Application Abatement Form 2009

What is the Application Abatement Form

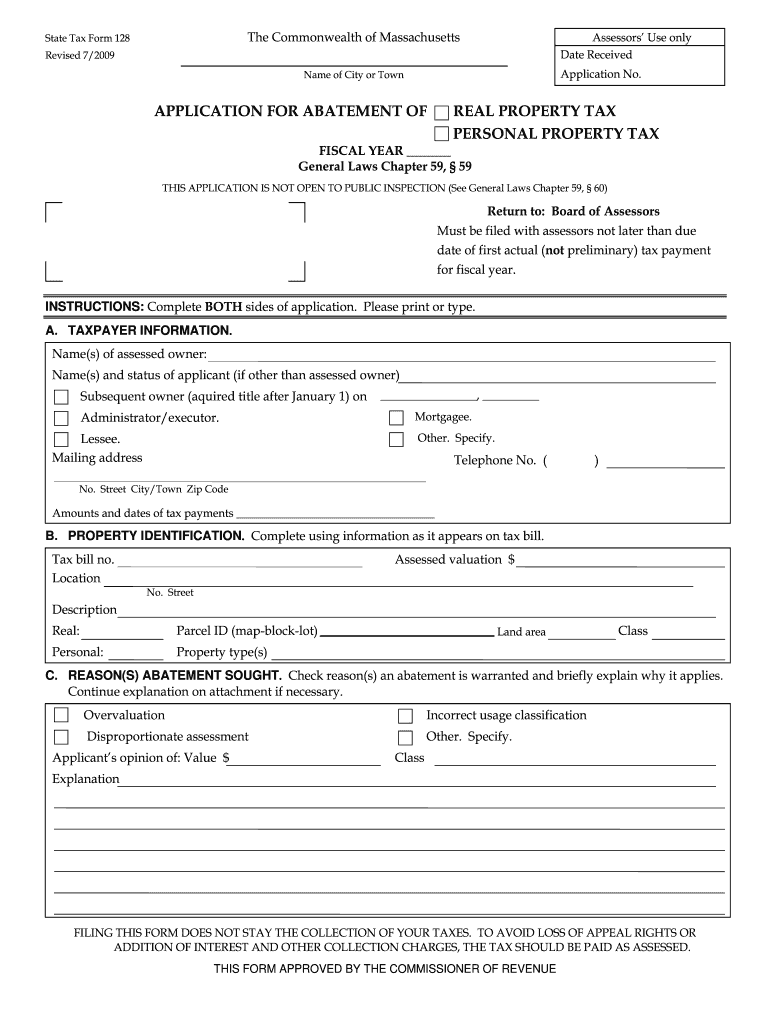

The Application Abatement Form is a document used primarily in the context of tax and regulatory compliance. It allows individuals or businesses to request a reduction or elimination of certain obligations, such as penalties or interest, associated with tax liabilities. This form is essential for those seeking relief from financial burdens imposed by the tax authority due to various circumstances, such as errors, delays, or unforeseen events. Understanding the purpose of this form is crucial for effectively navigating the application process and ensuring compliance with relevant laws.

How to Use the Application Abatement Form

Using the Application Abatement Form involves a systematic approach to ensure that all necessary information is accurately provided. First, gather relevant documentation that supports your request, such as tax returns, payment records, or correspondence with tax authorities. Next, fill out the form with precise details, ensuring that all sections are completed. It is important to clearly articulate the reasons for your request, supported by the gathered documentation. Finally, review the form for accuracy before submission to avoid delays or rejections.

Steps to Complete the Application Abatement Form

Completing the Application Abatement Form requires careful attention to detail. Follow these steps for effective completion:

- Gather all necessary documentation that supports your claim.

- Fill out the form, ensuring all required fields are completed accurately.

- Clearly explain the reasons for your request, providing context and supporting evidence.

- Review the form for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal Use of the Application Abatement Form

The legal use of the Application Abatement Form is governed by specific regulations that outline the circumstances under which it can be submitted. It is important to ensure that the form is used in compliance with federal and state tax laws. This includes understanding eligibility criteria and ensuring that all claims made in the form are truthful and supported by documentation. Failure to comply with these regulations can result in penalties or denial of the request.

Eligibility Criteria

Eligibility for filing the Application Abatement Form typically depends on several factors, including the nature of the tax obligation and the circumstances surrounding the request. Common criteria include:

- Demonstrating reasonable cause for the request, such as illness or financial hardship.

- Having a history of compliance with tax obligations.

- Submitting the form within the designated timeframe following the tax event.

Meeting these criteria is essential for a successful application.

Form Submission Methods

The Application Abatement Form can be submitted through various methods, depending on the requirements set forth by the tax authority. Common submission methods include:

- Online submission through the official tax authority website.

- Mailing the completed form to the designated office.

- In-person submission at local tax offices.

Choosing the appropriate submission method can affect the processing time and outcome of the application.

Quick guide on how to complete application abatement 2009 form

Finalize Application Abatement Form with ease on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage Application Abatement Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered procedure today.

How to modify and eSign Application Abatement Form effortlessly

- Obtain Application Abatement Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign Application Abatement Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application abatement 2009 form

Create this form in 5 minutes!

How to create an eSignature for the application abatement 2009 form

How to create an electronic signature for the Application Abatement 2009 Form online

How to make an electronic signature for the Application Abatement 2009 Form in Google Chrome

How to generate an electronic signature for putting it on the Application Abatement 2009 Form in Gmail

How to create an electronic signature for the Application Abatement 2009 Form straight from your smartphone

How to create an eSignature for the Application Abatement 2009 Form on iOS devices

How to create an electronic signature for the Application Abatement 2009 Form on Android devices

People also ask

-

What is an Application Abatement Form?

An Application Abatement Form is a document used by individuals or businesses to request the reduction or cancellation of a fee or tax liability. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining the process and ensuring accurate submissions.

-

How does airSlate SignNow facilitate the completion of an Application Abatement Form?

airSlate SignNow offers an intuitive interface that allows users to create, edit, and eSign their Application Abatement Form effortlessly. With features like templates and drag-and-drop functionality, completing your form is quick and efficient, saving you valuable time.

-

Is there a cost associated with using airSlate SignNow for the Application Abatement Form?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs, allowing you to choose the best option for handling your Application Abatement Form. Each plan is designed to be cost-effective while providing robust features to enhance your document management.

-

Can I integrate airSlate SignNow with other applications for managing the Application Abatement Form?

Absolutely! airSlate SignNow offers seamless integrations with numerous third-party applications, enabling you to manage your Application Abatement Form alongside other tools you use. This ensures a streamlined workflow and better document tracking.

-

What are the key benefits of using airSlate SignNow for my Application Abatement Form?

Using airSlate SignNow for your Application Abatement Form provides signNow benefits, such as faster processing times, enhanced security, and easier tracking. The platform improves collaboration among team members and offers instant notifications once documents are signed.

-

Is my data safe when using airSlate SignNow for the Application Abatement Form?

Yes, airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards. When you use the platform for your Application Abatement Form, you can be confident that your data is protected against unauthorized access.

-

Can I modify my Application Abatement Form after it has been created?

You can easily modify your Application Abatement Form even after creation using airSlate SignNow. The platform allows for quick edits, ensuring that your forms can be updated as necessary without starting from scratch.

Get more for Application Abatement Form

Find out other Application Abatement Form

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document