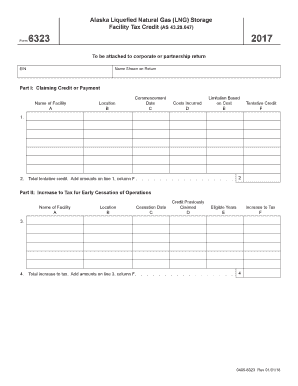

Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit as 2017

What is the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS

The Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS is a financial incentive designed to encourage the development and expansion of liquefied natural gas storage facilities in Alaska. This tax credit aims to support businesses involved in the LNG sector by reducing their tax liabilities, thereby promoting investment in infrastructure that is crucial for energy production and distribution. The credit is applicable to eligible costs incurred during the construction or expansion of LNG storage facilities, making it a vital tool for companies looking to enhance their operations in this industry.

How to use the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS

Utilizing the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS involves several steps. First, businesses must determine their eligibility based on the specific criteria set forth by the state. Once eligibility is confirmed, companies can calculate the eligible expenses incurred during the development of their LNG storage facilities. It is essential to maintain accurate records of all expenditures, as these will be required when claiming the tax credit. Finally, businesses must include the appropriate forms and documentation when filing their state tax returns to ensure they receive the credit.

Eligibility Criteria

To qualify for the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS, businesses must meet specific eligibility criteria. These typically include being a registered entity in Alaska and engaging in activities directly related to the construction or expansion of LNG storage facilities. Additionally, the costs claimed must be directly associated with eligible projects, such as construction materials, labor, and equipment. It is crucial for applicants to review the detailed requirements to ensure compliance and maximize their potential benefits from the tax credit.

Required Documents

When applying for the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS, businesses need to prepare several key documents. These include proof of eligibility, such as business registration and project details, along with comprehensive records of all eligible expenses incurred during the project. Invoices, receipts, and contracts should be collected and organized to substantiate the claims made on the tax return. Proper documentation is essential to facilitate the review process and ensure that the credit is granted without delays.

Steps to complete the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS

Completing the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS involves a systematic approach. Start by confirming your eligibility and gathering necessary documentation. Next, calculate the total eligible expenses associated with your LNG storage facility project. Fill out the required forms accurately, ensuring all information is complete and correct. Finally, submit the forms along with your state tax return by the designated filing deadline to claim the credit effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS are critical for businesses to observe. Typically, tax returns must be submitted by the state’s annual filing deadline, which is usually in April. However, specific deadlines may vary based on the fiscal year or any changes in state regulations. It is advisable for businesses to stay informed about any updates to ensure timely submission and avoid potential penalties.

Legal use of the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS

The legal use of the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS is governed by state tax laws and regulations. Businesses must adhere to these legal frameworks to ensure compliance when claiming the credit. This includes accurately reporting eligible expenses and maintaining proper documentation to support the claims made. Understanding the legal implications and requirements is essential for businesses to avoid issues with tax authorities and to ensure the credit is valid and enforceable.

Quick guide on how to complete alaska liquefied natural gas lng storage facility tax credit as

Complete Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without setbacks. Handle Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS without hassle

- Obtain Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska liquefied natural gas lng storage facility tax credit as

Create this form in 5 minutes!

How to create an eSignature for the alaska liquefied natural gas lng storage facility tax credit as

How to make an eSignature for your Alaska Liquefied Natural Gas Lng Storage Facility Tax Credit As in the online mode

How to generate an electronic signature for the Alaska Liquefied Natural Gas Lng Storage Facility Tax Credit As in Google Chrome

How to make an electronic signature for signing the Alaska Liquefied Natural Gas Lng Storage Facility Tax Credit As in Gmail

How to generate an electronic signature for the Alaska Liquefied Natural Gas Lng Storage Facility Tax Credit As straight from your mobile device

How to create an eSignature for the Alaska Liquefied Natural Gas Lng Storage Facility Tax Credit As on iOS devices

How to create an eSignature for the Alaska Liquefied Natural Gas Lng Storage Facility Tax Credit As on Android devices

People also ask

-

What is the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS?

The Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS is a financial incentive designed to promote the development of LNG storage facilities in Alaska. This tax credit helps businesses reduce their tax liabilities, encouraging investment in infrastructure that supports liquefied natural gas production and transportation.

-

How can the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS benefit my business?

By utilizing the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS, businesses can signNowly lower their capital expenditures involved in building LNG storage facilities. This tax credit not only reduces the overall costs but also enhances the financial feasibility of energy projects in the region.

-

What are the eligibility requirements for the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS?

To qualify for the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS, businesses must demonstrate that their projects meet specific criteria set forth by the state. This typically includes compliance with environmental standards and proof of investment in LNG storage infrastructure that aligns with state energy goals.

-

Is there a limit on the amount of tax credit available under the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS?

Yes, the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS has a cap on the total amount of credits available to businesses. The specifics may vary, so it's important for businesses to consult with a tax professional to understand how to maximize their benefits while staying within regulatory limits.

-

How does the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS integrate with other tax incentives?

The Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS can often be combined with other federal and state incentives aimed at renewable energy and infrastructure development. This integration can provide businesses with a more comprehensive financial support system for their LNG projects.

-

What steps do I need to take to apply for the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS?

To apply for the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS, businesses should begin by preparing a detailed project plan that outlines their proposed LNG storage facility. Following this, they must submit the necessary documentation to state authorities, ensuring compliance with all application requirements.

-

How can I find out more information about the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS?

For more information on the Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS, businesses can visit the Alaska state website or consult with a financial advisor specializing in tax credits. They can provide expert guidance and support specific to your project's needs.

Get more for Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS

Find out other Alaska Liquefied Natural Gas LNG Storage Facility Tax Credit AS

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation