Nc Oic 2018

What is the Nc Oic

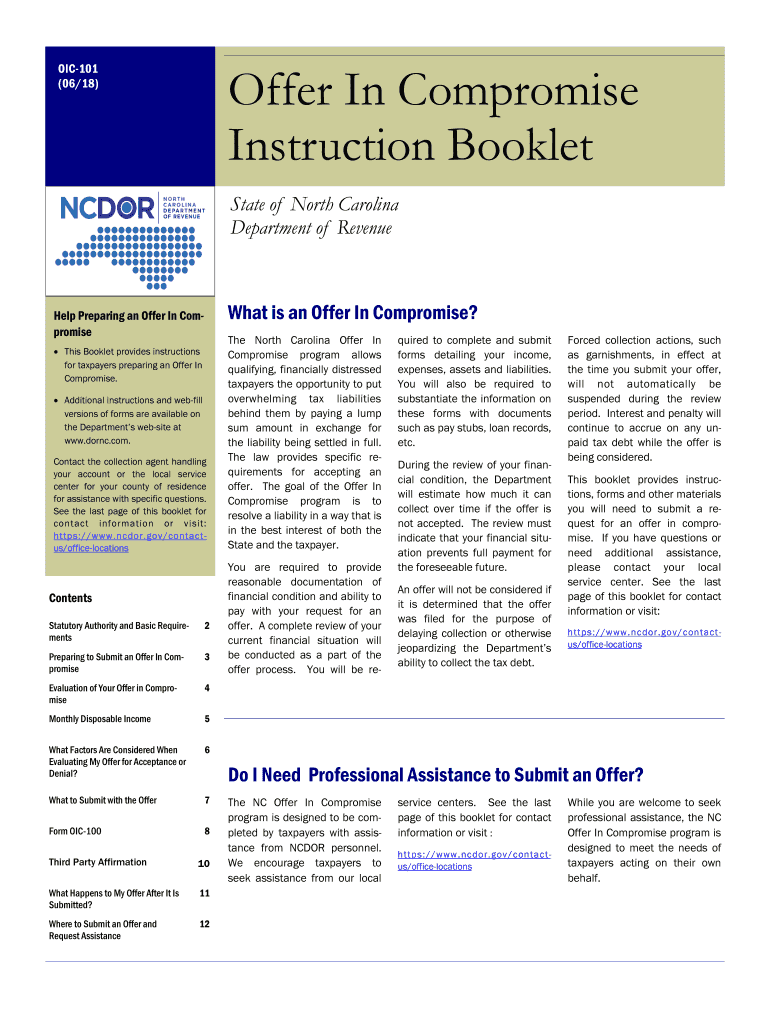

The Nc Oic, or North Carolina Offer in Compromise, is a tax resolution program designed to help individuals and businesses settle their tax debts with the North Carolina Department of Revenue (NCDOR). This program allows eligible taxpayers to negotiate a reduced tax liability, making it easier to pay off outstanding debts. The Nc Oic is particularly beneficial for those facing financial hardships, as it provides a structured way to resolve tax obligations without the burden of full payment.

How to use the Nc Oic

Using the Nc Oic involves several steps to ensure that taxpayers can successfully submit their offers. First, individuals must determine their eligibility by assessing their financial situation, including income, expenses, and assets. Next, they should gather necessary documentation, such as tax returns and financial statements, to support their offer. Once the required information is compiled, taxpayers can complete the Nc Oic form, detailing their proposed settlement amount. Finally, the completed form and supporting documents should be submitted to the NCDOR for review.

Steps to complete the Nc Oic

Completing the Nc Oic requires careful attention to detail. Here are the essential steps:

- Assess your financial situation to determine if you qualify for the Nc Oic.

- Gather necessary documentation, including income statements, tax returns, and any relevant financial records.

- Fill out the Nc Oic form accurately, providing all required information.

- Submit the completed form along with supporting documents to the NCDOR.

- Await a response from the NCDOR regarding the acceptance or rejection of your offer.

Eligibility Criteria

To qualify for the Nc Oic, taxpayers must meet specific criteria set by the NCDOR. Generally, eligibility is based on financial hardship, which may include factors such as income level, outstanding tax liabilities, and overall financial stability. Taxpayers should demonstrate that they cannot pay the full amount owed without incurring significant financial distress. Additionally, individuals must be current with all tax filings to be considered for the program.

Required Documents

Submitting a Nc Oic requires several key documents to support the offer. These typically include:

- Completed Nc Oic form.

- Recent tax returns for the past three years.

- Financial statements detailing income, expenses, and assets.

- Any additional documentation that may substantiate claims of financial hardship.

Form Submission Methods

The Nc Oic can be submitted in various ways, providing flexibility for taxpayers. Options include:

- Online submission through the NCDOR’s official website.

- Mailing a physical copy of the completed form and documents to the designated NCDOR address.

- In-person submission at local NCDOR offices, where assistance may be available.

Quick guide on how to complete nc instruction booklet 2018 2019 form

Complete Nc Oic effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files promptly without any holdups. Manage Nc Oic on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

The easiest way to edit and eSign Nc Oic with minimal effort

- Find Nc Oic and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Nc Oic and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc instruction booklet 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the nc instruction booklet 2018 2019 form

How to make an electronic signature for the Nc Instruction Booklet 2018 2019 Form in the online mode

How to create an eSignature for your Nc Instruction Booklet 2018 2019 Form in Google Chrome

How to make an electronic signature for signing the Nc Instruction Booklet 2018 2019 Form in Gmail

How to create an eSignature for the Nc Instruction Booklet 2018 2019 Form right from your mobile device

How to create an eSignature for the Nc Instruction Booklet 2018 2019 Form on iOS devices

How to create an electronic signature for the Nc Instruction Booklet 2018 2019 Form on Android OS

People also ask

-

What is NC OIC in relation to airSlate SignNow?

NC OIC stands for North Carolina Office of Insurance Commissioner. airSlate SignNow enables businesses operating in North Carolina to easily manage eSignatures and document workflows, which can streamline compliance with NC OIC regulations.

-

How does airSlate SignNow support NC OIC compliance?

airSlate SignNow provides secure, legally binding eSignatures that comply with NC OIC standards. By using airSlate SignNow, businesses can ensure that their document handling meets all necessary regulations set forth by the NC OIC.

-

What are the pricing options for airSlate SignNow users interested in NC OIC?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes, ensuring accessibility for those needing to comply with NC OIC. Users can select a plan that fits their budget while benefiting from features tailored for efficient document management.

-

What key features does airSlate SignNow offer for NC OIC users?

Key features include customizable templates, automated workflows, and advanced security measures. These features are designed to enhance document handling for NC OIC-related tasks, making it easier for businesses to secure signatures and manage compliance.

-

What benefits does airSlate SignNow provide when managing NC OIC-related documents?

Using airSlate SignNow allows businesses to save time and reduce errors in handling NC OIC documents. The platform's intuitive interface streamlines the eSigning process, making it efficient for users while ensuring adherence to necessary regulations.

-

Can airSlate SignNow integrate with other tools for NC OIC management?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools, enhancing its functionality for NC OIC management. This integration allows users to connect their workflows with existing systems, improving efficiency and productivity.

-

Is airSlate SignNow suitable for both small and large businesses in NC OIC?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including those in the NC OIC sector. Its flexible solutions can be tailored to meet the specific needs of both small startups and large enterprises.

Get more for Nc Oic

- Condominium filing statement dbpr form co 6000 2

- Dbpr form hoa 6000 6 myfloridalicensecom

- Dbpr form hoa 6000 3

- Cieinfofldoeorg form

- Doea form 236 affidavit of compliance employee april 2012 elderaffairs state fl

- Fl 3008 form

- Zoning certificate of use application anne arundel county aacounty form

- Sf 254 aacounty form

Find out other Nc Oic

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template