTS Codes: The appropriate Harmonized Tariff Schedule codes that classify the goods for duty assessment.

Form Submission Methods

The Cbp 3461 Form can be submitted through various methods, allowing flexibility for importers. Options include:

- Electronic Submission: Many importers choose to submit the form electronically through the Automated Commercial Environment (ACE), which streamlines the process and enhances tracking.

- Paper Submission: For those preferring traditional methods, the form can be completed and mailed to the appropriate CBP office. However, this method may result in longer processing times.

Quick guide on how to complete cbp 3461 2015 form

Execute Cbp 3461 Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents swiftly without delays. Manage Cbp 3461 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

The easiest way to edit and electronically sign Cbp 3461 Form effortlessly

- Find Cbp 3461 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize the relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Cbp 3461 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cbp 3461 2015 form

Create this form in 5 minutes!

How to create an eSignature for the cbp 3461 2015 form

How to create an electronic signature for the Cbp 3461 2015 Form in the online mode

How to make an electronic signature for your Cbp 3461 2015 Form in Google Chrome

How to make an eSignature for signing the Cbp 3461 2015 Form in Gmail

How to create an electronic signature for the Cbp 3461 2015 Form from your smart phone

How to create an electronic signature for the Cbp 3461 2015 Form on iOS

How to make an eSignature for the Cbp 3461 2015 Form on Android

People also ask

-

What is the Cbp 3461 Form?

The Cbp 3461 Form is a customs entry form used by importers to declare their goods entering the United States. It provides essential information to the U.S. Customs and Border Protection (CBP) regarding the shipped items, allowing for the proper assessment of duties and compliance with import regulations.

-

How can airSlate SignNow help with the Cbp 3461 Form?

airSlate SignNow simplifies the process of completing and submitting the Cbp 3461 Form by allowing users to fill out, sign, and send documents electronically. With its user-friendly interface, businesses can streamline their customs documentation process, helping to ensure compliance and expedite shipments.

-

Is there a cost associated with using airSlate SignNow for the Cbp 3461 Form?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for businesses needing to manage the Cbp 3461 Form. Depending on your needs, you can choose a plan that best fits your volume of document processing while keeping costs manageable.

-

Can I store the Cbp 3461 Form securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for all your documents, including the Cbp 3461 Form. This ensures that your sensitive information remains protected and easily accessible whenever you need to retrieve it for customs or business purposes.

-

Does airSlate SignNow integrate with other software for managing the Cbp 3461 Form?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for handling the Cbp 3461 Form. You can connect tools like CRMs and project management systems to automate processes and save time.

-

What features does airSlate SignNow offer for the Cbp 3461 Form?

airSlate SignNow boasts features such as electronic signatures, document templates, and customizable workflows that can be particularly useful for the Cbp 3461 Form. These tools help ensure that your customs documentation is completed accurately and efficiently.

-

Who can benefit from using airSlate SignNow for the Cbp 3461 Form?

Importers, freight forwarders, and customs brokers can greatly benefit from using airSlate SignNow for the Cbp 3461 Form. By utilizing our eSigning and document management solutions, organizations can enhance compliance and reduce delays in their import processes.

Get more for Cbp 3461 Form

- Fedloan servicing fax number form

- Affidavit blank form

- Alaska notice quit form

- Dc tenant complaint form

- Standard rental application form

- New york city rental assistance fund application pdf form

- Fidelis careprior authorization request form prior authorization request form

- Packet 13a temporary orders form

Find out other Cbp 3461 Form

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple