E 595CF Application for Conditional Farmer Exemption Certificate Number for Qualified Purchases Web 6 14 Office Use North Caroli 2014

Understanding the E-595CF Application for Conditional Farmer Exemption Certificate

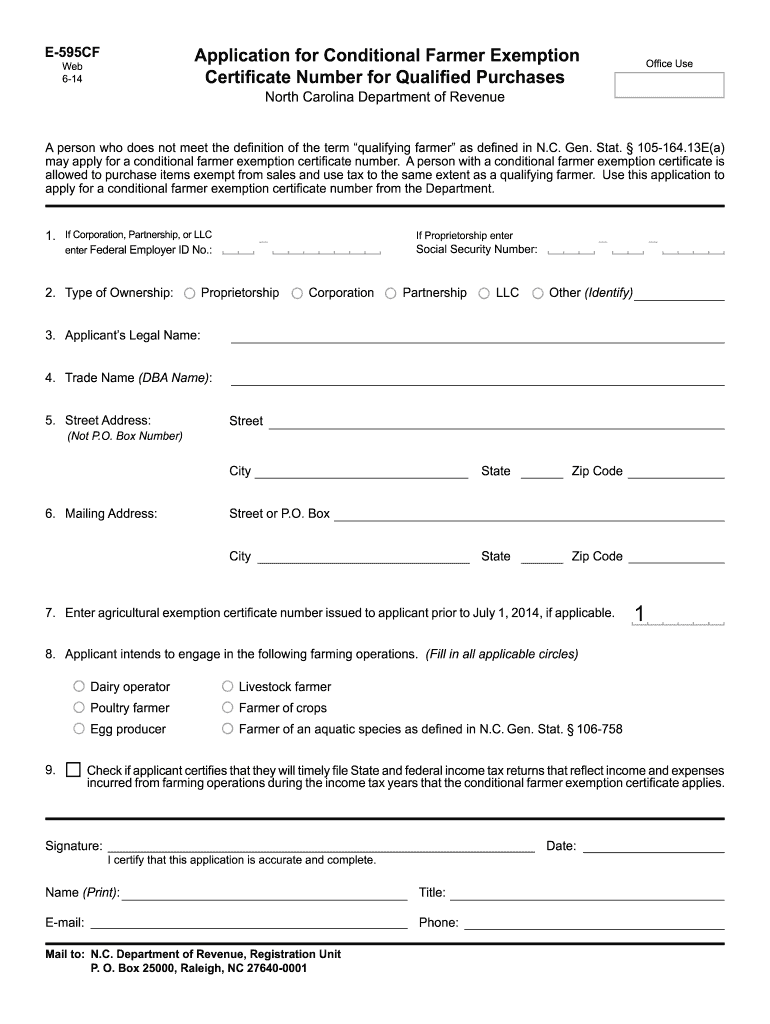

The E-595CF application is a crucial document for farmers in the United States seeking a conditional exemption from sales tax on qualified purchases. This certificate allows eligible farmers to buy certain items without paying sales tax, provided they meet specific criteria outlined by state regulations. The application form is designed to streamline the process of obtaining this exemption, ensuring that farmers can efficiently manage their expenses while complying with tax laws.

Steps to Complete the E-595CF Application

Completing the E-595CF application involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, tax identification number, and the specific items for which you are seeking exemption. Next, fill out the application form carefully, ensuring that all sections are completed. After filling out the form, review it for any errors before submission. Finally, submit the application to the appropriate state department, either electronically or via mail, depending on your state’s requirements.

Legal Use of the E-595CF Application

The E-595CF application is legally binding when completed correctly, allowing farmers to purchase qualifying items without incurring sales tax. To ensure its legal validity, the form must be signed and dated by the applicant. Additionally, it is essential to retain copies of the completed application and any supporting documentation for record-keeping and potential audits. Compliance with state regulations is crucial, as misuse of the exemption can lead to penalties.

Eligibility Criteria for the E-595CF Application

To qualify for the E-595CF application, applicants must meet specific eligibility criteria set by their state. Generally, the applicant must be an active farmer engaged in agricultural production. The items purchased under this exemption must be directly related to farming activities. It is important to review your state’s guidelines to ensure that you meet all requirements before applying, as each state may have unique stipulations regarding eligibility.

Required Documents for the E-595CF Application

When applying for the E-595CF certificate, certain documents may be required to support your application. Typically, these include proof of agricultural production, such as receipts or invoices for farming supplies, and your tax identification number. Some states may also request additional documentation to verify your farming status. Ensuring that you have all necessary documents ready will facilitate a smoother application process.

Form Submission Methods for the E-595CF Application

The E-595CF application can usually be submitted through various methods, depending on your state’s regulations. Common submission methods include online applications through state tax authority websites, mailing a paper form, or delivering it in person to the appropriate office. It is advisable to check your state’s specific submission guidelines to choose the most efficient method for your application.

Quick guide on how to complete e 595cf application for conditional farmer exemption certificate number for qualified purchases web 6 14 office use north

Complete E 595CF Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North Caroli seamlessly on any device

Web-based document management has become favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and efficiently. Handle E 595CF Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North Caroli on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign E 595CF Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North Caroli effortlessly

- Find E 595CF Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North Caroli and click on Get Form to proceed.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign E 595CF Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North Caroli and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct e 595cf application for conditional farmer exemption certificate number for qualified purchases web 6 14 office use north

Create this form in 5 minutes!

How to create an eSignature for the e 595cf application for conditional farmer exemption certificate number for qualified purchases web 6 14 office use north

How to create an eSignature for the E 595cf Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North in the online mode

How to create an eSignature for your E 595cf Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North in Google Chrome

How to generate an eSignature for signing the E 595cf Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North in Gmail

How to make an eSignature for the E 595cf Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North right from your smartphone

How to create an electronic signature for the E 595cf Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North on iOS devices

How to generate an electronic signature for the E 595cf Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North on Android

People also ask

-

What is a farmer certificate format?

A farmer certificate format is a standardized document that verifies the status, ownership, and registration of a farming operation. It is essential for various agricultural processes, including securing loans, applying for grants, and participating in government programs. Utilizing the correct farmer certificate format ensures compliance and facilitates smoother operations in agricultural business.

-

How can airSlate SignNow help with farmer certificate format management?

airSlate SignNow provides a user-friendly platform to create, send, and eSign documents, including farmer certificate formats. With its templating features, you can easily generate customized certificates and streamline the signing process. This efficiency reduces paper usage and accelerates the document workflow, making it an ideal solution for farmers.

-

What are the pricing options for using airSlate SignNow for farmer certificate format signing?

The pricing for airSlate SignNow is competitive and designed to accommodate various business needs. You can choose from different plans based on the number of users and features, which allows for flexibility when handling multiple farmer certificate formats. Explore our pricing page for more details and find a plan that suits your budget.

-

Is it easy to integrate airSlate SignNow with other software for managing farmer certificates?

Absolutely! airSlate SignNow offers seamless integrations with popular CRM, document management, and cloud storage solutions. This capability allows you to manage your farmer certificate formats effortlessly across different platforms and ensures that all your documents are synchronized and accessible.

-

What features of airSlate SignNow make it suitable for handling farmer certificate formats?

airSlate SignNow includes features like customizable templates, bulk sending, and advanced security for farmer certificate formats. Additionally, its intuitive interface makes it easy for users to send and eSign documents without technical barriers. All these features contribute to an efficient document management process for farmers.

-

Are there any mobile features for managing farmer certificate formats on airSlate SignNow?

Yes, airSlate SignNow has a mobile app that allows you to manage your farmer certificate formats on the go. You can create, send, and sign documents directly from your smartphone or tablet, ensuring that you can operate your farming business efficiently from anywhere. The mobile solution is designed for convenience and flexibility.

-

What benefits does eSigning provide when using farmer certificate format?

eSigning provides numerous benefits when using a farmer certificate format, including faster processing times and increased security. With airSlate SignNow, you can track document status in real-time and ensure that all signatures are gathered efficiently. This digital approach also reduces the likelihood of errors associated with traditional paper processes.

Get more for E 595CF Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North Caroli

Find out other E 595CF Application For Conditional Farmer Exemption Certificate Number For Qualified Purchases Web 6 14 Office Use North Caroli

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure