Tax Alaska 2019-2026

What is the Tax Alaska

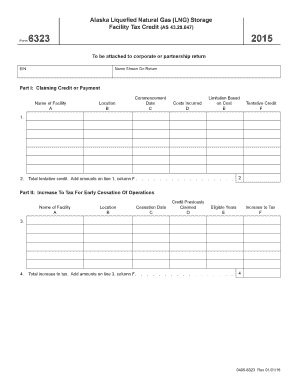

The Tax Alaska form is a specific document used for tax purposes within the state of Alaska. It is designed to collect necessary information from individuals or businesses for accurate tax assessment and compliance. This form may be required for various tax-related activities, including income tax reporting, business tax filings, and other financial disclosures mandated by state law.

Steps to complete the Tax Alaska

Completing the Tax Alaska form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, expense records, and any relevant identification numbers. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. After filling out the form, review it thoroughly for any errors or omissions. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on the specific requirements outlined by the state.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is crucial for maintaining compliance with state tax laws. This form must be filled out truthfully and submitted on time to avoid penalties. The information provided on the form is used by state tax authorities to assess tax liabilities and ensure that individuals and businesses are meeting their tax obligations. Failing to use this form correctly can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form vary depending on the type of tax being reported. Generally, individual income tax returns are due on April fifteenth, while business tax filings may have different deadlines based on the business structure. It is important to stay informed about these dates to avoid late fees or penalties. Taxpayers should also be aware of any extensions that may be available and the processes for applying for them.

Required Documents

To complete the Tax Alaska form, several documents are typically required. These may include:

- W-2 forms from employers, detailing annual wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business-related costs or charitable contributions.

- Previous year’s tax return for reference and accuracy.

Having these documents ready will facilitate a smoother completion of the form.

Form Submission Methods (Online / Mail / In-Person)

The Tax Alaska form can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online: Many taxpayers prefer to submit their forms electronically through the state’s tax portal, which offers a secure and efficient way to file.

- Mail: Taxpayers can also print the completed form and send it via postal service to the designated tax office.

- In-Person: For those who prefer face-to-face interactions, submitting the form in person at local tax offices is an option.

Choosing the right submission method depends on personal preference and the specific requirements of the Tax Alaska form.

Quick guide on how to complete tax alaska 6967220

Handle Tax Alaska easily on any device

Online document organization has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to design, modify, and electronically sign your documents swiftly without any holdups. Manage Tax Alaska on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Tax Alaska without hassle

- Locate Tax Alaska and click Obtain Form to begin.

- Utilize the tools available to submit your document.

- Emphasize signNow sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Finish button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Tax Alaska and ensure excellent communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967220

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967220

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how can it help with Tax Alaska documentation?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. With its easy-to-use interface, you can streamline your Tax Alaska documentation processes, saving both time and resources. It ensures that your tax documents are securely signed and organized, allowing for seamless integration with existing workflows.

-

How does airSlate SignNow handle Tax Alaska compliance?

airSlate SignNow takes compliance seriously, especially for critical documents related to Tax Alaska. The platform adheres to industry standards and regulations to ensure that all electronic signatures and document management processes are compliant. This guarantees that your tax-related documents meet legal requirements, providing peace of mind for users.

-

What are the pricing options for airSlate SignNow for Tax Alaska-related services?

Pricing for airSlate SignNow is designed to be competitive and flexible, offering plans that cater to businesses of all sizes addressing Tax Alaska needs. Customers can choose from various subscription levels, each providing different features and benefits tailored to their specific tax documentation requirements. Visit our pricing page for a detailed breakdown of options.

-

Can I integrate airSlate SignNow with my existing systems for Tax Alaska processes?

Yes, airSlate SignNow offers robust integration capabilities that allow it to connect seamlessly with many business tools and systems you may already use for Tax Alaska. This includes popular software like CRMs, document management systems, and cloud storage solutions. Integrating airSlate SignNow streamlines your workflows and enhances overall productivity.

-

What features does airSlate SignNow offer to help manage Tax Alaska documents?

airSlate SignNow includes a suite of features designed to simplify the management of Tax Alaska documents, such as customizable templates, automated reminders, and real-time tracking. Users can easily create, send, and manage their tax documents with complete visibility and control. This functionality helps ensure that critical deadlines and requirements are consistently met.

-

Is airSlate SignNow secure for handling sensitive Tax Alaska information?

Absolutely! airSlate SignNow employs industry-leading security measures to protect sensitive Tax Alaska information. Data encryption, secure access controls, and compliance with regulations ensure that your documents and signatures are kept safe from unauthorized access. Your privacy and security are paramount to us.

-

Can I use airSlate SignNow for both personal and business Tax Alaska documentation?

Yes, airSlate SignNow is versatile enough to serve both personal and business needs related to Tax Alaska documentation. Whether you're an individual taxpayer or a business handling various tax documents, the platform can accommodate all your eSigning requirements. Its user-friendly interface makes it easy for anyone to use.

Get more for Tax Alaska

- Ohio natural resources form

- Fidelity traditional ira custodian agreement form

- For immediate release form

- Fidelitycomautowithd form

- 1545 1007 department of the treasury internal revenue service attachment sequence no form

- Door county official directory state of wisconsin form

- Fidelity advisor 529 plan account application form

- Buy a house contract template form

Find out other Tax Alaska

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile