6395 2017

What is the 6395

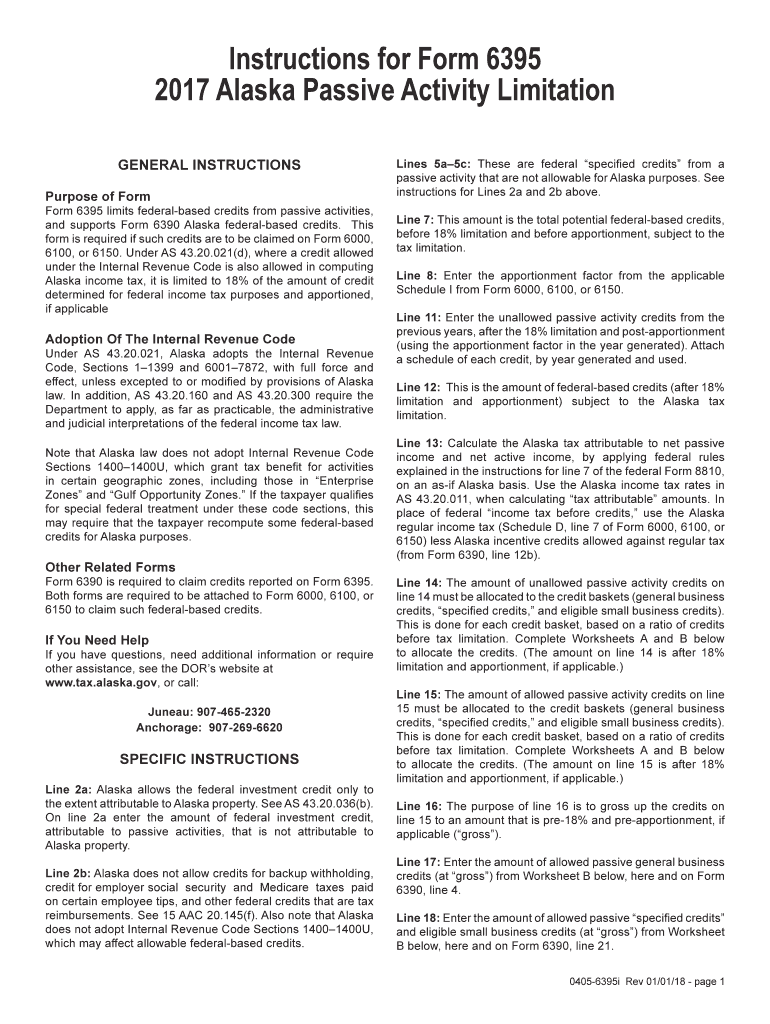

The 6395 form is a specific document used for various administrative purposes, primarily within the context of tax and financial reporting. This form is essential for individuals and businesses to comply with federal regulations. It serves as a means to report specific information to the Internal Revenue Service (IRS) or other relevant authorities. Understanding the purpose and requirements of the 6395 form is crucial for ensuring compliance and avoiding potential penalties.

How to use the 6395

Using the 6395 form involves several steps that ensure accurate completion and submission. First, gather all necessary information and documents required to fill out the form. This may include personal identification, financial records, and any relevant tax documentation. Next, carefully complete each section of the form, ensuring that all information is accurate and up-to-date. Once the form is filled out, review it for any errors or omissions before submitting it to the appropriate authority.

Steps to complete the 6395

Completing the 6395 form requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all necessary documents, including identification and financial records.

- Read the instructions carefully to understand the requirements for each section.

- Fill out the form, providing accurate and complete information.

- Review the completed form for any mistakes or missing information.

- Submit the form electronically or via mail, depending on the submission guidelines.

Legal use of the 6395

The legal use of the 6395 form is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed in accordance with the guidelines set forth by the IRS or relevant authorities. This includes providing accurate information and adhering to submission deadlines. Additionally, electronic signatures may be used if they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant legislation.

Filing Deadlines / Important Dates

Filing deadlines for the 6395 form are crucial for compliance. It is important to be aware of the specific dates by which the form must be submitted to avoid penalties. Generally, these deadlines align with the tax year and may vary based on individual circumstances or business structures. Keeping track of these dates ensures that individuals and businesses remain compliant with federal regulations.

Who Issues the Form

The 6395 form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for overseeing tax collection and enforcing tax laws in the United States. The IRS provides guidelines on how to obtain the form, complete it, and submit it properly. Understanding the role of the IRS in the issuance of the 6395 form helps users navigate the compliance process effectively.

Quick guide on how to complete instructions for form 6395

Effortlessly Prepare 6395 on Any Device

The management of online documents has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to find the appropriate template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 6395 on any platform with the airSlate SignNow apps available for Android or iOS and simplify any document-related task today.

Effortless Modification and Electronic Signing of 6395

- Obtain 6395 and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click the Done button to preserve your changes.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, the hassle of searching for forms, or mistakes that require new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign 6395 to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 6395

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 6395

How to generate an electronic signature for the Instructions For Form 6395 online

How to create an eSignature for your Instructions For Form 6395 in Chrome

How to generate an electronic signature for putting it on the Instructions For Form 6395 in Gmail

How to generate an electronic signature for the Instructions For Form 6395 straight from your smart phone

How to create an eSignature for the Instructions For Form 6395 on iOS

How to create an electronic signature for the Instructions For Form 6395 on Android

People also ask

-

What is the significance of the '6395' in airSlate SignNow?

The number '6395' refers to a specific pricing tier within the airSlate SignNow platform, designed to meet the needs of various businesses. This tier offers essential features for document signing and management, making it an ideal choice for organizations looking for an affordable yet robust eSigning solution.

-

How does airSlate SignNow's pricing structure work for the 6395 plan?

The pricing for the 6395 plan is designed to provide a cost-effective solution without compromising on features. Businesses can access a range of eSigning tools, integrations, and customer support, ensuring they get the best value for their investment.

-

What features are included in the airSlate SignNow 6395 plan?

The 6395 plan includes essential features such as customizable templates, real-time document tracking, and advanced security options. These features empower businesses to streamline their document workflows and enhance productivity.

-

Can I integrate airSlate SignNow 6395 with other applications?

Yes, the 6395 plan supports integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This interoperability allows businesses to seamlessly incorporate eSigning into their existing workflows, improving efficiency.

-

What benefits can I expect from choosing the 6395 plan?

By selecting the 6395 plan, businesses can enjoy a user-friendly interface, competitive pricing, and strong customer support. This plan is designed to help organizations save time and reduce costs associated with document signing and management.

-

Is there a free trial available for the 6395 plan of airSlate SignNow?

Yes, airSlate SignNow offers a free trial for the 6395 plan, allowing prospective customers to explore its features and benefits before committing. This trial enables businesses to evaluate how well the platform meets their eSigning needs.

-

How secure is the airSlate SignNow 6395 plan for handling sensitive documents?

The 6395 plan includes advanced security features such as encryption and two-factor authentication to protect sensitive documents. Businesses can trust that their data remains secure while utilizing airSlate SignNow for eSigning.

Get more for 6395

Find out other 6395

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy