DR 486DP Petition to the VAB Florida Department of Revenue 2017-2026

What is the DR-486DP Petition to the VAB Florida Department of Revenue

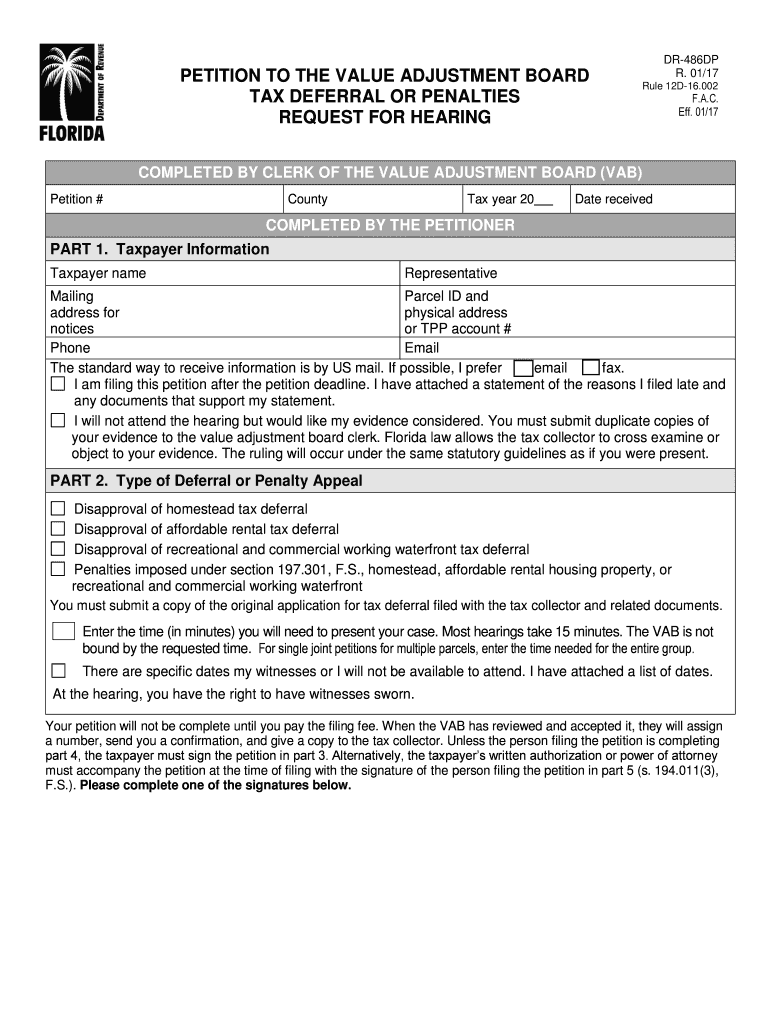

The DR-486DP Petition to the Value Adjustment Board (VAB) is a formal request used in Florida to appeal property tax assessments. This document allows property owners to contest the assessed value of their property, which can significantly impact their tax obligations. The petition is crucial for those who believe their property has been overvalued or misclassified. Understanding the purpose and implications of this form is essential for effective tax management and ensuring fair property taxation.

Steps to Complete the DR-486DP Petition to the VAB Florida Department of Revenue

Completing the DR-486DP Petition involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation, including the property’s current assessment and any evidence supporting your claim. Next, fill out the petition form thoroughly, providing detailed information about the property and the reasons for the appeal. After completing the form, review it for accuracy before submitting it to the appropriate VAB office. Timeliness is crucial, as there are specific deadlines for filing the petition.

Eligibility Criteria for the DR-486DP Petition to the VAB Florida Department of Revenue

To file the DR-486DP Petition, property owners must meet certain eligibility criteria. Primarily, the petitioner must be the owner of the property or an authorized representative. Additionally, the petition must be based on valid grounds, such as overvaluation, incorrect classification, or denial of an exemption. Understanding these criteria is vital to ensure that your petition is accepted and considered by the VAB.

Required Documents for the DR-486DP Petition to the VAB Florida Department of Revenue

When submitting the DR-486DP Petition, several documents are typically required to support your case. These may include the property’s current tax assessment notice, evidence of comparable property values, and any relevant photographs or reports that substantiate your claim. Having these documents ready can strengthen your petition and enhance the likelihood of a favorable outcome.

Form Submission Methods for the DR-486DP Petition to the VAB Florida Department of Revenue

The DR-486DP Petition can be submitted through various methods, ensuring flexibility for property owners. Options typically include online submission through designated state portals, mailing the completed form to the local VAB office, or delivering it in person. Each method has its own guidelines and deadlines, so it is important to choose the one that best fits your circumstances and to follow the specific instructions for submission.

Penalties for Non-Compliance with the DR-486DP Petition to the VAB Florida Department of Revenue

Failing to comply with the requirements for the DR-486DP Petition can result in significant penalties. These may include the dismissal of the appeal, loss of the right to contest the assessment, or additional fees. Understanding these potential consequences emphasizes the importance of adhering to the filing guidelines and deadlines associated with the petition.

Quick guide on how to complete dr 486dp petition to the vab florida department of revenue

Finish DR 486DP Petition To The VAB Florida Department Of Revenue effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to draft, alter, and electronically sign your documents swiftly without delays. Manage DR 486DP Petition To The VAB Florida Department Of Revenue on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest method to modify and electronically sign DR 486DP Petition To The VAB Florida Department Of Revenue seamlessly

- Find DR 486DP Petition To The VAB Florida Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for that task.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your document, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that require you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign DR 486DP Petition To The VAB Florida Department Of Revenue and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 486dp petition to the vab florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dr 486dp petition to the vab florida department of revenue

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is a petition value deferral?

A petition value deferral refers to a temporary delay in the processing of a petition, allowing individuals or businesses to manage their cash flow more effectively. Understanding this concept is crucial for organizations looking to optimize their operations while ensuring compliance with legal requirements.

-

How can airSlate SignNow assist with petition value deferral processes?

airSlate SignNow offers a seamless eSigning solution that streamlines the submission and management of documents related to petition value deferrals. With our user-friendly interface, businesses can easily create, send, and sign documents, ensuring that petition deferral requests are handled efficiently and promptly.

-

What features does airSlate SignNow provide for managing petition value deferrals?

Our platform includes robust features such as customizable templates, real-time tracking, and automated reminders specifically for managing petition value deferrals. These tools enable businesses to stay organized and maintain effective communication throughout the deferral process.

-

Is airSlate SignNow cost-effective for businesses dealing with petition value deferrals?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling petition value deferrals. Our pricing structure offers competitive plans that provide excellent value for the comprehensive features we offer.

-

Can I integrate airSlate SignNow with other tools for petition value deferrals?

Absolutely! airSlate SignNow seamlessly integrates with various applications and software to enhance your workflow around petition value deferrals. This flexibility allows you to connect your existing tools and streamline the entire document management process.

-

What benefits do businesses gain by using airSlate SignNow for petition value deferrals?

By utilizing airSlate SignNow for petition value deferrals, businesses benefit from increased efficiency, reduced turnaround times, and improved compliance. Our platform simplifies the documentation process, allowing you to focus more on your core operations.

-

Are there any security measures in place for documents related to petition value deferrals?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption protocols and adhere to industry standards to protect sensitive documents related to petition value deferrals, ensuring that your information remains confidential.

Get more for DR 486DP Petition To The VAB Florida Department Of Revenue

- Www uslegalforms comform library484802 selfself certification affidavit north dakota department of

- Affidavit of sale of involuntarily towed vehicle form

- Sewer lateral application village of bel ridge website bel ridge form

- Ag ny gov sites defaultplattsburgh complaint new york state attorney general form

- Surrogates court of the state of new york form

- Get the writ of restitution maricopa county form

- Praecipe pinal county clerk of the superior court form

- Pc 655 report for court review of minor michigan courts form

Find out other DR 486DP Petition To The VAB Florida Department Of Revenue

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF