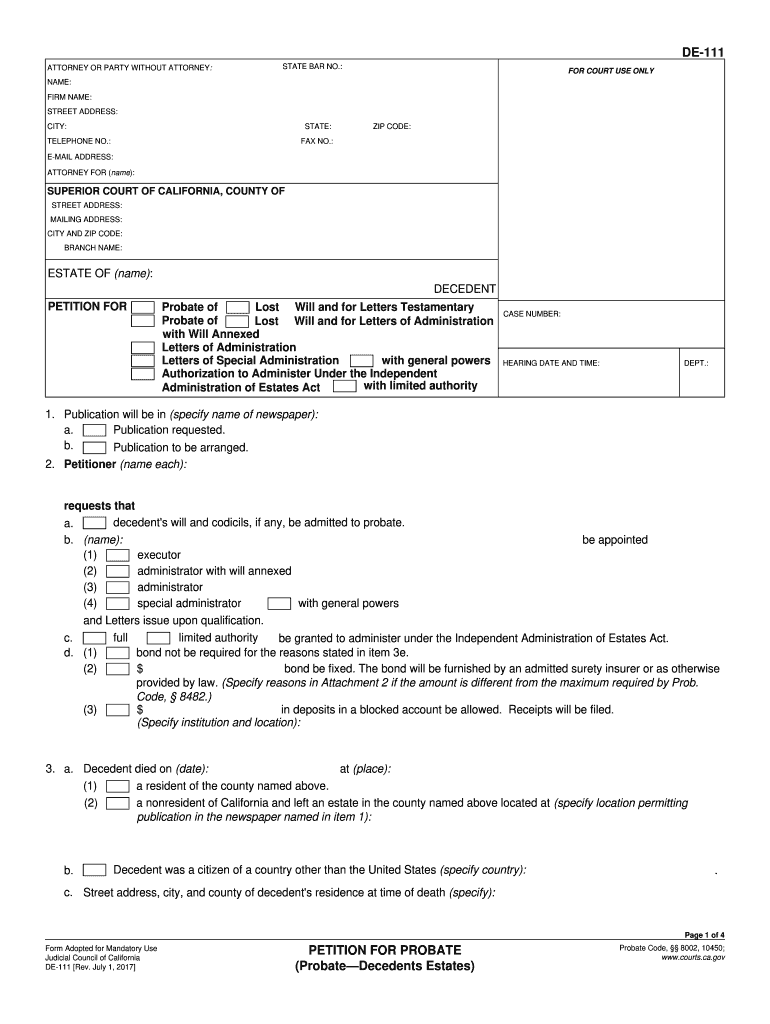

California Form 111 2008

What is the California Form 111

The California Form 111 is a tax form used for reporting income and calculating tax liability for individuals and businesses in California. This form is essential for ensuring compliance with state tax laws and is particularly relevant for those who have income subject to California taxation. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

How to use the California Form 111

Using the California Form 111 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax records. Next, carefully fill out the form, providing accurate information regarding your income, deductions, and credits. It is important to review the form for any errors before submission to avoid potential penalties or delays in processing.

Steps to complete the California Form 111

Completing the California Form 111 requires a systematic approach. Follow these steps:

- Gather all required documentation, such as W-2s, 1099s, and other income statements.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- List any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the California Form 111

The California Form 111 must be completed and submitted in compliance with state tax laws. Legal use of this form ensures that taxpayers report their income accurately and fulfill their tax obligations. It is important to understand the legal implications of submitting false information, which can lead to penalties or legal action. Utilizing reliable digital tools for e-signatures can enhance the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 111 are crucial for compliance. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to deadlines or specific extensions that may apply to your situation.

Form Submission Methods (Online / Mail / In-Person)

Submitting the California Form 111 can be done through various methods. Taxpayers can file online using approved e-filing services, which can streamline the process and provide immediate confirmation of submission. Alternatively, the form can be mailed to the appropriate state tax authority, ensuring it is postmarked by the filing deadline. In-person submissions may also be possible at designated tax offices, providing an option for those who prefer direct interaction.

Quick guide on how to complete california form 111 2008 2019

Complete California Form 111 effortlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage California Form 111 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The simplest way to modify and eSign California Form 111 with ease

- Find California Form 111 and then click Get Form to begin.

- Utilize the instruments we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Formulate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting document copies. airSlate SignNow accommodates all your document management requirements in a few clicks from any device of your selection. Edit and eSign California Form 111 and guarantee outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 111 2008 2019

Create this form in 5 minutes!

How to create an eSignature for the california form 111 2008 2019

How to create an eSignature for your California Form 111 2008 2019 in the online mode

How to make an electronic signature for the California Form 111 2008 2019 in Chrome

How to generate an eSignature for putting it on the California Form 111 2008 2019 in Gmail

How to make an electronic signature for the California Form 111 2008 2019 right from your smartphone

How to generate an electronic signature for the California Form 111 2008 2019 on iOS

How to make an eSignature for the California Form 111 2008 2019 on Android

People also ask

-

What is California Form 111, and why is it important?

California Form 111 is a crucial document used for reporting various tax-related information to the state. Understanding its requirements and ensuring accurate completion can help businesses comply with state laws and avoid penalties. Using airSlate SignNow simplifies the process by allowing easy filling and eSigning of California Form 111.

-

How can airSlate SignNow help me with California Form 111?

airSlate SignNow provides a user-friendly platform to create, send, and manage California Form 111 documents efficiently. Our solution enables you to eSign documents securely and access templates specifically designed for California Form 111, streamlining your workflow and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for California Form 111?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost depends on the features you require, such as advanced integrations and additional storage space. By investing in airSlate SignNow, you gain access to a cost-effective solution that simplifies handling California Form 111 and other documents.

-

What features does airSlate SignNow offer for California Form 111 users?

With airSlate SignNow, users benefit from features such as customizable templates for California Form 111, secure eSigning, and real-time document tracking. Additionally, our platform allows for easy integration with various third-party applications, enhancing the overall efficiency of document management.

-

Can I integrate airSlate SignNow with other tools for California Form 111?

Absolutely! airSlate SignNow seamlessly integrates with a wide range of applications, including CRM systems and cloud storage services. This integration capability ensures that managing California Form 111 and other documents remains efficient and connected to your existing workflows.

-

What are the benefits of using airSlate SignNow for eSigning California Form 111?

Utilizing airSlate SignNow for eSigning California Form 111 offers numerous benefits, including enhanced security, lower processing times, and increased efficiency. Our platform ensures that signatures are legally binding and easily verifiable, providing peace of mind for businesses handling sensitive documentation.

-

Is airSlate SignNow compliant with California regulations for Form 111?

Yes, airSlate SignNow is designed to comply with California regulations regarding digital signatures and document management, including California Form 111. Our platform continuously updates its features to align with state laws, helping users maintain compliance while managing their documents.

Get more for California Form 111

- Sc uniform credentialing application

- James madison high school transcript pdf form

- Transportation manifest form

- Georgia highlands college nursing form

- Ga tax g4p form 2008

- Georgia how to fill petition to probate will in solemn form

- Affidavit form b

- Business license application dawson county georgia dawsoncounty form

Find out other California Form 111

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online