Lgst Form 2003-2026

What is the Lgst Form

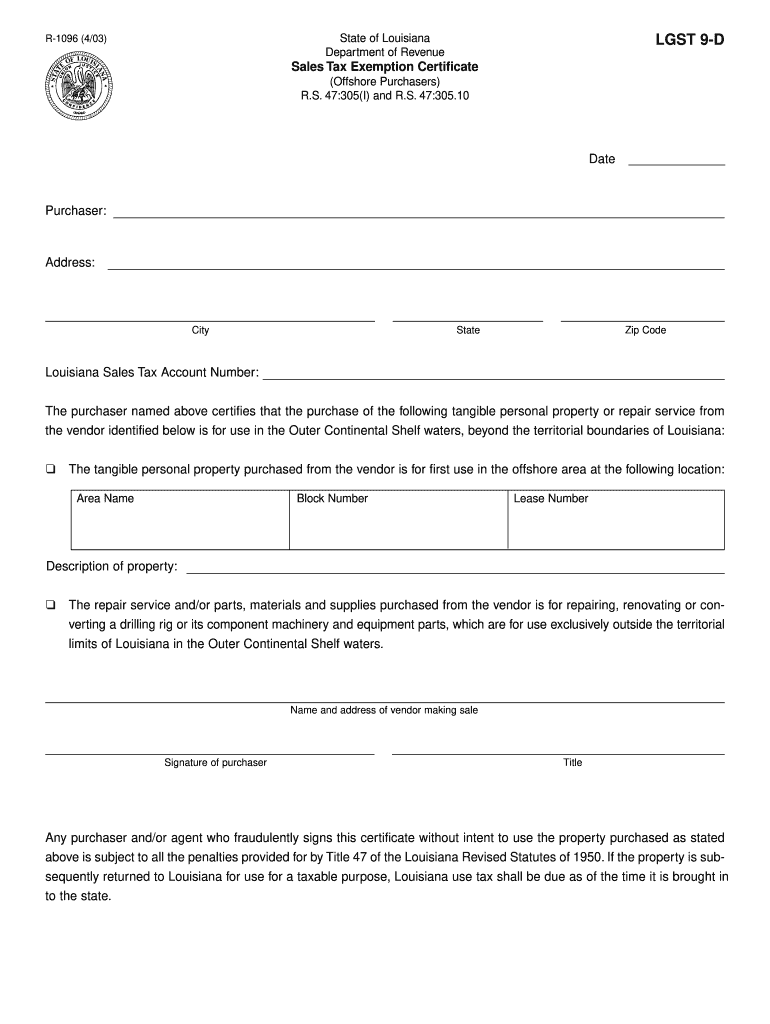

The Lgst form, often referred to as the lgst d, is a critical document used for various tax-related purposes in the United States. It is primarily utilized to claim sales tax exemptions for specific transactions. Businesses and individuals must understand the importance of this form to ensure compliance with state tax regulations. The Lgst form serves as a declaration that the purchaser is exempt from paying sales tax on eligible purchases, which can lead to significant savings.

How to use the Lgst Form

Using the Lgst form involves a straightforward process. First, ensure that you meet the eligibility criteria for claiming a sales tax exemption. Next, accurately fill out the form with the required information, including your name, address, and the nature of the exemption. It is essential to provide detailed information about the items or services being purchased. Once completed, submit the form to the seller to validate your exemption status. Retaining a copy for your records is also advisable, as it may be needed for future reference or audits.

Steps to complete the Lgst Form

Completing the Lgst form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your tax identification number and details about the purchase.

- Obtain the Lgst form from a reliable source, ensuring it is the most current version.

- Fill in your personal and business information accurately.

- Specify the reason for the exemption clearly, including any relevant codes or descriptions.

- Review the form for accuracy before submission.

- Submit the completed form to the seller or relevant authority.

Legal use of the Lgst Form

The legal use of the Lgst form is governed by state tax laws, which outline the specific circumstances under which sales tax exemptions can be claimed. It is crucial for users to familiarize themselves with these laws to ensure that their claims are valid. Misuse of the Lgst form can lead to penalties, including fines and back taxes owed. Therefore, understanding the legal implications and ensuring compliance with all relevant regulations is vital for both individuals and businesses.

IRS Guidelines

While the Lgst form is primarily a state-level document, it is essential to be aware of IRS guidelines regarding sales tax exemptions. The IRS provides general information on tax-exempt organizations and transactions, which can help users understand their responsibilities. Familiarity with these guidelines ensures that users are not only compliant with state laws but also aligned with federal tax regulations. Consulting with a tax professional may also be beneficial for navigating complex situations.

Required Documents

When completing the Lgst form, certain documents may be required to support your exemption claim. Commonly needed documents include:

- Proof of tax-exempt status, such as a letter from the IRS.

- Invoices or receipts for the purchases in question.

- Identification documents, such as a driver's license or business registration.

Having these documents readily available can streamline the process and help avoid delays in processing your exemption claim.

Quick guide on how to complete r 1096 sales tax exemption certificate certcapture

Complete Lgst Form effortlessly on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents promptly without delays. Manage Lgst Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Lgst Form without difficulty

- Obtain Lgst Form and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Lgst Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1096 sales tax exemption certificate certcapture

How to create an eSignature for your R 1096 Sales Tax Exemption Certificate Certcapture online

How to create an eSignature for the R 1096 Sales Tax Exemption Certificate Certcapture in Google Chrome

How to create an electronic signature for signing the R 1096 Sales Tax Exemption Certificate Certcapture in Gmail

How to make an eSignature for the R 1096 Sales Tax Exemption Certificate Certcapture straight from your mobile device

How to make an eSignature for the R 1096 Sales Tax Exemption Certificate Certcapture on iOS

How to make an eSignature for the R 1096 Sales Tax Exemption Certificate Certcapture on Android OS

People also ask

-

What is certcapture in airSlate SignNow?

Certcapture is a feature within airSlate SignNow that allows users to securely capture and verify e-signatures on important documents. This ensures authenticity and compliance, making it an essential component for businesses looking to streamline their signing process while maintaining security.

-

How does certcapture enhance the eSignature experience?

Certcapture enhances the eSignature experience by providing detailed verification and tracking of document signatures. It allows businesses to have confidence in the legitimacy of signed documents and improves the overall efficiency of the signing process, making it easier for all parties involved.

-

What are the pricing options for using certcapture with airSlate SignNow?

Pricing for certcapture within airSlate SignNow is competitive and depends on the subscription plan you choose. Various tiers offer different features, allowing businesses of all sizes to select the best value for their e-signature needs while leveraging the certcapture functionality.

-

What benefits does certcapture provide for businesses?

Certcapture provides several benefits for businesses, including enhanced security, time savings, and improved compliance. By using certcapture, companies can eliminate paper trails, reduce the risk of fraud, and expedite the signing process, resulting in overall operational efficiencies.

-

Can I integrate certcapture with other applications?

Yes, certcapture can be integrated with various third-party applications to enhance your workflow. airSlate SignNow provides robust API support, allowing seamless integration with CRM systems, project management tools, and other platforms to ensure a smooth signing process.

-

Is certcapture suitable for all industry types?

Certcapture is suitable for a wide range of industries, including finance, healthcare, legal, and education. Its flexibility accommodates various e-signature needs, making it an ideal choice for businesses looking to enhance document authentication and signature verification.

-

How easy is it to set up certcapture in airSlate SignNow?

Setting up certcapture in airSlate SignNow is very straightforward and user-friendly. With guided instructions and resources available, users can quickly enable certcapture for their e-signature processes without requiring extensive technical knowledge.

Get more for Lgst Form

Find out other Lgst Form

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online