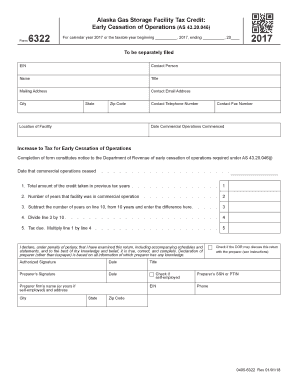

Alaska Gas Storage Facility Tax Credit Early Cessation of 2017

What is the Alaska Gas Storage Facility Tax Credit Early Cessation Of

The Alaska Gas Storage Facility Tax Credit Early Cessation Of refers to a specific tax credit designed to incentivize the development and operation of gas storage facilities in Alaska. This credit aims to support energy infrastructure and promote economic growth within the state. It provides financial benefits to businesses engaged in the construction and maintenance of these facilities, thereby facilitating a more robust energy sector.

How to obtain the Alaska Gas Storage Facility Tax Credit Early Cessation Of

To obtain the Alaska Gas Storage Facility Tax Credit Early Cessation Of, businesses must first ensure they meet the eligibility criteria set forth by the state. This typically involves demonstrating that the facility meets specific operational and regulatory standards. Once eligibility is confirmed, businesses can apply for the credit through the appropriate state tax authority, providing necessary documentation and evidence of compliance.

Steps to complete the Alaska Gas Storage Facility Tax Credit Early Cessation Of

Completing the Alaska Gas Storage Facility Tax Credit Early Cessation Of involves several key steps:

- Gather all required documentation, including proof of facility operation and compliance with state regulations.

- Fill out the appropriate application form, ensuring all information is accurate and complete.

- Submit the application to the relevant state tax authority, either electronically or by mail.

- Monitor the application status and respond to any requests for additional information from the tax authority.

Eligibility Criteria

Eligibility for the Alaska Gas Storage Facility Tax Credit Early Cessation Of is determined by several factors. Businesses must operate a gas storage facility that meets specific operational standards established by the state. Additionally, they must comply with all relevant local, state, and federal regulations. It is essential for applicants to review these criteria thoroughly to ensure they qualify before applying for the tax credit.

Legal use of the Alaska Gas Storage Facility Tax Credit Early Cessation Of

The legal use of the Alaska Gas Storage Facility Tax Credit Early Cessation Of requires adherence to state tax laws and regulations. Businesses must ensure that their operations align with the stipulations of the tax credit program. Proper documentation and compliance with reporting requirements are critical to maintaining the legal validity of the credit. Failure to comply with these regulations may result in penalties or disqualification from receiving the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Gas Storage Facility Tax Credit Early Cessation Of can vary based on the specific tax year and the business's fiscal calendar. It is crucial for applicants to be aware of these important dates to ensure timely submission of their applications. Missing deadlines may result in the loss of eligibility for the tax credit, so businesses should plan accordingly and keep track of all relevant dates.

Required Documents

To successfully apply for the Alaska Gas Storage Facility Tax Credit Early Cessation Of, several documents are typically required. These may include:

- Proof of facility operation, such as operational reports or permits.

- Financial statements demonstrating the costs associated with the facility.

- Compliance documentation showing adherence to state and federal regulations.

Ensuring all required documents are complete and accurate will facilitate a smoother application process.

Quick guide on how to complete alaska gas storage facility tax credit early cessation of

Effortlessly prepare Alaska Gas Storage Facility Tax Credit Early Cessation Of on any device

The management of online documents has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Alaska Gas Storage Facility Tax Credit Early Cessation Of on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Alaska Gas Storage Facility Tax Credit Early Cessation Of seamlessly

- Find Alaska Gas Storage Facility Tax Credit Early Cessation Of and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Edit and eSign Alaska Gas Storage Facility Tax Credit Early Cessation Of to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska gas storage facility tax credit early cessation of

Create this form in 5 minutes!

How to create an eSignature for the alaska gas storage facility tax credit early cessation of

How to make an electronic signature for the Alaska Gas Storage Facility Tax Credit Early Cessation Of in the online mode

How to create an eSignature for your Alaska Gas Storage Facility Tax Credit Early Cessation Of in Chrome

How to make an eSignature for signing the Alaska Gas Storage Facility Tax Credit Early Cessation Of in Gmail

How to generate an eSignature for the Alaska Gas Storage Facility Tax Credit Early Cessation Of from your smartphone

How to create an electronic signature for the Alaska Gas Storage Facility Tax Credit Early Cessation Of on iOS

How to generate an electronic signature for the Alaska Gas Storage Facility Tax Credit Early Cessation Of on Android

People also ask

-

What is the 'Alaska Gas Storage Facility Tax Credit Early Cessation Of'?

The 'Alaska Gas Storage Facility Tax Credit Early Cessation Of' refers to specific tax implications related to the early termination of gas storage projects in Alaska. Understanding this credit is crucial for businesses involved in energy to maintain compliance and optimize their financial strategies.

-

How can the 'Alaska Gas Storage Facility Tax Credit Early Cessation Of' affect my business finances?

The 'Alaska Gas Storage Facility Tax Credit Early Cessation Of' can signNowly impact your business finances by influencing your tax liabilities. Businesses that navigate these credits properly can minimize their tax burden and reallocate funds towards other operational needs.

-

Are there any fees associated with utilizing the 'Alaska Gas Storage Facility Tax Credit Early Cessation Of'?

While the 'Alaska Gas Storage Facility Tax Credit Early Cessation Of' does not directly incur a fee, seeking professional assistance for tax credits might involve consultancy fees. It is vital to assess these costs against potential tax savings to determine the best approach for your business.

-

What features does airSlate SignNow provide to manage documents related to the Alaska Gas Storage Facility Tax Credit?

airSlate SignNow offers a seamless document management experience, enabling businesses to eSign and send important tax-related documents promptly. By integrating these features, users can simplify the handling of documents related to the 'Alaska Gas Storage Facility Tax Credit Early Cessation Of.'

-

What are the benefits of eSigning documents related to the Alaska Gas Storage Facility Tax Credit?

eSigning documents enhances efficiency by allowing for quicker approvals on paperwork associated with the 'Alaska Gas Storage Facility Tax Credit Early Cessation Of.' This streamlining minimizes delays and promotes compliance with state regulations, driving better business outcomes.

-

How does airSlate SignNow integrate with other platforms for Alaska Gas Storage Facility tax documentation?

airSlate SignNow integrates seamlessly with numerous platforms, ensuring that all documentation linked with the 'Alaska Gas Storage Facility Tax Credit Early Cessation Of' can be managed efficiently. This connectivity helps you keep all tax-related information organized and easily accessible.

-

What type of customer support does airSlate SignNow offer for queries about the Alaska Gas Storage Facility Tax Credit?

airSlate SignNow provides comprehensive customer support to address any queries regarding the 'Alaska Gas Storage Facility Tax Credit Early Cessation Of.' Our team is dedicated to assisting you with any questions or issues that may arise during your document management process.

Get more for Alaska Gas Storage Facility Tax Credit Early Cessation Of

Find out other Alaska Gas Storage Facility Tax Credit Early Cessation Of

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe