Alaska Gas Storage Facility Tax Credit Early Cessation of Operations 2019-2026

Understanding the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations

The Alaska Gas Storage Facility Tax Credit Early Cessation of Operations is a financial incentive designed to support businesses involved in gas storage operations. This tax credit is applicable when a facility ceases operations earlier than planned. It aims to alleviate some of the financial burdens associated with the early shutdown of gas storage facilities, encouraging companies to maintain compliance with state regulations while managing their operational costs effectively.

Steps to Complete the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations

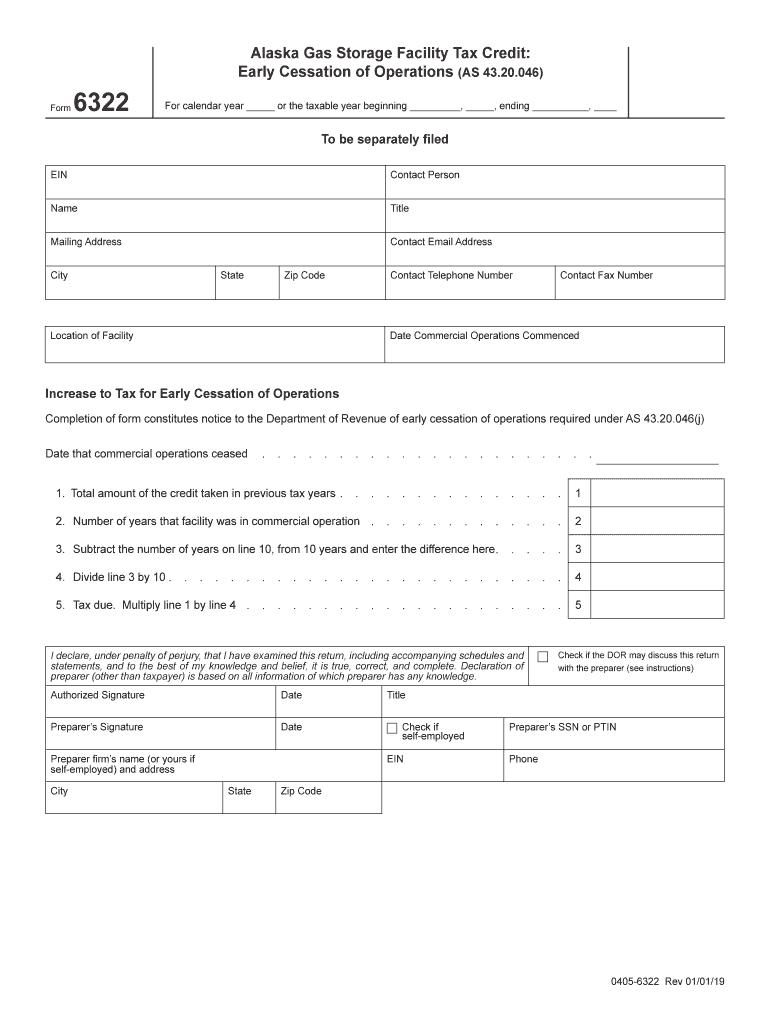

Completing the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations form involves several key steps:

- Gather all necessary documentation related to the gas storage facility, including operational records and financial statements.

- Ensure you meet the eligibility criteria for the tax credit, which may include specific operational benchmarks and compliance with state regulations.

- Fill out the form accurately, providing all required information such as facility details, cessation dates, and financial data.

- Review the completed form for accuracy and completeness to avoid potential delays in processing.

- Submit the form through the designated method, whether online, by mail, or in person, as per state guidelines.

Legal Use of the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations

The legal use of the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations form is governed by state tax laws and regulations. To ensure compliance, businesses must adhere to the specific guidelines outlined by the Alaska Department of Revenue. This includes maintaining accurate records of operations and ensuring that the cessation of operations aligns with the criteria set forth in the tax code. Proper legal use not only protects the business from penalties but also maximizes the benefits of the tax credit.

Eligibility Criteria for the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations

To qualify for the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations, applicants must meet certain eligibility criteria. These may include:

- The facility must be recognized as a gas storage operation under state regulations.

- The cessation of operations must occur within the specified time frame outlined in the tax credit guidelines.

- All necessary permits and licenses must be in good standing prior to cessation.

- Documentation proving the financial impact of the early cessation must be provided.

Required Documents for the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations

When applying for the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations, several documents are typically required:

- Operational records detailing the timeline of the facility's operations.

- Financial statements that reflect the impact of the cessation.

- Permits and licenses associated with the gas storage facility.

- Any correspondence with state regulatory bodies regarding the cessation.

Filing Deadlines for the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations

Filing deadlines for the Alaska Gas Storage Facility Tax Credit Early Cessation of Operations are crucial for ensuring that applications are processed in a timely manner. Typically, businesses must submit their forms by a specific date following the cessation of operations. It is important to check the Alaska Department of Revenue’s official guidelines for the most accurate and up-to-date deadlines to avoid missing out on potential tax credits.

Quick guide on how to complete alaska gas storage facility tax credit early cessation of operations

Easily Prepare Alaska Gas Storage Facility Tax Credit Early Cessation Of Operations on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the correct form and securely save it online. airSlate SignNow offers all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Handle Alaska Gas Storage Facility Tax Credit Early Cessation Of Operations on any device using airSlate SignNow’s Android or iOS applications and simplify your document-related processes today.

How to Modify and Electronically Sign Alaska Gas Storage Facility Tax Credit Early Cessation Of Operations with Ease

- Obtain Alaska Gas Storage Facility Tax Credit Early Cessation Of Operations and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Alaska Gas Storage Facility Tax Credit Early Cessation Of Operations and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska gas storage facility tax credit early cessation of operations

Create this form in 5 minutes!

How to create an eSignature for the alaska gas storage facility tax credit early cessation of operations

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the 2019 Alaska 6322 storage tax?

The 2019 Alaska 6322 storage tax is a tax imposed on certain storage facilities in Alaska. This tax affects businesses that utilize storage services and is essential for compliance. Understanding this tax is crucial for businesses to maintain financial health and avoid penalties.

-

How can airSlate SignNow help with documentation related to the 2019 Alaska 6322 storage tax?

AirSlate SignNow streamlines the process of preparing and sending documents related to the 2019 Alaska 6322 storage tax. With its easy-to-use interface, you can create, manage, and eSign documents quickly. This ensures that your tax documentation is organized and submitted on time, minimizing compliance risks.

-

What pricing options does airSlate SignNow offer for businesses dealing with the 2019 Alaska 6322 storage tax?

AirSlate SignNow offers a range of pricing plans tailored to fit various business needs, including those handling the 2019 Alaska 6322 storage tax. The plans are designed to be cost-effective, providing essential features without breaking the bank. Contact our sales team for personalized pricing based on your specific requirements.

-

What features does airSlate SignNow provide that are beneficial for the 2019 Alaska 6322 storage tax filings?

AirSlate SignNow offers features like document templates, automated workflows, and secure eSigning, which are especially beneficial for the 2019 Alaska 6322 storage tax filings. These features help ensure that all necessary documents are ready and compliant. Users can also track document status, making the filing process transparent and efficient.

-

Can I integrate airSlate SignNow with other tools for managing the 2019 Alaska 6322 storage tax?

Yes, airSlate SignNow can be integrated with various third-party applications to enhance your workflow related to the 2019 Alaska 6322 storage tax. This integration allows for seamless data transfer and improved document management. Using these tools together can streamline the compliance process and enhance productivity.

-

How does airSlate SignNow ensure document security for the 2019 Alaska 6322 storage tax?

Security is a top priority for airSlate SignNow, especially for documents related to the 2019 Alaska 6322 storage tax. The platform uses advanced encryption protocols and secure cloud storage to protect sensitive information. Additionally, document access can be controlled and monitored to prevent unauthorized access.

-

What are the benefits of using airSlate SignNow for the 2019 Alaska 6322 storage tax?

Using airSlate SignNow for the 2019 Alaska 6322 storage tax offers numerous benefits, including time savings, increased accuracy, and easier compliance. Businesses can quickly prepare and submit required documentation, reducing the risk of mistakes. This efficiency ultimately supports better tax management and financial planning.

Get more for Alaska Gas Storage Facility Tax Credit Early Cessation Of Operations

- Application occupancy permit santa clara county fire department sccfd form

- Residential eviction summons form

- Additional submittal form

- Code of conduct due to legal restrictions it is n form

- Banner permit applicationdepartment of streets form

- 643 quince street mendota ca 93640 form

- Redbook forms 495611469

- Tree bank registration form

Find out other Alaska Gas Storage Facility Tax Credit Early Cessation Of Operations

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later