Form G 26 Rev Use Tax Return Forms Fillable 2016

What is the Form G 26 Rev Use Tax Return Forms Fillable

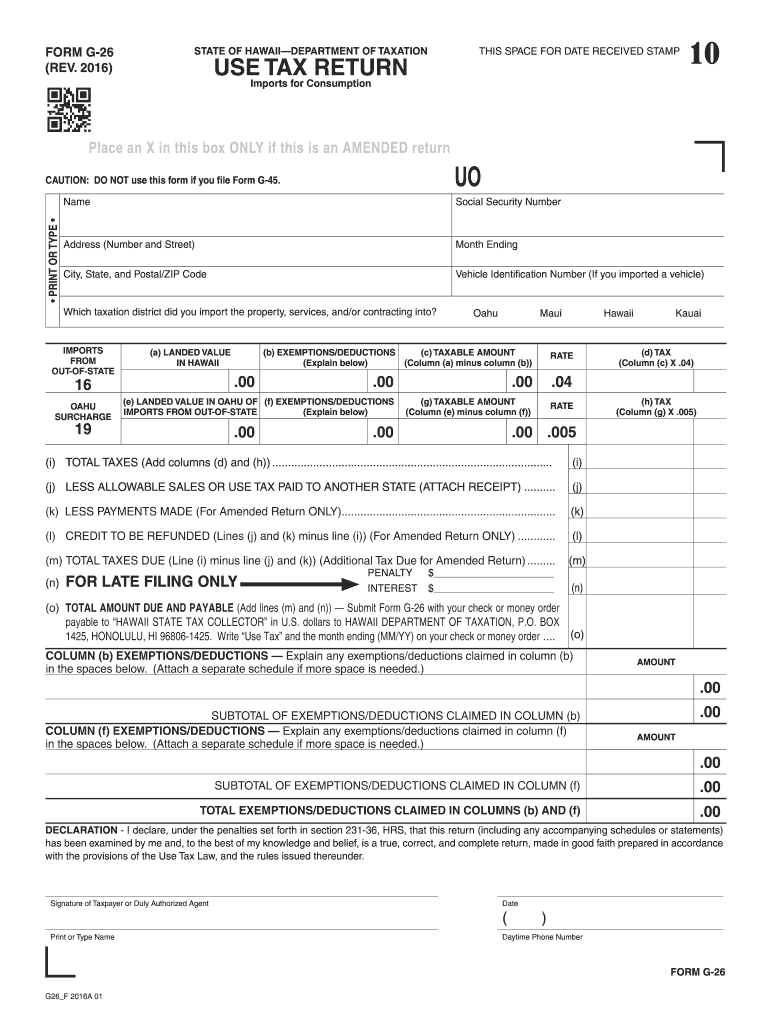

The Form G 26 Rev Use Tax Return is a tax document used by individuals and businesses to report and pay use tax in the United States. This form is particularly relevant for those who have purchased goods or services from out-of-state vendors and have not paid sales tax at the time of purchase. The fillable version of this form allows users to complete it electronically, making the process more efficient and accessible. The use tax is designed to ensure that local businesses are not disadvantaged by out-of-state transactions, promoting fair competition within the market.

How to use the Form G 26 Rev Use Tax Return Forms Fillable

Using the Form G 26 Rev Use Tax Return is straightforward. First, access the fillable form, which can be completed on a computer or mobile device. Users should enter their personal information, including name, address, and taxpayer identification number. Next, individuals must list the items purchased that are subject to use tax, along with their respective purchase prices. After filling out the necessary sections, users can electronically sign the document. This digital signature, combined with the completion of the form, allows for a legally binding submission.

Steps to complete the Form G 26 Rev Use Tax Return Forms Fillable

Completing the Form G 26 Rev Use Tax Return involves several key steps:

- Access the fillable form online.

- Provide your personal information, including name and address.

- List all items subject to use tax, along with their purchase prices.

- Calculate the total amount of use tax owed based on the listed items.

- Review the completed form for accuracy.

- Sign the form electronically to validate it.

- Submit the form according to your state’s guidelines.

Legal use of the Form G 26 Rev Use Tax Return Forms Fillable

The Form G 26 Rev Use Tax Return is legally binding when completed and signed correctly. To ensure its legal standing, the form must comply with federal and state regulations regarding electronic signatures. Using a trusted eSignature platform, such as signNow, guarantees that the document meets the necessary legal requirements, including adherence to the ESIGN Act and UETA. This legal framework validates the electronic signature and ensures that the form is recognized by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form G 26 Rev Use Tax Return may vary by state. Typically, taxpayers are required to file this form annually or quarterly, depending on their specific tax obligations. It is essential to check with your state’s tax authority for precise deadlines to avoid penalties. Staying informed about these important dates helps ensure timely compliance and prevents unnecessary fines.

Form Submission Methods (Online / Mail / In-Person)

The Form G 26 Rev Use Tax Return can be submitted through various methods, depending on state regulations. Many states allow electronic submission via their tax authority's website, which is often the most efficient option. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate tax office. In some cases, in-person submissions may also be accepted. It is advisable to verify the submission methods accepted by your state to ensure compliance.

Quick guide on how to complete form g 26 rev 2016 use tax return forms 2016 fillable

Complete Form G 26 Rev Use Tax Return Forms Fillable effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Form G 26 Rev Use Tax Return Forms Fillable on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest way to edit and eSign Form G 26 Rev Use Tax Return Forms Fillable without hassle

- Obtain Form G 26 Rev Use Tax Return Forms Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form G 26 Rev Use Tax Return Forms Fillable and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form g 26 rev 2016 use tax return forms 2016 fillable

Create this form in 5 minutes!

How to create an eSignature for the form g 26 rev 2016 use tax return forms 2016 fillable

How to make an eSignature for your Form G 26 Rev 2016 Use Tax Return Forms 2016 Fillable online

How to make an eSignature for your Form G 26 Rev 2016 Use Tax Return Forms 2016 Fillable in Google Chrome

How to make an electronic signature for putting it on the Form G 26 Rev 2016 Use Tax Return Forms 2016 Fillable in Gmail

How to create an eSignature for the Form G 26 Rev 2016 Use Tax Return Forms 2016 Fillable from your smart phone

How to make an eSignature for the Form G 26 Rev 2016 Use Tax Return Forms 2016 Fillable on iOS devices

How to generate an eSignature for the Form G 26 Rev 2016 Use Tax Return Forms 2016 Fillable on Android OS

People also ask

-

What are Form G 26 Rev Use Tax Return Forms Fillable?

Form G 26 Rev Use Tax Return Forms Fillable are official documents designed for reporting use tax obligations. They allow users to easily input necessary details and calculations related to use taxes on purchased goods. By using our fillable format, you can ensure accuracy while saving time during tax preparation.

-

How can I fill out Form G 26 Rev Use Tax Return Forms Fillable using airSlate SignNow?

You can fill out Form G 26 Rev Use Tax Return Forms Fillable directly in the airSlate SignNow platform. Simply upload the form, and use our intuitive interface to enter your information. Once completed, you can eSign the document and send it securely without any hassle.

-

Is there a cost associated with using Form G 26 Rev Use Tax Return Forms Fillable on airSlate SignNow?

Using airSlate SignNow to fill and eSign Form G 26 Rev Use Tax Return Forms Fillable involves a subscription fee. However, our pricing is competitive and designed to deliver signNow value to businesses of all sizes. You can choose a plan that fits your needs and budget.

-

What are the benefits of using airSlate SignNow for Form G 26 Rev Use Tax Return Forms Fillable?

Using airSlate SignNow for Form G 26 Rev Use Tax Return Forms Fillable streamlines your tax filing process. The electronic format allows for quick and easy completion, eSigning directly saves printing and mailing time, and our platform ensures compliance and security of your sensitive information.

-

Can I integrate airSlate SignNow with other tools for managing Form G 26 Rev Use Tax Return Forms Fillable?

Yes, airSlate SignNow offers integrations with various business tools and applications. This allows you to manage your Form G 26 Rev Use Tax Return Forms Fillable alongside other accounting and document management software seamlessly. Integration enhances workflow efficiency and collaboration.

-

What if I have issues while filling out Form G 26 Rev Use Tax Return Forms Fillable?

If you encounter any issues while using airSlate SignNow for Form G 26 Rev Use Tax Return Forms Fillable, our customer support team is available to help. We offer detailed tutorials and resources to guide you through the process. Additionally, you can signNow out for personalized assistance.

-

Is my data secure when filling out Form G 26 Rev Use Tax Return Forms Fillable?

Absolutely! airSlate SignNow prioritizes the security of your data when using Form G 26 Rev Use Tax Return Forms Fillable. We implement stringent encryption protocols and adhere to industry standards to protect your personal and financial information throughout the signing and filing process.

Get more for Form G 26 Rev Use Tax Return Forms Fillable

Find out other Form G 26 Rev Use Tax Return Forms Fillable

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form