PETITION to the VALUE ADJUSTMENT BOARD, TAX DEFERRAL or PENALTIES 2012

Understanding the petition to the value adjustment board, tax deferral or penalties

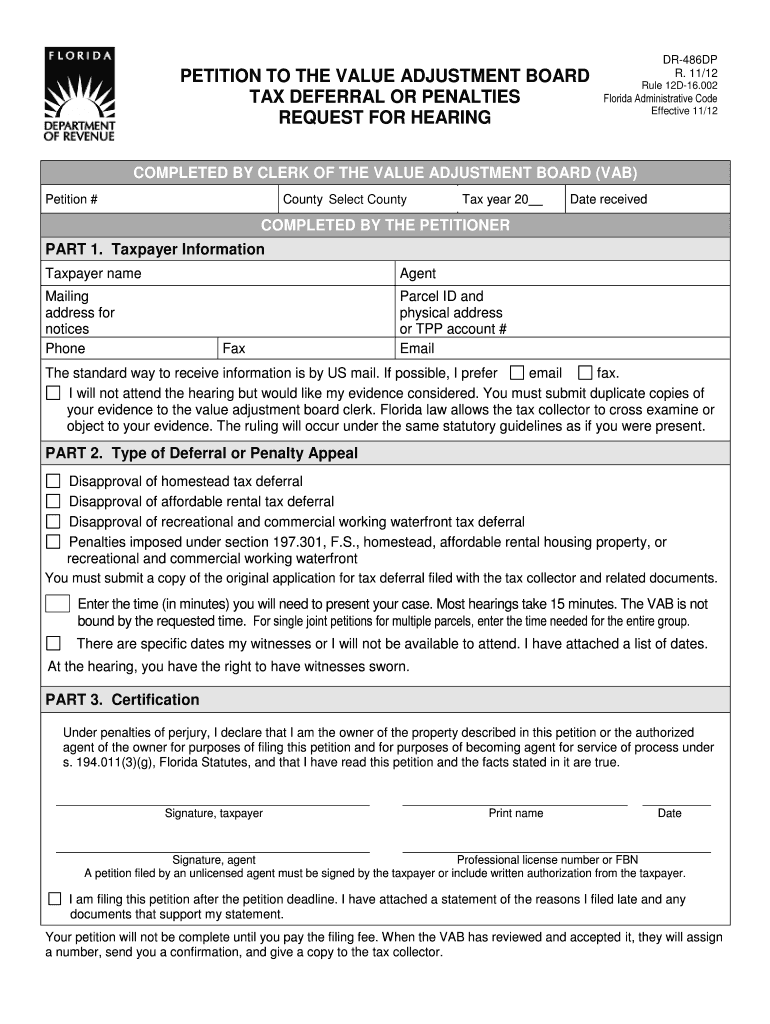

The petition to the value adjustment board, tax deferral or penalties is a formal request made by property owners to contest the assessed value of their property or to seek relief from penalties associated with tax obligations. This petition allows taxpayers to present their case for a tax deferral or to challenge any penalties imposed due to late payments or other issues. It is essential for property owners to understand the implications of this petition, as it can significantly impact their financial responsibilities and tax liabilities.

Steps to complete the petition to the value adjustment board, tax deferral or penalties

Completing the petition involves several key steps to ensure that it is filed correctly and meets all necessary requirements. Begin by gathering all relevant documentation, including property tax assessments and any correspondence related to penalties. Next, fill out the petition form accurately, providing detailed information about your property and the reasons for your request. Once completed, review the form for accuracy and completeness before submitting it to the appropriate value adjustment board. It is advisable to keep copies of all submitted documents for your records.

Eligibility criteria for the petition to the value adjustment board, tax deferral or penalties

To be eligible to file the petition, property owners must meet specific criteria set by their local jurisdiction. Generally, this includes being the legal owner of the property in question and having a valid reason for contesting the assessment or seeking a deferral. Common eligibility factors may include financial hardship, errors in the assessment process, or other extenuating circumstances. It is crucial to check local regulations to ensure compliance with all eligibility requirements before filing.

Required documents for the petition to the value adjustment board, tax deferral or penalties

When filing the petition, certain documents are typically required to support your case. These may include the original property tax assessment notice, documentation of any penalties incurred, and evidence that supports your claim for a deferral or adjustment. Additional documents, such as financial statements or proof of hardship, may also be necessary depending on the circumstances. Ensuring that all required documents are included can help strengthen your petition and facilitate a smoother review process.

Form submission methods for the petition to the value adjustment board, tax deferral or penalties

The petition can usually be submitted through various methods, including online, by mail, or in person, depending on the regulations of your local value adjustment board. Online submissions may be the most efficient method, allowing for quick processing and confirmation of receipt. If submitting by mail, ensure that you use a reliable mailing service and retain proof of mailing. In-person submissions can provide an opportunity to ask questions and clarify any issues directly with board officials.

Penalties for non-compliance with the petition to the value adjustment board, tax deferral or penalties

Failing to comply with the requirements for filing the petition can result in significant penalties. These may include the denial of your request for tax deferral or the imposition of additional fines for late submissions. It is important to be aware of all deadlines and procedural requirements to avoid these consequences. Understanding the potential penalties can motivate property owners to take timely and appropriate action when contesting assessments or seeking relief from penalties.

Quick guide on how to complete petition to the value adjustment board tax deferral or penalties

Easily Prepare PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES on Any Device

Managing documents online has gained increasing popularity among businesses and individuals. It offers a suitable eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to quickly create, edit, and eSign your documents without any delays. Handle PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

Effortlessly Edit and eSign PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES

- Locate PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct petition to the value adjustment board tax deferral or penalties

Create this form in 5 minutes!

How to create an eSignature for the petition to the value adjustment board tax deferral or penalties

How to make an eSignature for the Petition To The Value Adjustment Board Tax Deferral Or Penalties online

How to make an electronic signature for the Petition To The Value Adjustment Board Tax Deferral Or Penalties in Google Chrome

How to create an eSignature for signing the Petition To The Value Adjustment Board Tax Deferral Or Penalties in Gmail

How to create an electronic signature for the Petition To The Value Adjustment Board Tax Deferral Or Penalties right from your smart phone

How to create an electronic signature for the Petition To The Value Adjustment Board Tax Deferral Or Penalties on iOS devices

How to make an electronic signature for the Petition To The Value Adjustment Board Tax Deferral Or Penalties on Android OS

People also ask

-

What is the process for filing a PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES using airSlate SignNow?

Filing a PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES using airSlate SignNow is straightforward. You can create, send, and eSign your petition documents through our intuitive platform. Our tools simplify the process, allowing you to manage all related paperwork digitally, ensuring efficiency and compliance.

-

How much does airSlate SignNow cost for filing a PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES?

Our pricing plans are designed to be cost-effective, allowing you to file a PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES without breaking the bank. We offer various subscription options that cater to different business sizes and needs. You can choose the plan that best fits your usage requirements and budget.

-

What features does airSlate SignNow provide for managing a PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES?

airSlate SignNow offers a range of features specifically tailored for managing a PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES. This includes easy document creation, secure eSignature capability, and real-time tracking of documents. Our platform ensures that you can efficiently handle your petitions with ease and security.

-

Can I integrate airSlate SignNow with other tools for my PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES?

Absolutely! airSlate SignNow supports integrations with various tools and platforms that can enhance your experience in filing a PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES. Whether you use document management systems or CRM software, our integration capabilities ensure seamless workflow across your business processes.

-

What benefits does airSlate SignNow offer for businesses submitting a PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES?

Using airSlate SignNow for your PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES offers signNow benefits, including time savings and increased accuracy. Our platform reduces the complexity of managing documents and provides a legally valid eSignature for your petitions. This means you can focus more on your core tasks while ensuring compliance.

-

Is there customer support available for questions about my PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions regarding your PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES. Our experts are available to help you navigate the process and resolve any issues promptly. We’re committed to ensuring you have a smooth experience on our platform.

-

Are there templates available for my PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES?

Yes, airSlate SignNow offers a variety of customizable templates for your PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES. These templates help streamline your document preparation, reducing the time spent on drafting while ensuring that all necessary legal elements are included. You can easily personalize the templates to fit your specific situation.

Get more for PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES

Find out other PETITION TO THE VALUE ADJUSTMENT BOARD, TAX DEFERRAL OR PENALTIES

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple