HI G 26 Fill Out Tax Template OnlineUS Legal Forms 2019-2026

Understanding the Hawaii G-26 Tax Form

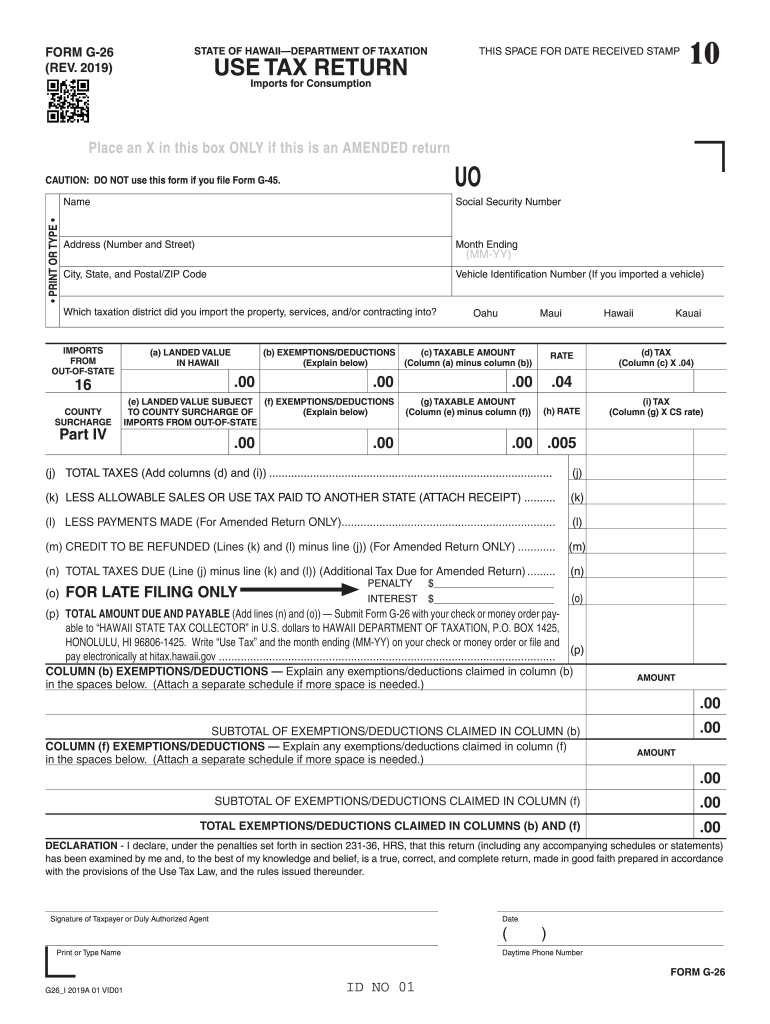

The Hawaii G-26 form is a crucial document for individuals and businesses that need to report their use tax obligations. This form is specifically designed for reporting the use tax on goods and services purchased outside of Hawaii and brought into the state. Understanding the purpose and requirements of the G-26 form is essential for compliance with state tax laws.

Use tax is applicable when items are purchased without paying Hawaii sales tax, which can occur when buying from out-of-state vendors. The G-26 form ensures that taxpayers fulfill their legal obligations by reporting these purchases accurately.

Steps to Complete the Hawaii G-26 Form

Filling out the Hawaii G-26 form requires attention to detail to ensure accuracy and compliance. Here are the steps to complete the form:

- Gather necessary information, including details of purchases made outside Hawaii.

- Provide your name, address, and taxpayer identification number in the designated fields.

- List each item purchased, including the description, purchase date, and amount paid.

- Calculate the total use tax owed based on the current tax rate.

- Review the completed form for accuracy before submission.

Completing the form accurately helps avoid penalties and ensures compliance with state tax regulations.

Legal Use of the Hawaii G-26 Form

The Hawaii G-26 form is legally binding when completed and submitted according to state tax laws. To ensure its legal validity, the form must be filled out correctly and submitted by the appropriate deadlines. Electronic submission of the G-26 form is permissible, provided it meets all legal requirements for e-signatures and document integrity.

Using a reliable electronic signing platform can enhance the legal standing of your submission, as it ensures compliance with regulations such as the ESIGN Act and UETA.

Filing Deadlines for the Hawaii G-26 Form

Timely submission of the Hawaii G-26 form is essential to avoid penalties. The filing deadline typically coincides with the annual tax return due date. Taxpayers should be aware of specific deadlines associated with their filing status, whether they are individual taxpayers or businesses.

Staying informed about these deadlines helps ensure that all tax obligations are met promptly, minimizing the risk of late fees or additional interest charges.

Required Documents for the Hawaii G-26 Form

To complete the Hawaii G-26 form, certain documents and information are necessary. Taxpayers should have:

- Receipts or invoices for all items purchased outside Hawaii.

- Documentation of any sales tax paid to other states.

- Your taxpayer identification number or Social Security number.

Having these documents ready will streamline the process and ensure that the form is filled out accurately.

Examples of Using the Hawaii G-26 Form

There are various scenarios in which individuals or businesses might need to use the Hawaii G-26 form. For instance:

- A resident purchases furniture online from a mainland retailer without paying Hawaii sales tax.

- A business acquires equipment from an out-of-state vendor and brings it into Hawaii.

- Individuals buying goods while traveling and later bringing them back to Hawaii.

Each of these examples illustrates the importance of reporting use tax accurately to comply with Hawaii state laws.

Quick guide on how to complete hi g 26 2018 fill out tax template onlineus legal forms

Complete HI G 26 Fill Out Tax Template OnlineUS Legal Forms effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle HI G 26 Fill Out Tax Template OnlineUS Legal Forms on any device with the airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to modify and eSign HI G 26 Fill Out Tax Template OnlineUS Legal Forms with ease

- Locate HI G 26 Fill Out Tax Template OnlineUS Legal Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign HI G 26 Fill Out Tax Template OnlineUS Legal Forms and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hi g 26 2018 fill out tax template onlineus legal forms

Create this form in 5 minutes!

How to create an eSignature for the hi g 26 2018 fill out tax template onlineus legal forms

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is Hawaii form G 26 and why do I need it?

Hawaii form G 26 is a document used for tax purposes in the state of Hawaii. It is essential for businesses to comply with local regulations and ensure accurate reporting. Leveraging airSlate SignNow can streamline the process of filling out and eSigning this form efficiently.

-

How can airSlate SignNow help with Hawaii form G 26?

airSlate SignNow offers a user-friendly platform that simplifies the completion and signing of Hawaii form G 26. With our eSignature capabilities, you can easily send, sign, and manage your documents from anywhere, ensuring compliance and saving time.

-

Is there a cost associated with using airSlate SignNow for Hawaii form G 26?

Yes, airSlate SignNow operates on a subscription model, which provides various pricing plans based on your business needs. Choose a plan that fits your budget and start leveraging our features to enhance the management of Hawaii form G 26 and other documents.

-

What features does airSlate SignNow offer for handling Hawaii form G 26?

airSlate SignNow offers a suite of features, including customizable templates, automated workflow processes, and secure cloud storage, specifically designed to facilitate the management of documents like Hawaii form G 26. These features help streamline your document handling process efficiently.

-

Can I send Hawaii form G 26 to multiple recipients for signing?

Absolutely! With airSlate SignNow, you can easily send Hawaii form G 26 to multiple recipients for eSignature. Our platform supports sequential or simultaneous signing, ensuring quick turnaround times for all your document needs.

-

Is my data secure when using airSlate SignNow for Hawaii form G 26?

Yes, airSlate SignNow prioritizes the security of your data. We comply with strict security standards and protocols to protect your information when processing Hawaii form G 26 and other documents, giving you peace of mind as you handle sensitive data.

-

What integrations does airSlate SignNow offer for Hawaii form G 26?

airSlate SignNow integrates seamlessly with various applications, including CRM systems, email services, and cloud storage solutions. This allows you to efficiently manage Hawaii form G 26 alongside other documents, enhancing productivity and collaboration across your organization.

Get more for HI G 26 Fill Out Tax Template OnlineUS Legal Forms

- Quitclaim deed from husband and wife to an individual virginia form

- Virginia husband wife 497427993 form

- Quitclaim deed from husband and wife to three individuals virginia form

- Virginia quitclaim 497427995 form

- Quitclaim deed real estate form 497427997

- Warranty deed from individual to individual virginia form

- Gift deed virginia form

- Virginia certificate form

Find out other HI G 26 Fill Out Tax Template OnlineUS Legal Forms

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure