North Carolina Farmer Exemption Form 2018-2026

What is the North Carolina Farmer Exemption Form

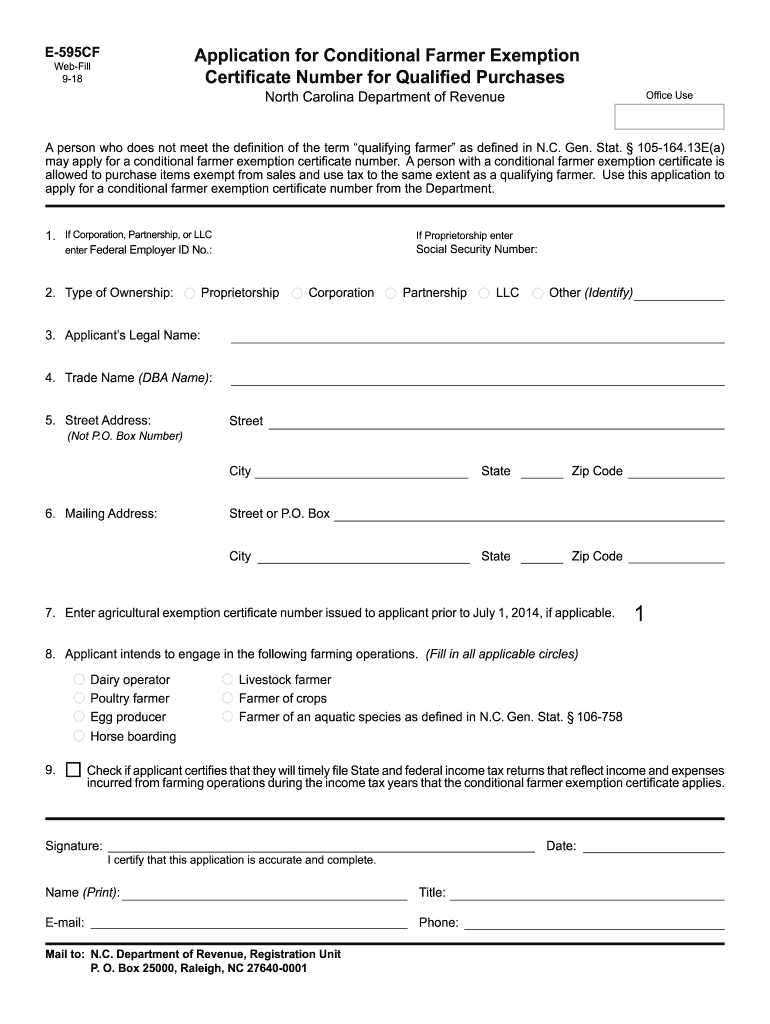

The North Carolina Farmer Exemption Form, commonly referred to as the e 595cf exemption, allows qualifying farmers in North Carolina to claim an exemption from sales and use tax on certain purchases related to their agricultural operations. This form is essential for farmers looking to reduce their tax burden while ensuring compliance with state tax regulations. The exemption applies specifically to items necessary for farming, such as seeds, fertilizers, and farm equipment.

Eligibility Criteria

To qualify for the North Carolina Farmer Exemption, applicants must meet specific criteria. Farmers must be engaged in the production of agricultural products for sale and must provide proof of their farming activities. This may include documentation such as a farm registration number or evidence of sales. Additionally, the exemption is typically limited to purchases directly related to agricultural production, so farmers should ensure that their purchases align with the guidelines set forth by the state.

Steps to Complete the North Carolina Farmer Exemption Form

Completing the North Carolina Farmer Exemption Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation that verifies your farming status and the items for which you are claiming the exemption. Next, fill out the e 595cf form with the required information, including your name, address, and farm registration number. It's crucial to review the form for completeness and accuracy before submission. Once completed, submit the form to the appropriate tax authority, either online or through traditional mail.

Legal Use of the North Carolina Farmer Exemption Form

The legal use of the North Carolina Farmer Exemption Form is governed by state tax laws. To ensure that the exemption is recognized, farmers must adhere to the stipulations outlined in the form and maintain accurate records of their purchases. Misuse of the exemption can lead to penalties, including fines and back taxes. Therefore, it is essential for farmers to understand the legal implications of using the exemption and to keep thorough documentation of all transactions related to their farming activities.

Form Submission Methods

The North Carolina Farmer Exemption Form can be submitted through various methods, providing flexibility for farmers. Options include online submission through the state’s tax portal, mailing a physical copy of the form to the designated tax office, or delivering it in person. Each submission method has its own processing times, so farmers should choose the one that best fits their needs and timelines. Ensuring that the form is submitted correctly will help avoid delays in processing the exemption.

Required Documents

When submitting the North Carolina Farmer Exemption Form, several documents may be required to support the application. This typically includes proof of farming activity, such as a farm registration number or sales receipts. Additionally, farmers may need to provide documentation of the specific purchases they are claiming as exempt. Having these documents ready will facilitate a smoother application process and help substantiate the claim for exemption.

Examples of Using the North Carolina Farmer Exemption Form

Farmers can utilize the North Carolina Farmer Exemption Form in various scenarios. For instance, a farmer purchasing seeds and fertilizers for crop production can claim these items as exempt from sales tax. Similarly, if a farmer invests in new equipment necessary for their farming operations, they may also use the exemption for that purchase. Understanding these practical applications can help farmers maximize their benefits under the exemption program while remaining compliant with state laws.

Quick guide on how to complete north carolina farmer exemption form

Complete North Carolina Farmer Exemption Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Handle North Carolina Farmer Exemption Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric task today.

The easiest method to alter and eSign North Carolina Farmer Exemption Form seamlessly

- Locate North Carolina Farmer Exemption Form and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign North Carolina Farmer Exemption Form to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct north carolina farmer exemption form

Create this form in 5 minutes!

How to create an eSignature for the north carolina farmer exemption form

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the NC farmer exemption?

The NC farmer exemption allows qualifying farmers in North Carolina to be exempt from certain taxes on materials and equipment used for agricultural production. This exemption can signNowly reduce operational costs for farmers, making it beneficial for those engaged in farming activities.

-

How can airSlate SignNow help with the NC farmer exemption process?

airSlate SignNow streamlines the documentation process for the NC farmer exemption. With our eSignature solution, farmers can easily prepare, send, and sign necessary documents online, ensuring compliance and efficiency without the hassle of paper forms.

-

Are there any fees associated with using airSlate SignNow for NC farmer exemption documents?

While airSlate SignNow offers a cost-effective solution for document management, there may be standard pricing plans in place. However, the savings from using the NC farmer exemption and reducing paperwork can more than compensate for any fees associated with our services.

-

What features does airSlate SignNow offer that support the NC farmer exemption?

airSlate SignNow provides features like customizable templates, automatic reminders, and secure cloud storage which are essential for managing NC farmer exemption documents. These functionalities help farmers easily adapt their documentation process to fit their specific needs.

-

Can airSlate SignNow integrate with accounting software for NC farmer exemption management?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, allowing for a smooth workflow in managing NC farmer exemption-related expenses. This integration can enhance accuracy and efficiency in tracking tax-related documentation.

-

What are the benefits of using airSlate SignNow for the NC farmer exemption?

Using airSlate SignNow for the NC farmer exemption simplifies the entire document-signing process while ensuring compliance. The benefits include time savings, reduced paperwork, and the ability to manage documentation from anywhere, enhancing productivity.

-

Is customer support available for questions about the NC farmer exemption?

Absolutely! airSlate SignNow offers dedicated customer support to assist with any inquiries about the NC farmer exemption process. Our team is available to help ensure you maximize the benefits of your exemption efficiently.

Get more for North Carolina Farmer Exemption Form

- 001c form fill up

- Mail redirection form

- Directions use your notes on rules of divisibility to complete this page linfield5 form

- 5 2 review and reinforcement answer key form

- Drca 32 version 9 form

- Fundamentals of e discovery form

- Veterinary antidotes and availability an update susan j bright form

- Art loan contract template form

Find out other North Carolina Farmer Exemption Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors