Ma State Tax Form 128 122000 2016-2026

Understanding the Massachusetts State Tax Form 128

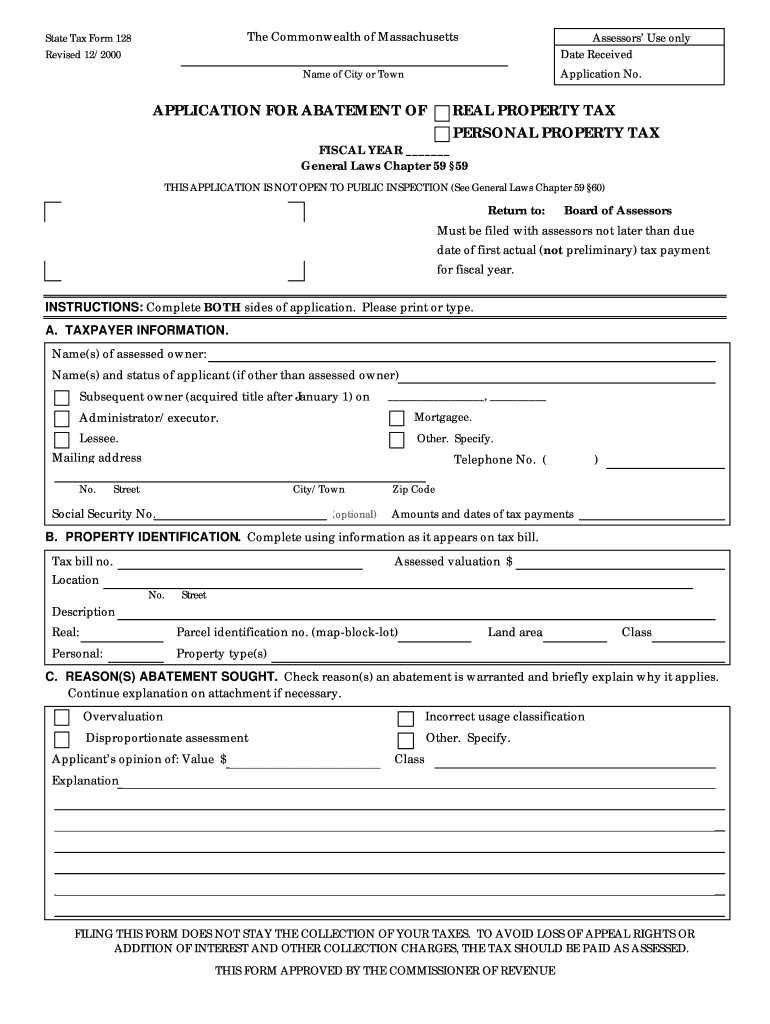

The Massachusetts State Tax Form 128, also known as the Massachusetts tax abatement application, is a crucial document for property owners seeking tax relief. This form allows taxpayers to request a reduction in their property taxes based on specific criteria, such as changes in property value or financial hardship. Understanding the purpose and requirements of this form is essential for anyone looking to navigate the tax abatement process effectively.

Steps to Complete the Massachusetts State Tax Form 128

Completing the Massachusetts State Tax Form 128 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including property tax bills and any relevant financial statements. Next, fill out the form with accurate information regarding your property and the reasons for your abatement request. Be sure to review the form for completeness and correctness before submission. Finally, submit the form by the specified deadline, either online or via mail, depending on your preference.

Eligibility Criteria for Massachusetts Tax Abatement

To qualify for a Massachusetts tax abatement, property owners must meet specific eligibility criteria. Generally, applicants must demonstrate a valid reason for requesting an abatement, such as a decrease in property value or financial difficulties. It is essential to provide supporting documentation that substantiates your claims. Additionally, there may be deadlines for filing the abatement application, so it is important to be aware of these timelines to ensure your application is considered.

Required Documents for the Massachusetts Tax Abatement Application

When submitting the Massachusetts tax abatement application, certain documents are typically required to support your request. These may include:

- Your most recent property tax bill

- Evidence of property value changes, such as recent appraisals

- Financial statements that demonstrate hardship, if applicable

- Any additional documentation requested by the local tax assessor's office

Providing thorough and accurate documentation can significantly enhance the chances of a successful abatement application.

Form Submission Methods for Massachusetts Tax Abatement

There are various methods for submitting the Massachusetts tax abatement application. Taxpayers can choose to file the form online through the Massachusetts Department of Revenue website, which often provides a more streamlined process. Alternatively, applicants may opt to submit the form via mail, ensuring it is sent to the appropriate local tax assessor's office. In-person submissions may also be possible, depending on local regulations and office hours.

Legal Use of the Massachusetts Tax Abatement Form

The Massachusetts tax abatement application is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies could result in penalties or denial of the application. Utilizing a reliable electronic signature solution can further enhance the legal validity of your submission, ensuring compliance with eSignature laws and regulations.

Quick guide on how to complete ma state tax form 128 122000

Accomplish Ma State Tax Form 128 122000 effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It serves as an excellent sustainable alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents rapidly and without interruptions. Handle Ma State Tax Form 128 122000 on any gadget using the airSlate SignNow Android or iOS applications, and simplify any document-related tasks today.

The simplest method to modify and electronically sign Ma State Tax Form 128 122000 effortlessly

- Find Ma State Tax Form 128 122000 and then click Acquire Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure confidential information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature utilizing the Signature tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Finish button to save your changes.

- Select your preferred method of sending your form, whether via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Ma State Tax Form 128 122000 to guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ma state tax form 128 122000

Create this form in 5 minutes!

How to create an eSignature for the ma state tax form 128 122000

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Massachusetts tax abatement?

Massachusetts tax abatement is a process that allows property owners to reduce their property tax assessments. This can signNowly lower the tax burden on homeowners and businesses. Understanding this process is essential for anyone looking to save money on property taxes in Massachusetts.

-

How can airSlate SignNow assist with Massachusetts tax abatement applications?

airSlate SignNow streamlines the process of preparing and submitting Massachusetts tax abatement applications by allowing users to eSign and send documents quickly. Our platform minimizes paperwork and helps ensure submissions are accurate. This efficiency can expedite the approval process for tax abatements.

-

What are the benefits of using airSlate SignNow for managing tax abatement documents?

Using airSlate SignNow for managing tax abatement documents provides a user-friendly interface and cost-effective solution. It enhances collaboration by allowing multiple parties to review and sign documents remotely. This ensures that all necessary paperwork for Massachusetts tax abatement is processed efficiently.

-

Is there a cost associated with using airSlate SignNow for Massachusetts tax abatement?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, making it a cost-effective solution for Massachusetts tax abatement management. You can choose a plan that fits your budget while enjoying all the features needed for efficient document handling. Explore our pricing options on the website for more details.

-

Does airSlate SignNow integrate with other software for tax abatement processes?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications that facilitate financial and tax management. These integrations help streamline the entire process, including Massachusetts tax abatement, by ensuring data flows smoothly between platforms, saving time and reducing errors.

-

How secure is airSlate SignNow for handling Massachusetts tax abatement documents?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and security protocols to protect sensitive information related to Massachusetts tax abatement applications. You can trust that your documents are safe and secure while using our services.

-

Can I use airSlate SignNow on mobile devices for tax abatement submissions?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage your Massachusetts tax abatement submissions on the go. Whether you're in the office or out in the field, you can easily access, sign, and send documents with just a few taps on your phone or tablet.

Get more for Ma State Tax Form 128 122000

Find out other Ma State Tax Form 128 122000

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate