Florida Sales and Use Tax BApplicationb for Release or Refund of Bb 2010

What is the Florida Sales And Use Tax Application For Release Or Refund Of Tax

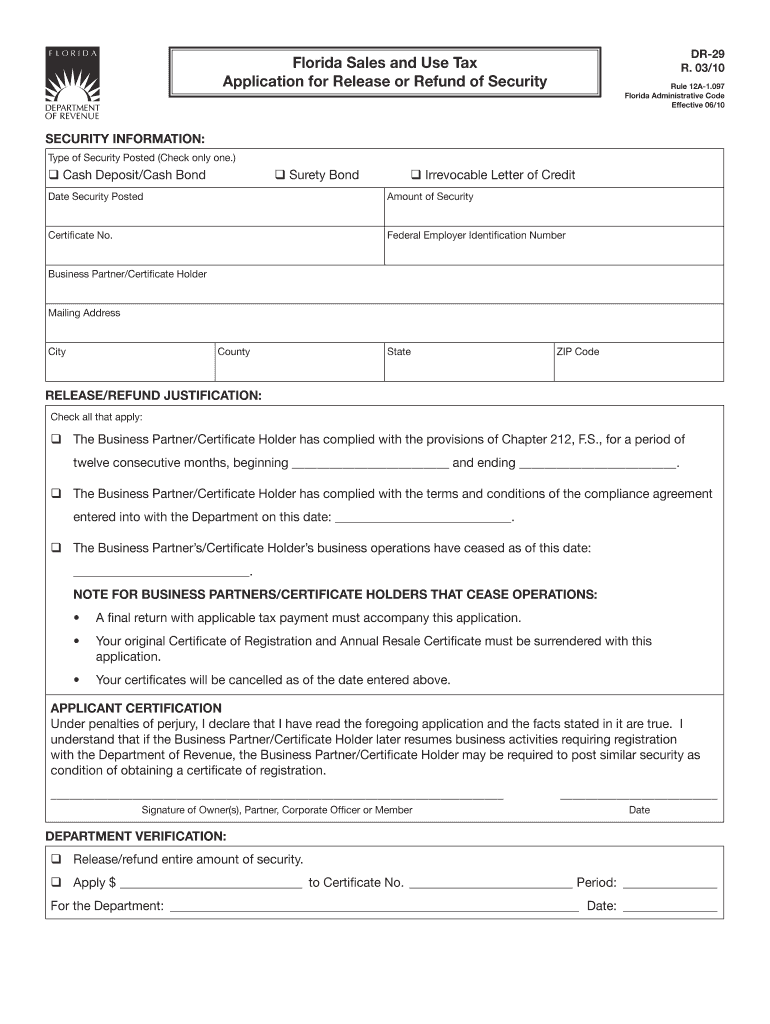

The Florida Sales And Use Tax Application For Release Or Refund Of Tax is a formal document used by businesses and individuals to request a refund or release from sales and use tax obligations. This application is essential for taxpayers who believe they have overpaid taxes or are eligible for a refund due to specific circumstances, such as tax exemptions or errors in tax assessment. Understanding the purpose and function of this application is crucial for ensuring compliance with Florida tax laws.

Steps to Complete the Florida Sales And Use Tax Application For Release Or Refund Of Tax

Completing the Florida Sales And Use Tax Application For Release Or Refund Of Tax involves several key steps:

- Gather all necessary documentation, including receipts and proof of payment.

- Clearly identify the tax period for which you are requesting a refund.

- Fill out the application form accurately, ensuring all required fields are completed.

- Provide a detailed explanation of the reason for the refund request.

- Review the application for accuracy before submission.

Following these steps helps ensure that your application is processed smoothly and efficiently.

Legal Use of the Florida Sales And Use Tax Application For Release Or Refund Of Tax

The legal use of the Florida Sales And Use Tax Application For Release Or Refund Of Tax is governed by state tax laws. It is essential to use this application in accordance with the guidelines set forth by the Florida Department of Revenue. Submitting the application without proper justification or documentation may result in denial of the refund request. Additionally, compliance with all relevant regulations ensures that the application holds legal validity in the eyes of the state.

Eligibility Criteria for the Florida Sales And Use Tax Application For Release Or Refund Of Tax

To be eligible to submit the Florida Sales And Use Tax Application For Release Or Refund Of Tax, applicants must meet specific criteria:

- Have a valid sales tax registration number.

- Demonstrate that the tax was paid on the goods or services for which a refund is sought.

- Provide evidence of eligibility for a refund, such as exemption certificates or documentation of tax overpayment.

Meeting these criteria is essential for a successful application process.

Form Submission Methods for the Florida Sales And Use Tax Application For Release Or Refund Of Tax

The Florida Sales And Use Tax Application For Release Or Refund Of Tax can be submitted through various methods:

- Online submission via the Florida Department of Revenue's website.

- Mailing the completed form to the appropriate department address.

- In-person submission at designated tax offices.

Choosing the appropriate submission method can affect the processing time of your application.

Required Documents for the Florida Sales And Use Tax Application For Release Or Refund Of Tax

When submitting the Florida Sales And Use Tax Application For Release Or Refund Of Tax, it is important to include all required documents to support your claim. These may include:

- Proof of tax payment, such as receipts or bank statements.

- Any relevant exemption certificates.

- A detailed explanation of the circumstances leading to the refund request.

Providing comprehensive documentation helps facilitate a smoother review process.

Quick guide on how to complete florida sales and use tax bapplicationb for release or refund of bb

Effortlessly Prepare Florida Sales And Use Tax BApplicationb For Release Or Refund Of Bb on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the essential tools you require to create, modify, and electronically sign your documents swiftly without any delays. Manage Florida Sales And Use Tax BApplicationb For Release Or Refund Of Bb on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

Easily Edit and Electronically Sign Florida Sales And Use Tax BApplicationb For Release Or Refund Of Bb

- Locate Florida Sales And Use Tax BApplicationb For Release Or Refund Of Bb and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign Florida Sales And Use Tax BApplicationb For Release Or Refund Of Bb to ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida sales and use tax bapplicationb for release or refund of bb

Create this form in 5 minutes!

How to create an eSignature for the florida sales and use tax bapplicationb for release or refund of bb

How to generate an electronic signature for the Florida Sales And Use Tax Bapplicationb For Release Or Refund Of Bb online

How to create an electronic signature for the Florida Sales And Use Tax Bapplicationb For Release Or Refund Of Bb in Chrome

How to make an eSignature for putting it on the Florida Sales And Use Tax Bapplicationb For Release Or Refund Of Bb in Gmail

How to make an eSignature for the Florida Sales And Use Tax Bapplicationb For Release Or Refund Of Bb from your smart phone

How to make an electronic signature for the Florida Sales And Use Tax Bapplicationb For Release Or Refund Of Bb on iOS

How to make an electronic signature for the Florida Sales And Use Tax Bapplicationb For Release Or Refund Of Bb on Android devices

People also ask

-

What is the Florida Sales And Use Tax Application For Release Or Refund Of B?

The Florida Sales And Use Tax Application For Release Or Refund Of B is a form that allows businesses to request a refund for overpaid sales and use taxes. This application is crucial for ensuring compliance and obtaining refunds that can signNowly benefit cash flow.

-

How can airSlate SignNow assist with the Florida Sales And Use Tax Application For Release Or Refund Of B?

airSlate SignNow offers features that simplify the process of preparing, signing, and submitting the Florida Sales And Use Tax Application For Release Or Refund Of B. With its user-friendly interface, businesses can streamline document management and ensure timely submissions.

-

What are the pricing options for using airSlate SignNow for tax applications?

airSlate SignNow provides flexible pricing plans to suit various business needs, including options for individual users and teams. By leveraging the platform for the Florida Sales And Use Tax Application For Release Or Refund Of B, companies can save time and reduce administrative costs.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow uses advanced security measures, including encryption and secure data storage, to protect sensitive information. This makes it a reliable choice for handling the Florida Sales And Use Tax Application For Release Or Refund Of B and other critical documents.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow offers various integrations with popular accounting software to enhance your workflow. This allows you to easily manage the Florida Sales And Use Tax Application For Release Or Refund Of B alongside your other financial processes.

-

What benefits does airSlate SignNow offer for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents like the Florida Sales And Use Tax Application For Release Or Refund Of B speeds up the approval process while maintaining legal compliance. ESigning enhances document tracking and improves overall efficiency.

-

How user-friendly is airSlate SignNow for new users?

airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those not tech-savvy. New users can quickly learn to manage their Florida Sales And Use Tax Application For Release Or Refund Of B without extensive training.

Get more for Florida Sales And Use Tax BApplicationb For Release Or Refund Of Bb

Find out other Florida Sales And Use Tax BApplicationb For Release Or Refund Of Bb

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP